NZ Braces for Dairy Storage Crunch as China Keeps Buying

Insight Focus

Chinese WMP demand lifts prices amid low stocks and storage scramble. NZ non-Fonterra supply jumps, market share pushing above 30%. EU SMP exports face tightening from Algerian tender despite FX challenges. US trade volatility raises risk premiums.NZ Milk Collections Surge

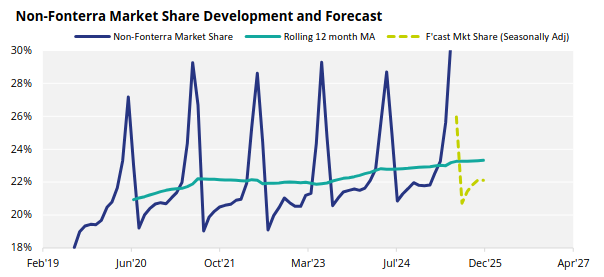

NZ June milk collections rose 17.8% year over year to 24 million kgMS. While June is the seasonal low point for NZ production (so percentage swings can be exaggerated), the more telling figure is the 3.4% increase in national production for Fonterra’s financial year-to-date through June.Non-Fonterra processors were up 26.1% year over year in June and 4.9% for the Financial Year to Date (FYTD), lifting their market share to 22.2% FYTD – and above 30% for the first time ever in a single month.

Temperatures were above average across most regions in June and July, with July being the fourth warmest on record. Rainfall was also above average over the same period, except in Canterbury, Otago, and more recently, Southland. Soil moisture remains higher than normal in most areas. Combined, these factors point to a strong peak milk production in the coming months. Anecdotally, there is “good pasture in front of cows and excellent cow conditions.”

A slight increase is expected in the national herd. This will be a combination of reduced culling and some additional dairy conversions, incentivized by the high milk price. According to The Press, dairy conversions are up significantly in Canterbury, with more than 15,000 additional cows approved in just six months.

Processors are clearly bracing for higher supply (or betting that the market will rally). Warehouse providers report they are “flat out” booking space nationwide for both dry and refrigerated dairy products, with chilled capacity increasingly scarce. This scramble suggests sales books may be soft.

GDT Prices Rise as Chinese Demand Fuels NZ Market

GDT Event 385 last week rose 0.7% at a headline level, against the expectations of many and contrary to the strong New Zealand supply expected to hit soon. Chinese demand has picked back up, with growing volumes across all commodities and seasonal buying ahead of Chinese New Year. Southeast Asia is also actively purchasing, supported by strong regional demand and low stock levels.For WMP, renewed Chinese buying is the clear catalyst. This is based on low Chinese in-market stocks and Fonterra indicating low availability. Chinese suppliers sold significant volumes into South Asia in June, tightening their domestic stocks of local product, and August export production is set to be light. The spot sales price in China is currently above USD 3,200/tonne – a much tighter spread versus New Zealand than is typical – potentially contributing to the upside we are seeing in New Zealand pricing at present.

Meanwhile, the question many are asking is whether the off-GDT market will recognise this price or remain quiet, as it did after the prior GDT WMP price rise. An Algerian Government tender is expected this week, which will set an important marker for off-GDT pricing.

New Zealand SMP appears to be running a two-tier market: GDT buyers (especially China) and enhanced-spec buyers (High-Heat, UHT) versus non-GDT buyers sourcing MH from the cheapest origin available.

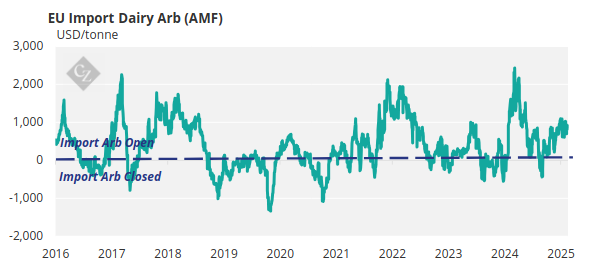

On fats, the Netherlands has become the second-largest destination for NZ AMF, behind only China. This reflects the recently observed divergence of the New Zealand and EU butter markets, and the extreme discount at which AMF has been trading versus butter on a fat-equivalent basis. This combination has made AMF extraordinarily good value for European milk fat users who can substitute, even after high tariffs are considered.

The Spacekraft packaging shortage (1 tonne bins specific for AMF) in New Zealand has also created a significant premium for this format: we are hearing of chocolatiers in Australia who require Spacekrafts having to pay up to get access to product.

A final indicator of growing output is a 34% rise in palm kernel expeller (PKE) imports, now trading around NZD 345/tonne ex-store for spot purchases. Given the impact that the use of this feed can have on the quality of butter production, this is an important point to consider in the New Zealand dairy landscape.

EU SMP Exports Shift as Butter Volumes Rebound

According to the European Commission, during Q1 2025, EU SMP exports fell 51% to Algeria and rose over 100% to both Nigeria and Indonesia, as we anticipated in our previous article.The EUR/USD FX rate has not been helping EU supply competitiveness. The SMP portion of the Algerian Government tender expected in the next few days should largely be covered with EU supply and may provide some measure of tightening. The EU is currently the most expensive SMP origin; however, if the tender plays out as expected, it should remain relatively tight.

After a sluggish Q1 2025 for EU butter exports (down 9%), volumes caught up significantly in May and June, now down only 4.5% year to date. Saudi Arabia, China and Indonesia are the big destinations that are down, while the US saw a large front-loading ahead of tariffs, so we will not see the growth there sustain.

Production data confirms strong butter output in Q2, while both retail and industrial consumption are reported to be down, and Q3 buying is largely complete. Fat imports hit 8,000 tonnes in H1 2025, already surpassing the 6,000-tonne total for all of 2024. French butter producers, previously said to be sold out through December, have also recently returned with offers of frozen butter at an inopportune time.

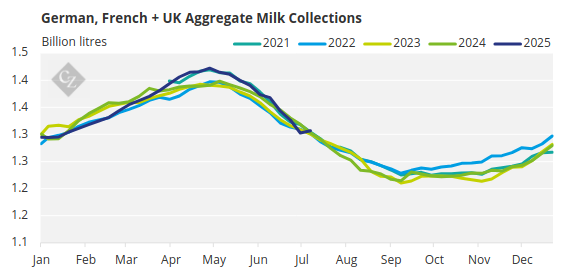

Low feed costs and high farmer payouts mean the recent heat wave has not significantly impacted milk flows, apart from some heat stress effects. Aggregate milk production across the three main producing countries remains strong, matching the 2021 peak and up 0.2% YTD.

US Export Interest Softens Amid Trade Risks

While US SMP pricing is similar to New Zealand, higher freight costs to Southeast Asia and trade volatility are adding a risk premium to US product. This is not helping US suppliers push exports, as many end users fear tariffs being implemented while goods are in transit. We have heard that “export interest is softening,” and that is backed up by the data: US exports of SMP to Asia were down 32% in April.Most buyers in the Americas cover around 80% of their calendar-year dairy needs across October and November. It will be interesting to see if typical trade lanes are maintained during this period, or if non-standard origins take a larger share of demand. Colombia is one market to watch; usually a decent import destination, it is currently awash with local milk and seeking export outlets.

US Cheese prices have been rising due to tighter milk supply. Export demand remains strong due to competitive US pricing. Cheese plants are running steady-to-lighter schedules at present.

National milk production and yields are down due to heat, while spot fluid milk buying has been increasing to cover supply gaps.ource : Dairynews7x7 Aug 13th 2025 Read full story here