China’s Dairy Industry – Market Trends and Opportunities

The dairy industry in China has boomed following the rise in incomes and living standards seen in recent decades. Previously a luxury product available only to the few, milk and dairy are increasingly becoming staples of the kitchen table, driven by changing attitudes and tastes. At the same time, the market has significant room for growth, with large parts of the population underserved. We look at the latest trends and changes in China’s dairy market and discuss opportunities for investors in this growing market.

China is home to the world’s second-largest market for dairy products after the United States. While dairy has not traditionally formed a part of the staple diet in China, the significant increase in incomes and living standards over the last four decades has helped make milk and dairy an increasingly common feature at the dining table. Today, milk and dairy are viewed as a crucial component of a healthy diet, particularly for children.

Despite the increase in dairy consumption in China since the 1980s, the market still has considerable room for growth. Absolute sales and consumption figures continue to surpass most other markets, but per-capita consumption remains significantly lower than in other middle- and high-income countries. Moreover, wealthier urban households consume dairy at much higher rates than rural households, meaning a large part of the population remains underserved.

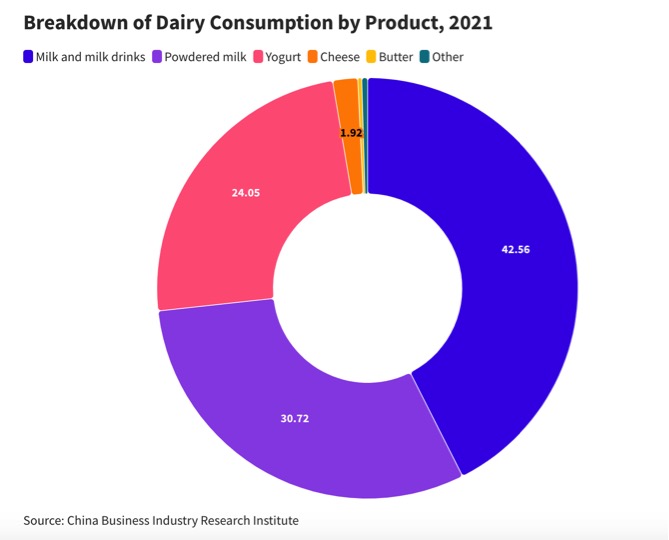

As the market has grown, various trends have emerged that are shaping the industry landscape. Whereas milk was previously mainly consumed in powdered form, pasteurized fresh milk and ultra-high temperature (UHT) milk have now become the most popular product segment. The rise in coffee consumption and the proliferation of milk tea stores are also driving the consumption of both fresh and powdered milk. Meanwhile, smaller market segments, such as cheese and butter, are also on the rise, thanks in large part to the increasing popularity of home baking and premium Western food products among wealthier urban households.

Overview of the dairy industry in China

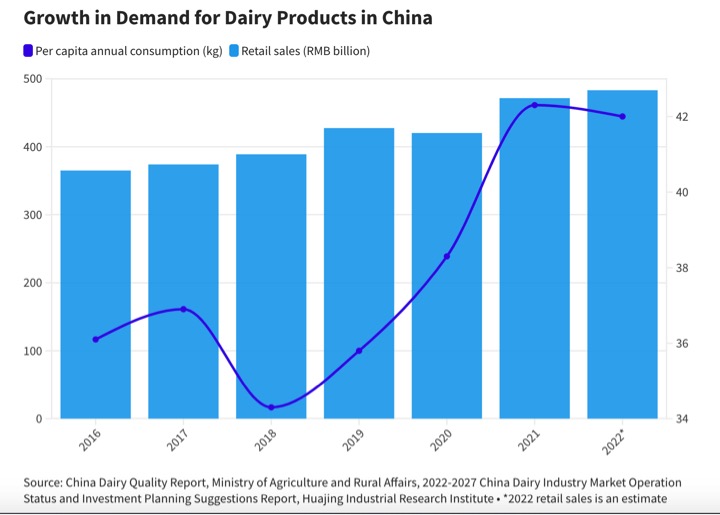

China’s dairy industry is estimated to have exceeded RMB 500 billion (US$69.6 billion) in 2023, per projections from the China Business Industry Research Institute.Meanwhile, according to a report by the Huajing Industrial Research Institute, retail sales grew by an average CAGR of 5.3 percent between 2016 and 2021 and are expected to maintain a CAGR of around 4.8 percent between 2022 and 2026 to reach RMB 596.65 billion (US$83 billion).

