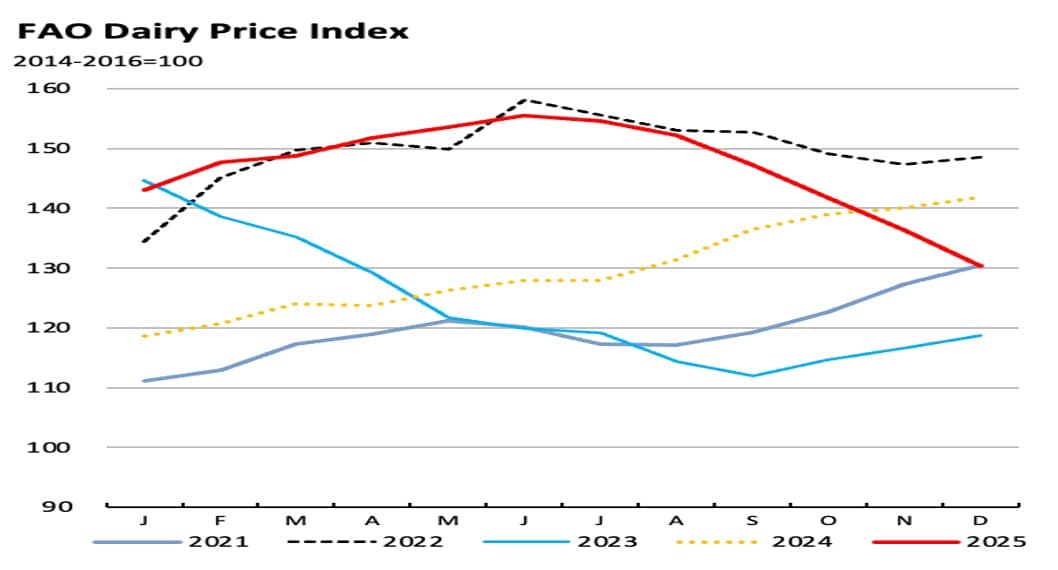

The FAO Dairy Price Index declined by 4.4% in Dec 2025

The FAO Dairy Price Index declined by 5.9 points (4.4 percent) in December. Butter prices fell sharply, driven by seasonally higher cream availability in Europe and stock accumulation following strong production earlier in the year. Whole milk powder (WMP) prices also declined, reflecting peak seasonal milk output in Oceania and subdued buying interest from major importing regions. By contrast, skim milk powder (SMP) and cheese prices eased more moderately. SMP prices edged down amid ample export availability and stable market fundamentals, while cheese prices declined overall. Well supplied markets and slower export demand in Europe outweighed firmer cheese prices in New Zealand, where peak milk supplies are mainly absorbed by products with greater processing flexibility, notably butter and milk powders. Despite the recent declines, the FAO Dairy Price Index averaged 146.9 points in 2025, 13.2 percent above the 2024 average, reflecting strong price increases during the first half of the year. The annual rise was driven primarily by cheese, WMP and butter, underpinned by strong global import demand and limited exportable supplies earlier in the year, while SMP prices increased only marginally, reflecting ample availability and comparatively subdued demand growth.

According to the Food and Agriculture Organization (FAO), the FAO Dairy Price Index declined by 4.4 % in December 2025 compared with November, primarily due to a sharp drop in butter prices following increased seasonal cream availability in Europe and peak milk output in Oceania, which softened export quotations for whole milk powder and other commodities at year-end. However, for the full calendar year 2025, the Dairy Price Index averaged 13.2 % higher than in 2024, reflecting strong import demand and constrained exportable supplies earlier in the year.

Recent trend context:

• After a period of elevated dairy prices through much of 2025, exportable supplies expanded later in the year as seasonal production in key regions peaked and cream flows increased, prompting downward price pressure.

• Butter led the December drop, followed by more moderate declines in skim milk powder and cheese prices; whole milk powder also eased amid subdued buying interest from some major importers.

• Despite the monthly dip, dairy remains a strong contributor to overall food price momentum across 2025, with annual averages significantly above 2024 levels.

Relation to broader FAO Food Price Index:

The overall FAO Food Price Index (which includes cereals, oils, meat, sugar and dairy) dipped 0.6 % in December to 124.3 points, marking the fourth consecutive monthly decline as dairy, meat and vegetable oils eased. While this December figure was 2.3 % lower than a year ago, the full-year 2025 average was 4.3 % higher than in 2024, underpinned in part by dairy and vegetable oil price strength earlier in the year.

Short to medium-term outlook:

• Balance of supply and demand will be key — elevated milk production in exporting regions and ample cream availability can continue to limit upside near term, especially for products like butter and WMP when seasonal peaks coincide.

• Import demand dynamics matter: sustained demand from large importing regions (e.g., Asia and the Middle East) could arrest or reverse near-term declines, particularly if exportable stocks tighten again.

• Geopolitical and weather risks remain upside drivers — unexpected disruptions, animal disease events or supply constraints could support stronger price levels later in 2026.

In summary: While December’s monthly dip reflects seasonal and supply-driven easing, dairy prices remain well above last year’s average, and medium-term prospects will depend on how global milk supplies and import demand balance as the new production cycle unfolds.

Source : Dairynews7x7 Jan 11th 2026 FAO release