Jayshri Gayatri Food Products Bhopal launched Milk Magic for B2C

After his B2B exports business came to a standstill, entrepreneur Kishan Modi launched Milk Magic, a B2C dairy brand, to sell paneer, butter and cheese in India. It’s USP is simple: retail export-quality, value-added dairy products at competitive prices. The COVID-19-induced lockdown presented a huge problem of unsold inventory for entrepreneur Kishan Modi.

His Bhopal-headquartered venture Jayshri Gayatri Food Products (JGF) was into manufacturing and selling paneer, butter, cheese, and other value-added dairy products to its B2B customers. His list of marquee international clients included McDonald’s, Domino’s and Subway in the US, countries in the Middle East, and Southeast Asia.

In India, his customers included ITC, Britannia, Vadilal, Kwality Wall’s, and other FMCG majors. Most of the venture’s dairy products originated from Madhya Pradesh to sell in other states and outside India. However, the lockdown presented a unique obstruction. “Our sales came to a complete standstill when India closed its international and inter-state borders. The ready inventory was stuck at JGF’s facility, and we had no visibility on when Indian borders would reopen for trade,” Kishan tells SMBStory.

However, like most challenging situations, this one too presented an opportunity – but only if Kishan dared to enter the B2C market. “Since India had closed its inter-state borders, the supply chains of national dairy brands were paralysed. Further, the household demand for dairy products was increasing. This presented local and regional dairy manufacturers with a chance to fill the supply gaps within their states,” he says. Kishan decided it was the right time to take the risk and compete in the same market as dairy FMCG behemoths Amul and Britannia.

This also allowed him to address JGF’s problem of unsold inventory by selling the products locally. A JGF truck at the company factory in Sehore, Madhya Pradesh . In late 2020, he launched Milk Magic, a domestic B2C dairy products brand, and began retailing in the domestic market in Madhya Pradesh. Milk Magic’s USP is simple: it retails export-quality value-added dairy products in the Indian market.

“Customers loved our competitively-priced dairy products as they were of superior and international quality. We received many repeat orders. Moreover, due to the health concerns created by the COVID-19 pandemic, consumers preferred packaged dairy products over loose and unbranded products. They were open to trying easily accessible and hygienic local brands, and this worked well in our favour,” he says.

As restrictions eased and inter-state movements of goods resumed, Kishan expanded Milk Magic to Bihar, Chhattisgarh, Rajasthan, Odisha, and Telangana. The brand set up its national retail network via distributors and direct tie-ups with large format food and grocery retailers such as Reliance Fresh. It plans to build its own distribution channel by establishing physical outlets in major cities, and will also sell on online retailing platforms. With this omnichannel strategy,

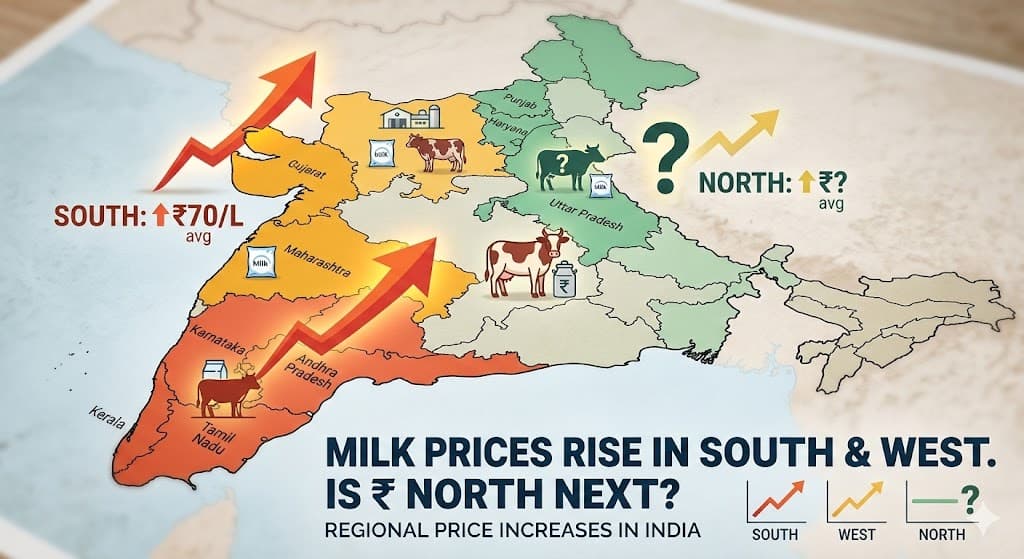

Milk Magic will soon enter Karnataka, Tamil Nadu, and Kerala, and will later expand into Maharashtra, Gujarat, Punjab, etc. In 2019-20, the parent company JGF recorded Rs 384 crore revenue. Though Kishan doesn’t disclose the financial impact of the pandemic or his expenses, he says: “We suffered losses in the B2B segment during the pandemic, so we started focusing on the B2C segment. The timely decision to foray in the domestic B2C market kept us profitable.”

Robust manufacturing setup

A big reason for JGF’s resilience is its manufacturing setup at Sehore, Madhya Pradesh. The plant processes four lakh litres of milk per day to produce 25 metric tonnes of paneer, 30 tonnes of butter, 20 tonnes of cheese, 30 tonnes of skimmed milk powder, and 15 tonnes of whey powder daily. “We have the biggest, state-of-the-art manufacturing facility for dairy products in all of Central India,” Kishan says.An additional manufacturing facility is being developed adjacent to the existing plant, which will more than double JGF’s production capacity. Kishan claims the new plant will be able to process five lakh litres of milk a day, and store 4,000 tonnes of products. “It will be operational by the end of 2021. Once the new plant is commissioned, the older plant will be used exclusively for processing whey powder, which is a by-product of paneer manufacturing,” he explains.

Armed with an increased production capacity, Kishan and JGF plans to simultaneously focus on B2B and B2C segments, and play a larger role in the massive Indian dairy market which reached Rs 11.36 lakh crore in 2020, according to IMARC data. The value-added dairy products market comprises established brands like Amul and Britannia. It also includes large dairy brands such as Heritage Foods, upcoming brands Desi Farms, Aadvik Foods, Mr Dairy etc that are making a difference with their strategies for farmer development and product innovation.

The value-added dairy products market also has its fair share of local and unorganised players. Kishan believes the market has a huge potential for innovative and superior quality dairy products like Milk Magic. “There is enough room for all organised players without hurting each other. This is more true now, as consumers are willing to switch to packaged dairy products due to hygiene and safety concerns,” he says. Inside the JGF facility in Sehore

Challenging past, promising future

Kishan’s entrepreneurial zeal and experience in the value-added dairy products industry can be traced back to his father, Rajendra Prasad Modi, who started a small dairy business in 1982. Kishan and his brother joined in 1995 to make curd and supply it to Nagpur, but they didn’t make any profits. Over the years, Kishan launched his own dairy businesses, tried his hand at numerous ventures, and even began making paneer. Shifting camp between Indore and Morena, for the longest time, success had eluded Kishan.It was only in 2013 when he bought land in Sehore and set up the JGF plant did he put himself on a clear path to prosperity. Learning from past mistakes and challenges, the entrepreneur has big plans for JGF. The business intends to launch a range of flavoured milk that will include some unconventional flavours, and also introduce cheese spreads, filler cheese, margarine, mayonnaise, gulab jamun, rasgulla, curd, buttermilk, and other products in its portfolio. “We are also building our ready-to-eat snacks segment under the brand name Inde’s Chef. This has a huge potential in the export markets, and I believe our potential business opportunity is worth Rs 30 crore in the first year,” Kishan explains.