Demand for dairy products has risen steadily in China across the last decade, as seen by gradual increases in dairy sales and consumption. In 2021, total retail sales of dairy products reached RMB 468.7 billion (US$65.2 billion), according to the China Business Industry Research Institute.

Meanwhile, the per capita consumption of dairy rose from 36.1 kg per person in 2016 to 42 kg per person in 2022, per data from the Ministry of Agriculture and Rural Affairs (MARA). This is only around half the annual per capita dairy consumption of South Korea and less than a fifth of that of the US.Fresh milk and milk-based drinks form the largest segment of the dairy market, accounting for 42.5 percent of dairy consumed in 2021, according to the China Business Industry Research Institute. This is followed by powdered milk, accounting for around 32 percent of dairy consumed, and yogurt at 24 percent.

The fastest-growing market segment in China is low-temperature pasteurized milk, more commonly known as fresh milk. According to Founder Securities Research Institute, the market grew at a CAGR of 9.4 percent between 2018 and 2022, outpacing the other liquid milk segments, and reached RMB 39.1 billion (US$5.4 billion) in 2022.The yogurt market is experiencing similarly rapid growth, experiencing a CAGR of 8.4 percent between 2016 to 2021 according to the China Yogurt Industry Development Trend Analysis and Investment Prospects Research Report (2023-2030). The sector is estimated to have reached RMB 171.33 billion (US$23.8 billion) in 2022.

Within the powdered milk sector, a split has emerged in the demand for infant milk formula and adult milk powder. The infant formula market in China has begun to see a slight decrease in recent years due to declining birth rates, as well as an increasing preference for breastfeeding over bottle feeding with infant formula. According to research from Euromonitor, while the market grew at a healthy rate of 7.9 percent from 2018 to 2019, it slowed to 0.5 percent from 2019 to 2020 before contracting by 2 percent between 2021 and 2022.

However, the outlook of the adult powdered milk industry is much brighter. Thanks in part to increasing demand among middle-aged people, the market size of the adult powdered milk segment is projected to grow from RMB 18 billion (US$2.5 billion) in 2021 to around RMB 20 billion (US$2.8 billion) in 2022.

Supply of dairy products

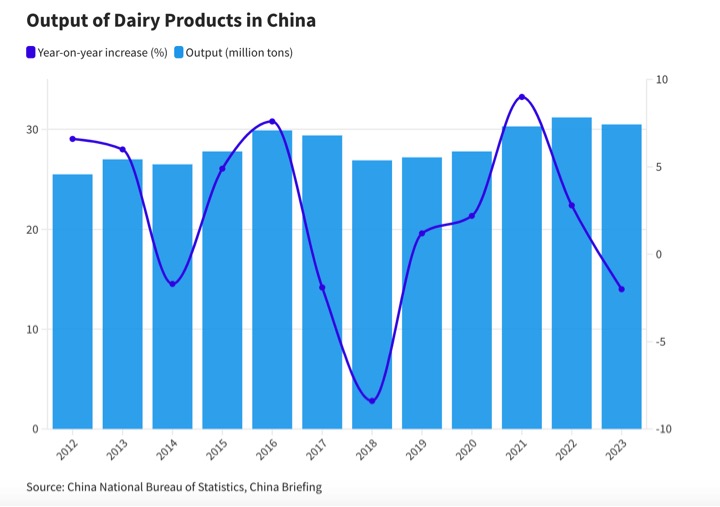

China’s domestic production of dairy has increased substantially in recent decades, following the uptick in consumption. The number of dairy cows in China has increased from 5.7 million dairy cows in 2001 to 7.1 million in 2023. The bulk of China’s milk production is located in north and northeastern China, in particular in Inner Mongolia, Heilongjiang, Hebei, Ningxia, Shaanxi, and Shanxi provinces.China’s domestic output of cow’s milk and dairy products has risen steadily in recent decades, with dairy product output growing at a CAGR of 1.5 percent from 2012 to 2023. In 2023, China produced around 30.5 million tons of dairy, according to the National Bureau of Statistics (NBS). Meanwhile, the production of milk reached a total of 39.31 million tons in 2022, up from around 30 million tons in 2013.

