Idaho Dairy Farmers

On a scorching July day, cattle farmers Jesus Hurtado and Dirk Rietsma welcomed international visitors to their soon-to-open dairy processing plant, Suntado, in Idaho’s Magic Valley. Among the visitors was a Chinese official, marking a crucial step in their $150 million dream of exporting their milk globally.

Unlike most of Idaho’s 500 family-owned dairy farms that sell locally, Hurtado and Rietsma have invested in 18 aseptic production lines, extending the shelf-life of milk from about two weeks to 12 months. This innovation allows them to explore new markets across the globe, producing around 100 million gallons of milk annually.

China as a dairy importer

China, the third-largest importer of American dairy after Mexico and Canada, spent $607 million on U.S. dairy last year. With changing cultural attitudes, China represents a significant growth opportunity. Currently, China consumes about 15% of the dairy Americans do per capita, and if that gap closes, it could add more than $600 billion to the global dairy market.

Despite rising geopolitical tensions, countries like the U.S. are vying for a share of this lucrative market. Last month, China’s minister of international trade, Wang Shouwen, invited American dairy firms to set up operations in China. Meanwhile, the U.S. Department of Agriculture announced a $1.2 billion investment in dairy exports. Major American banks are financing a $7 billion dairy boom, with private equity also showing interest.

Dirk Reitsma, who manages 10,000 cows at Sunrise Organic Dairy in Paul, Idaho, emphasizes the nutritional value of dairy protein, calling it “better than anything else that we consume.”

Opportunities

The opportunity in China dates back to 2008 when a scandal involving tainted milk shook consumer trust. The Chinese government responded aggressively, but the damage was done, and consumers still often prefer imported dairy. In 2018, China began efforts to revitalize its dairy industry, recognizing that restoring consumer trust was essential for increasing dairy consumption.

From 2017 to 2022, China’s dairy consumption grew from 30.4 million to 39.3 million metric tons, and it’s expected to reach 62.2 million metric tons by 2032. If China’s per capita consumption matched the U.S., it would reach 326 million metric tons, valued at $626 billion.

However, a Rabobank report predicts an 8% drop in Chinese dairy imports due to increased local production. New Zealand leads the market with a 42% share, followed by the U.S. at 13%, and Germany at 11%. Unlike New Zealand and Europe, which are adopting stringent sustainability measures, U.S. regulations remain more lenient, allowing continued expansion.

Suntado’s origins trace back to 1986 when Jesus Hurtado immigrated from Casacuarán, Mexico, and learned the dairy trade at Reitsma Dairy, owned by Dirk’s father. Hurtado eventually bought the farm, rebranding it as Hurtado Dairy, managing 30,000 cows. Reitsma later bought his own dairy nearby. Tired of relying on third-party processing plants, the friends-turned-competitors invested $45 million as collateral to secure $150 million in funding from BMO Harris.

Aseptic Lines

New technology at Suntado’s plant, including aseptic production lines, has attracted attention from major American banks. By keeping the processing in-house, they avoid tolling fees and expect to generate $300 million in revenue in the first year. Once fully operational, the plant will employ 300 people and generate over $1 billion in revenue.

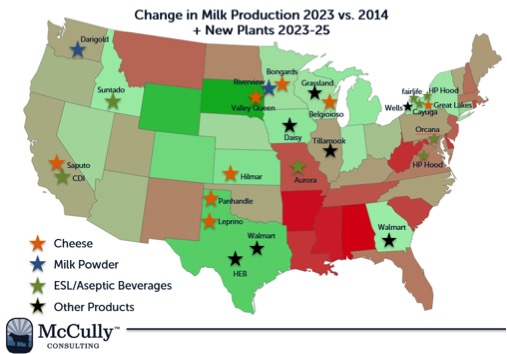

The dairy industry is experiencing a surge in processing facilities, with states like Idaho gaining prominence. Suntado is competing with global dairy giants, such as Coca-Cola’s fairlife, which is investing $650 million in a New York plant, and Darigold, which is building a $600 million facility in Washington.

The dairy boom is largely funded by commercial banks, including Bank of America, Bank of Montreal, and Wells Fargo, which has allocated over $1 billion to dairy companies. Private equity firms are also entering the market, with recent investments from Platinum Equity, Altamont Capital Partners, and Osprey Capital.

Silicon Valley venture capital firms are eyeing the Chinese dairy market as well. Sequoia Capital’s affiliate, Sequoia China, invested in Chinese yogurt company Simple Love and acquired a stake in Junlebao Dairy Group, but geopolitical tensions forced a separation, leaving the Chinese assets in China.