How to revive low-volume growth in India’s consumption economy

The year 2023 brings an ocean of challenges and opportunities for India. Budget 2023 is even more crucial as it coincides with India’s G20 supremacy. India has done a commendable job as compared to other member countries with the highest GDP growth and the lowest inflation. However, the fear of an impending recession is still lurking around the corner. The Russia–Ukraine war brought with it some serious financial implications in the form of flared input costs and a strained global demand. On the other hand, inclement climate conditions are posing a threat to food production and thus making it tougher to douse the inflationary pressures globally. This is the year for India to strike a balance between frugality and competence through some game-changing reforms in the forthcoming budget.

The government has already indicated that the forthcoming budget would be aimed at sustaining the current economic growth trajectory of India. It would also preferably lay more emphasis on encouraging investments, bringing India closer to Aatmanirbharta in most sectors. Countries aiming for self-sufficiency in production as well as consumption would be the ones to float through swiftly in this much anticipated economic turmoil.

The key to increasing low-volume growth is to increase consumption in the domestic market. The recessionary conditions are likely to grow in 2023 in the West and hence the impact of it will be felt in India’s export demand. To cope with the diminished export demand, we will have to strengthen the domestic demand. The government must revisit the tax slabs with additional rebates in consumption expenditure to increase the disposable income in the hands of the consumers. This will not only boost domestic demand but will also attract investments, increase capacity utilisation for manufacturing companies and increase the scope of employment opportunities in the country.Also Read

India’s wholesale inflation cools to 21-month low at 5.85%

In line with this, the budget must also focus on the development of rural infrastructure. The FMCG industry has realised the potential of rural demand, and this is the right time to infuse more capital investment to increase supply-chain efficiency at the grass root level. The development of rural infrastructure will give the much-needed impetus to rural entrepreneurship. Similarly, the government must announce special packages to set up small and medium-scale industries in rural India. Special rebates on income tax or availability of seed capital at reduced interest rates will help rural startups go ahead in full throttle. The ultimate objective is to address the disparity between Bharat (Rural India) and India.Also Read

Budget 2023: A case for stronger fiscal push

The last two years brought in a complete overhaul in the ways of running businesses. Companies were forced to learn the digital way of working and it has resulted in bringing cost-effectiveness as well as efficiency in operations. The government must now focus on building a more nuanced and developed digital infrastructure for rural India. Advancement in rural connectivity will help companies reach rural consumers with many more choices.

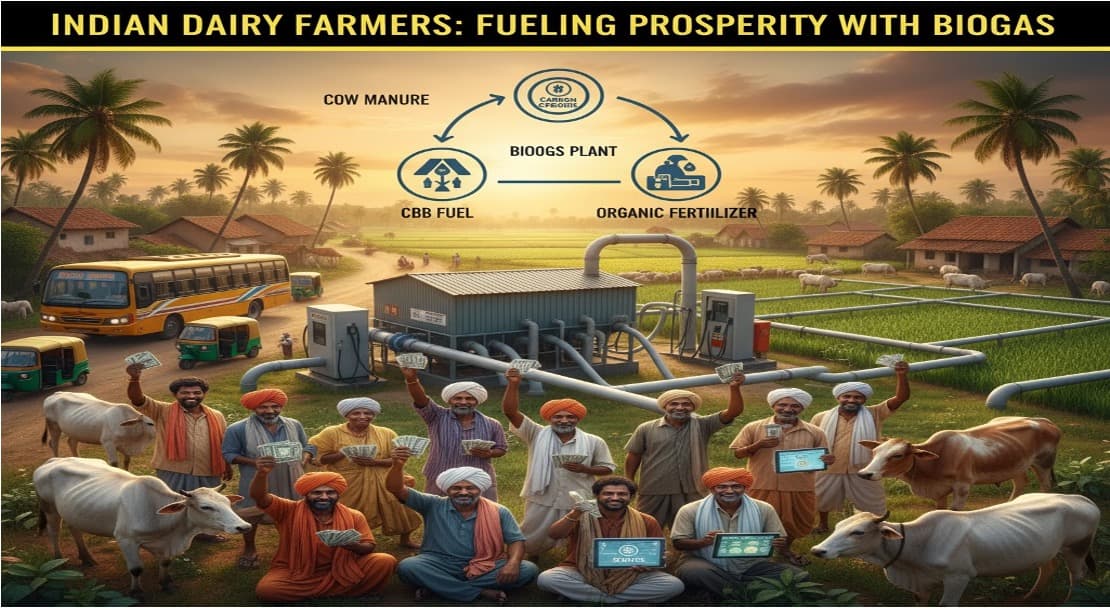

The cooperative business model has proven its worth in rural India. Especially in dairying and animal husbandry, agriculture, sugar, housing and credit etc, the cooperative mechanism has augmented growth and how! With the establishment of the “Ministry of Co-operation”, the government has acknowledged the contribution of the mechanism in bridging the gap between rural and urban India. In a bid to amplify domestic demand, budget 2023 must bring in incentives for adopting cooperative mechanisms in many other sectors as well.Also Read

India to be among fastest growing economies despite recession fears globally: RBI Guv

Simultaneously, the government must address the issue of reducing employability among young graduates. The pandemic has most definitely impacted the quality of education and training among students in urban areas where ample facilities are readily available. One can only imagine what a step down it would’ve been for the rural education system. Skill development based on industry requirements and vocational training are areas where accelerated growth is needed.

We need more openings in the skilled market space to keep domestic consumption ticking.

Recently, our Prime Minister announced his plans for Amritkal – the coming 25 years to the centenary of India’s independence, where he said India will play an important role in setting the direction for the world. The Indian dairy industry also has its targets set till 2047. We have been the largest producer of milk in the world since 1997 and our target is to increase our contribution to world milk production to 45%. While the government recognises the importance of dairying in India’s growth, it is yet to allocate proportionate budgetary resources to the sector. Strategic tax concessions for farmers are required at present to increase the profitability of agriculture and dairying in the country and incentivize the next generation of farmers to associate with the sector and invest their time and resources in the business. Including dairying under the gamut of agricultural income would bring much-needed relief for the dairy farmers and become a big boost for the government’s objective of doubling farmers’ income. Employment options catering to 60% of India’s population residing in Bharat will encourage them to stay back and uplift the rural economy. Not only this, but it will also help the government in monitoring excessive urban migration resulting in a higher rate of unemployment in urban India.

From the consumer’s point of view, it is imperative the government rethinks the GST rates applicable to several essential products. Products like ghee are taxed on the final price or at the manufacturing stage, which is finally impacting the buying behaviour of customers as well as the commercial viability of the producers. Similarly, molasses which is used in cattle feed plants are taxed at 28%, which also impacts the rates of cattle feed. Further, the cattle feed is not attracting any GST, which leads to no input credit received by these cattle feed plants.

Despite the overall financial growth that India has shown, the fact remains that we are still dependent on imports for crucial sectors such as edible oil, energy, etc. It is pivotal for the government to put a spotlight on such sectors and introduce reforms that would encourage indigenous production and self-reliance in all sectors. As India marches into 2023 with the world looking up to the country’s financial track amid uncertain global headwinds, the forthcoming budget will be India’s roadmap not just for the next financial year but also for the times to come.