India Milk Prices: Cost Shock and Procurement Pressure

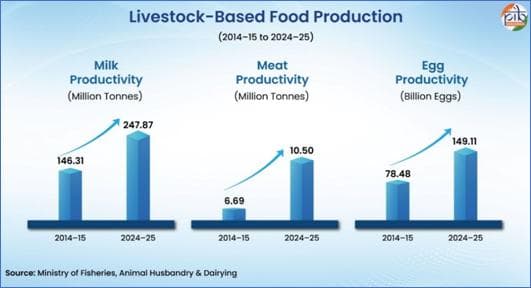

Milk prices in India face upward pressure as rising feed costs and procurement hikes reshape farm economics. Insight on dairy procurement, feed costs, and market outlook.

Official government and cooperative channels are signalling a renewed focus on farm economics and price stability: DAHD/PIB’s National Milk Day messaging foregrounds inclusive growth for producers and cooperative resilience even as NDDB highlights brand & procurement initiatives to support farmer incomes. At the same time, listed processors such as Heritage Foods reported margin pressure due to higher milk procurement costs, illustrating that inflation in feed and energy is already feeding through into corporate results.

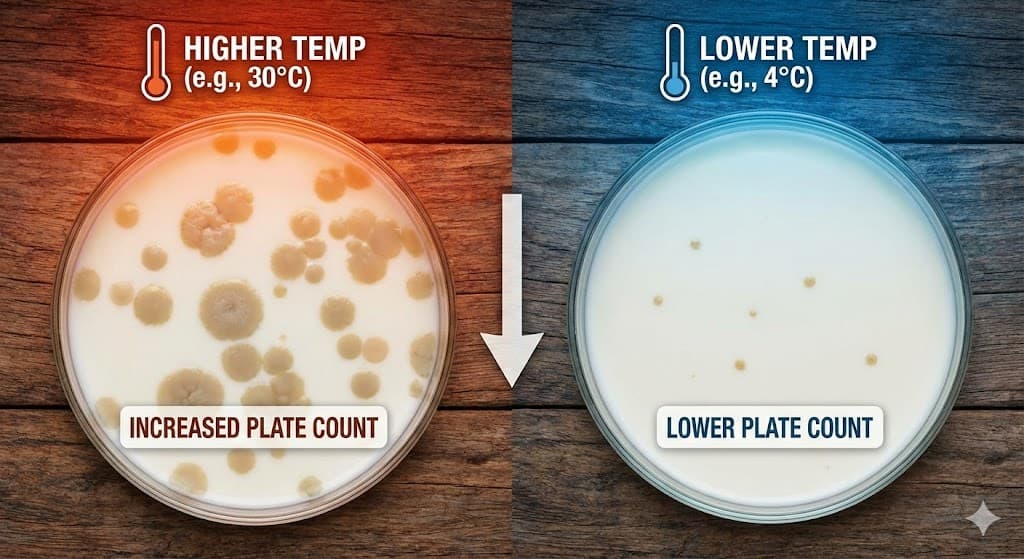

Global benchmarks are not insulated — Fonterra’s recent adjustments to farmgate price forecasts underline the interplay between global farmgate signals and domestic procurement. The short-term consequence is upward pressure on procurement prices and a likely slower cadence of retail price reductions; the medium-term trend to watch is whether coordinated feed-cost mitigation, productivity gains and cold-chain investment can decouple farmgate viability from international commodity swings.

Milk prices in India are at a crossroads: procurement costs are rising and cooperatives plus private processors are taking steps to protect farmer incomes. For dairy stakeholders, "milk prices India" is now the single most actionable indicator of margin stress across the value chain.

India’s dairy system is structurally resilient because of its cooperative procurement footprint and large smallholder base, but it is exposed to volatile input costs — notably feed and energy — that push up the minimum viable farmgate price. Global signals, including trimmed farmgate forecasts by major exporters, add complexity to domestic pricing dynamics.

In recent coverage, government messaging around National Milk Day emphasised cooperative-led support and producer welfare measures, while NDDB continued to publicise state-level brand expansions and procurement support programmes. Simultaneously, public filings and market reports show processors like Heritage Foods recording profit pressure linked to higher milk costs, and major retail brands (Mother Dairy/Amul) periodically adjusting consumer prices or procurement rates in response. These combined moves show active price management across the chain.

Short-term, higher procurement translates into squeezed processor margins unless companies pass costs to consumers or reduce other expenditures. Farmers benefit from better farmgate realisations, but sustained input inflation (feed, fertiliser, energy) risks eroding those gains. Global milk-price signals (Fonterra’s outlook) suggest limited relief from export markets in the near term.

For entrepreneurs and investors, the near-term playbook is clear: prioritise feed-cost efficiency, invest in cold-chain to cut losses, and accelerate value-added product strategies that insulate processors from raw milk swings. Policymakers should back targeted fodder programmes and incentives for precision feeding to stabilise farmgate economics. If these steps are implemented, India’s dairy sector can ride out global volatility while preserving farmer incomes and keeping consumer inflation measured.

Source : Dairynews7x7 Nov 28th 2025 an article by Kuldeep Sharma