The one exception to the growth in production is the powdered milk segment. The domestic output of powdered milk dropped from 1.6 million tons in 2013 to under 1 million tons in 2022. This has partly been attributed to falling domestic demand as a result of the declining birth rates.

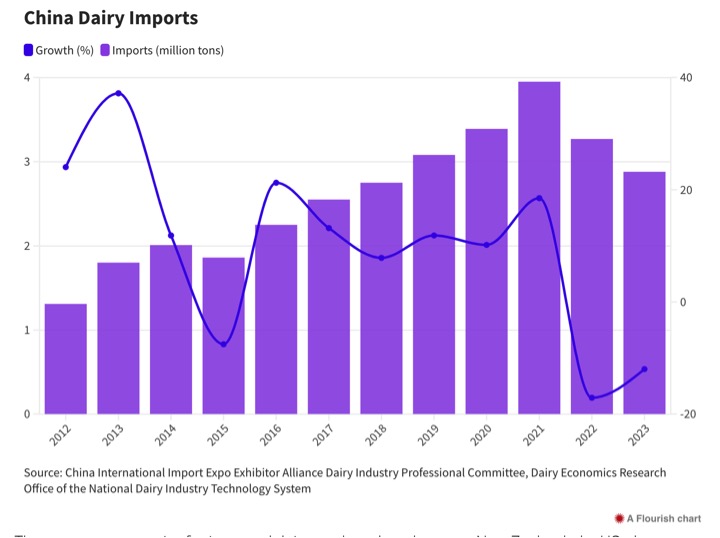

While China has increased its domestic supply of dairy, the country continues to import large amounts of dairy products and milk from other countries. Imports of dairy dropped in 2022 and 2023, following the trend of generally low imports during these years due to a drop in domestic demand. Nonetheless, dairy imports have risen steadily from 1.3 million tons in 2013, to a peak of 3.95 million tons in 2021.

The top source countries for imported dairy products by volume are New Zealand, the US, the Netherlands, and Australia. New Zealand alone accounted for 43.2 percent of China’s total dairy imports in 2022, according to research published by the China Animal Husbandry Magazine. The US accounted for the second-largest portion, at 18.1 percent of total imports.

Within the fresh milk segment, China’s dairy industry is dominated by domestic brands. The single largest dairy company is the Inner Mongolian Yili Group, which in 2022 had a market share of 21.2 percent, according to data from Euromonitor. The second-largest market player is Mengniu Dairy, also from Inner Mongolia, which held around 16.3 percent market share in 2022. The largest company for Chinese imports of dairy is the New Zealand company Fonterra, with China accounting for around one-third of the company’s exports.

Among other segments, some foreign brands are also dominant players. In the ice cream segment, for instance, the Uniliver-owned Wall’s brand comes second by market share after Yili. Meanwhile, in the much more fragmented yogurt segment, Nestle, Danone, and Yakult are among China’s top five providers, along with Yili and Mengniu.

In the cheese segment, many foreign brands enjoy a high level of recognition, with products from Laughing Cow, Anchor, Kraft Foods, President, Bridel, and Mainland frequently having shelf space in Chinese supermarkets.

Government policy

The growth of China’s dairy market has been spurred in large part by government support. The Chinese government has long framed dairy products as an important element in developing the economy and society. In particular, dairy products have been highlighted as one of the food products that can help China achieve food security, due to its relatively low resource requirements compared to the production of meat.In recent years, the government has sought to increase the domestic production of dairy to reduce the reliance on imports.