Dairy Demand will be in the driver’s seat in 2021: Rabo Bank

After a whole year of pandemic and lockdowns across the globe, the view of the future is clearer and more hopeful than it has been for months for the world dairy markets. By mid-year, there should be a palpable return to familiar consumer patterns. It won’t be immediate, and certainly not smooth, but on balance, it should be positive for dairy markets.

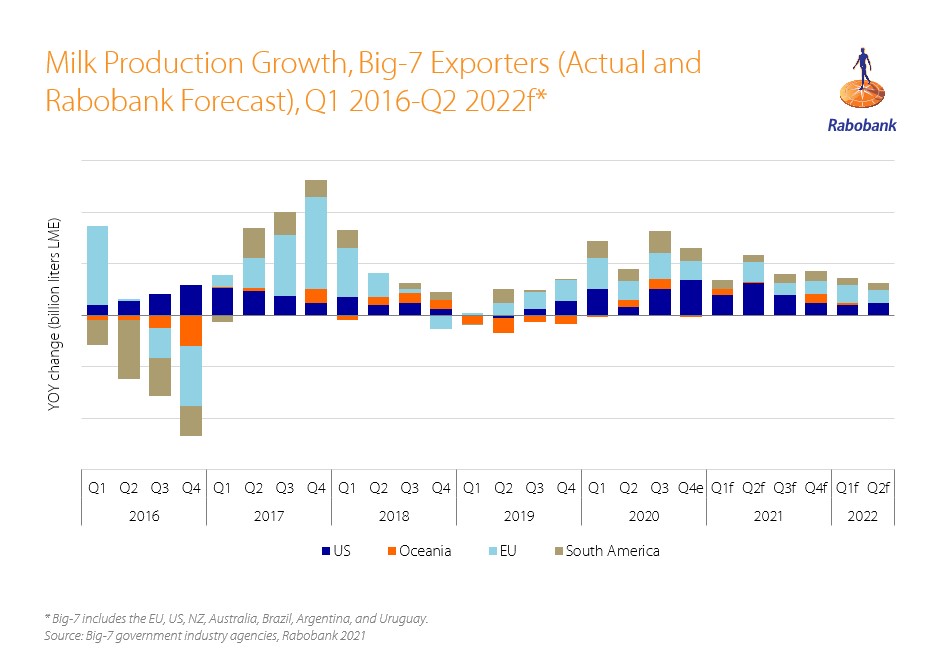

Rabobank forecasts a 1.1% increase in milk production across the Big-7 dairy-producing regions in 2021. This is a decrease compared to the 1.6% year-on-year increase in 2020 and represents a modest tightening of supply, which should help support markets as demand settles into post-vaccine balance.

“China’s near-term import demand is elevated, but is expected to slow in the second half of the year. High domestic milk prices are driving interest in expanding domestic milk production, which could reduce import needs in the future,” according to Ben Laine, analyst – dairy at Rabobank. The high milk prices favoured imported whole milk powder (WMP) early in the year, but that demand could see a pause following a recent spike in Oceania prices. Milk prices in China have likely reached a peak and will begin to soften from here.

Demand will be in the driver’s seat in 2021. “Throughout the pandemic, global milk supply has been much less impacted than demand. Disruptions arose as consumers made significant shifts in their consumption patterns, which spilled through supply chains. Most of those shifts were abrupt and severe as we entered the crisis, but coming out should be much more gradual,” explains Laine.

Most economies will grow in 2021 compared to 2020. Rabobank is forecasting a 4.5% year-on-year increase in global GDP for 2021, compared to a -3.8% contraction in 2020. The impact of widespread vaccination should be felt by mid-year, which will be positive for economic activity. There will still be a long tail to some aspects of the recovery.

Arenas or convention centres may not be filled this year, but restrictions on restaurants are likely to be lifted, and holiday gatherings are less likely to be discouraged. This will positively impact dairy demand, particularly in markets like the US, where a greater volume of dairy is consumed through foodservice channels than through food prepared at home.

Also in the US, whey and nonfat dry milk have done well, though exports are currently challenged by container availability. These logistical challenges are leading to a large price spread compared to the rest of the world and discounted US commodities. Still, demand from China for whey remains strong, and the shipping challenges should be resolved by the end of the second quarter of 2021.