What’s Driving Change In Beverages, FMCG And Dairy in 2025

India’s retail landscape in 2025 was marked by a decisive shift in how consumers choose, consume and connect with brands. From beverages to daily nutrition and even the most essential dairy products, the year revealed a sharper, more informed, and more value-driven Indian customer, one who prioritises authenticity, quality and convenience in equal measure. As industries prepare for 2026, founders and leaders across sectors outline the trends that shaped the year and the forces that will drive the next wave of growth.

Few segments captured the changing consumer mood as vividly as the specialty beverage market. According to Dhruv Kohli, Founder, Boba Bhai, 2025 was “a defining year for India’s retail F&B sector, driven by consumers who are far more experimental, quality-conscious, and convenience-first than ever before." He notes a strong shift toward premium yet accessible beverage formats, craft flavours and differentiated quick-service experiences.

The rise of functional beverages was among the most significant trends. “While matcha saw widespread adoption earlier, we are now noticing a shift towards Hōjicha, a roasted Japanese green tea, emerging as a key trend," explains Kohli. Cold brews, fusion drinks and café-style creations at competitive prices have further pushed the category into the mainstream.

Kohli emphasises that Tier-2 and Tier-3 markets were major growth engines, “Notably, smaller cities accelerated this momentum, showing strong appetite for premium, aspirational beverage formats." Moving into the new year, he sees innovation and personalisation becoming critical differentiators, with tech-enabled convenience driving loyalty. For Boba Bhai, 2026 represents an opportunity to bring “speed, creativity, and flavour-led innovation" to both metros and emerging markets.

FMCG Choices Driven by Honesty, Simplicity and Everyday Wellness

Beyond beverages, the FMCG sector experienced a structural shift in purchasing patterns. Families, especially urban middle-income households, moved away from health-washed marketing claims and gravitated toward products that blended transparency with everyday practicality.

“In 2025, we saw a clear shift in how families shop," says Sparsh Sachar, Director and Business Head, FMCG, Nutrica. “People weren’t just reaching for what looked healthy,they were choosing what genuinely fit into their daily routines." Clean ingredients, short labels and reliable sourcing took precedence over premium positioning or grand wellness promises.

Sachar believes this behavioural change will deepen in 2026. “Wellness will come from steady, everyday habits rather than dramatic lifestyle overhauls," he notes. Nutrica’s focus, he says, will remain on functional, honest products that elevate daily living without overwhelming the consumer. In his view, “the brands that stay honest, useful and consistent will be the ones that stay in the basket."

Dairy’s Digital Transformation: Transparency as the New Trust Pillar

If there is one sector where trust is paramount, it is dairy, a daily staple for millions. And the push toward transparency in 2025 was more pronounced here than anywhere else.

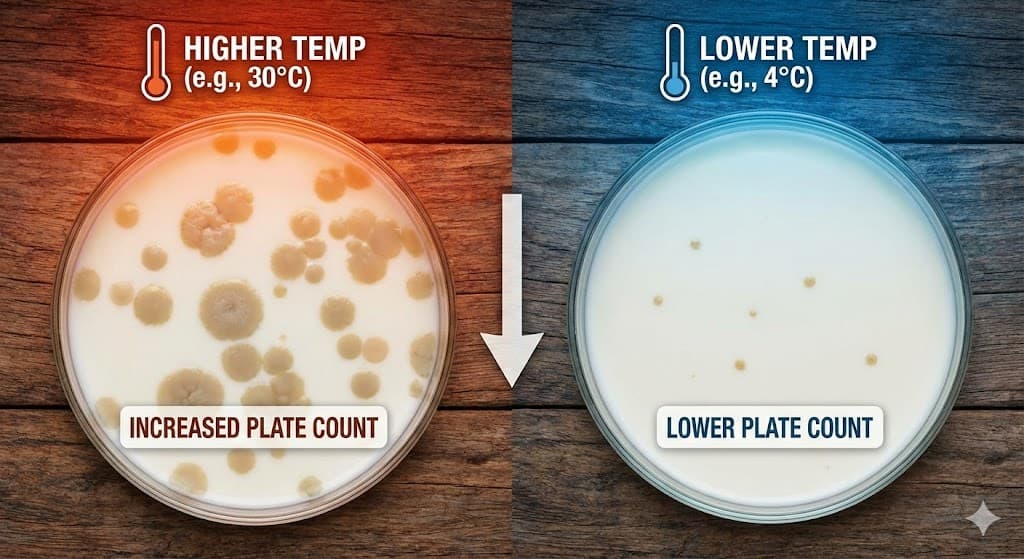

Mukundan defines the 2026 version of traceability in straightforward terms: complete visibility into the entire journey of a dairy product. “A consumer can know which farmers contributed the milk, what breed of cattle it came from, when the animal was vaccinated, what the fat and quality parameters were at collection, and whether the cold chain was maintained during transportation and processing," he explains. This depth of information, he says, strengthens brand loyalty and elevates consumer confidence.

Stellapps is driving this shift through end-to-end digitisation of the dairy supply chain. From animal activity sensors and digital milk passbooks to real-time quality monitoring at collection centres and cold-chain tracking at plants, the company ensures that every batch of milk carries verifiable, traceable freshness. “This allows FMCG companies to differentiate their products with verified quality and complete transparency," Mukundan says.

Dairy’s Premium Revolution: Purity, Protein & Provenance

While staples are experiencing rapid elevation, the dairy industry is undergoing an equally significant transformation, one that blends purity, provenance, and performance nutrition.

Puneet Kusumbia, VP Marketing, Heritage Foods, feels India is witnessing a “heightened consumption phase" in which premium dairy products are flourishing alongside everyday category-building items.

“The dairy category has proven to be an early and enthusiastic adopter of this trend, with considerable traction across several high-value spaces," explains Kusumbia.

Everyday dairy staples, milk, curd, paneer are being reimagined through the lens of purity, traceability, and high nutritional value. For modern consumers, it’s no longer enough for dairy to be fresh; it must be certified pure, consistently high-quality, and sourced responsibly.

At the same time, innovation-led, functional dairy products such as high-protein milk and paneer are gaining popularity among health-conscious households, fitness-forward youth, and working professionals seeking nutrient-rich options with convenience.

Kusumbia attributes this shift to three macro forces shaping India’s food psyche, “Rising disposable incomes due to lower taxation, heightened awareness of nutritional requirements, and powerful tailwinds favoring a more natural, rooted approach to food and well-being."

This dual rise of purity and functionality is also mirrored in the booming Better For You segment, spanning low-sugar yogurts, gut-friendly products, and premium ice creams designed for indulgence without compromise.

A Unified Consumer Trend: Trust, Transparency & Health

Despite spanning two different categories, both spokespersons point to the same core truth: Indian consumers in 2025 are choosing products that feel safer, purer, more transparent, and nutritionally aligned with their lifestyles.

Whether it’s premium rice or protein-rich dairy, the purchase decision is no longer solely about cost, it is about quality, credibility, and wellness.

Consumers are:

Reading labels carefully

Prioritizing branded, hygienically packaged goods

Seeking traceability and clear sourcing

Rewarding brands that deliver consistent quality

Embracing products that offer functional or nutritional benefits

This marks a powerful cultural shift in a country historically dominated by loose, unbranded, price-sensitive food categories.

As 2026 approaches, brands that embrace transparency, innovation, and everyday functionality while tailoring experiences to both metros and emerging cities are poised to lead India’s next retail transformation.

Source : Dairynews7x7 Dec 12th 2025 News18