U.S. milk production was less than year-ago levels during each of the 12 months from July 2023 through June 2024, with an average decrease during those months of 0.8 percent from production during the prior 12 months. Total milk-solids production increased by 0.4 percent and milkfat production increased by 1.7 percent during the period.

Fluid milk, yogurt, butter and non-American-type cheese posted positive annual growth in domestic commercial use during the second quarter this year. Significant export growth was posted by all types of cheese and by whey-protein concentrate and isolate, with dry whey showing a smaller increase. But overall aggregate domestic use was flat during the period.

Dairy-product and farm-level prices, as well as margins-over-feed costs, have continued to increase in recent months as supply has kept pace with demand.

Commercial use slightly decreases

Total commercial use of all U.S. dairy products, on a milk-equivalent total-milk-solids basis, was 0.8 percent less during the first half of 2024 than a year earlier, adjusting for the leap-year February month. It’s not common for total use during a six-month period to be less than a year earlier, especially to that extent, because that usually happens only when domestic use and exports are both weak. By contrast, for example, strong growth in domestic use during 2023 more than offset unusually large export losses following the surge in overseas sales a year earlier. But while exports have shown smaller losses this year, domestic use has also experienced a period of weakness – likely due to the cumulative effects of food-price inflation.

Dairy trade varies

During the first six months of 2024, the United States exported the equivalent of 2.1 percent less total milk solids than it did during the first half of 2023, adjusting for the leap-year February month. Those same percentages for the three main U.S. export-product categories, which account for more than 90 percent of total milk-solids exports, are 12 percent less for dry-milk products, 1.2 percent less for dry-whey products and 23 percent more for cheese.

Inflated domestic dairy-product prices relative to prices during the prior year attracted 6.4 percent more dairy imports into the United States during the first half of 2022, measured by total milk solids. The same price situation is repeating itself this year, although to a lesser extent, yet imports during the first half have already increased by 10.9 percent as compared to the previous year.

Dairy production adjusted

The U.S. Department of Agriculture preliminarily reported June U.S. milk production at 1 percent less than June 2023 production and revised its reported production for several earlier months of this year. The numbers show 12 straight months of being less than year-ago levels of milk production, averaging 0.8 percent less for that period compared to the previous 12 consecutive months, adjusting for leap year. During those same 12 months, total milk-solids production increased by 0.4 percent and milkfat production increased by 1.7 percent.

Total cheese production was essentially stable from a year ago during the second quarter this year, while production of American-type and other types continue to widen their divergent rates of change; American-type production is decreasing faster and other types are increasing faster. Dry-product production was less for the major types, especially for dry-skim-milk products, while butter production continued to grow.

Inventories show varied stocks

Monthly inventories of most major dairy products, including cheese and butter, have exhibited declines during the past few years in the number of days of total commercial use in their monthly stock levels. At the end of July, stocks of both American-type cheese and other cheese were just slightly less than their trend lines since 2020 for that measure. July-ending cold-storage stocks of butter, whose monthly stock levels exhibit the most pronounced seasonality of any dairy product, were at more than its trend, having receded only slightly from its likely seasonal peak of days of use in stock in April this year.

Dairy prices varied

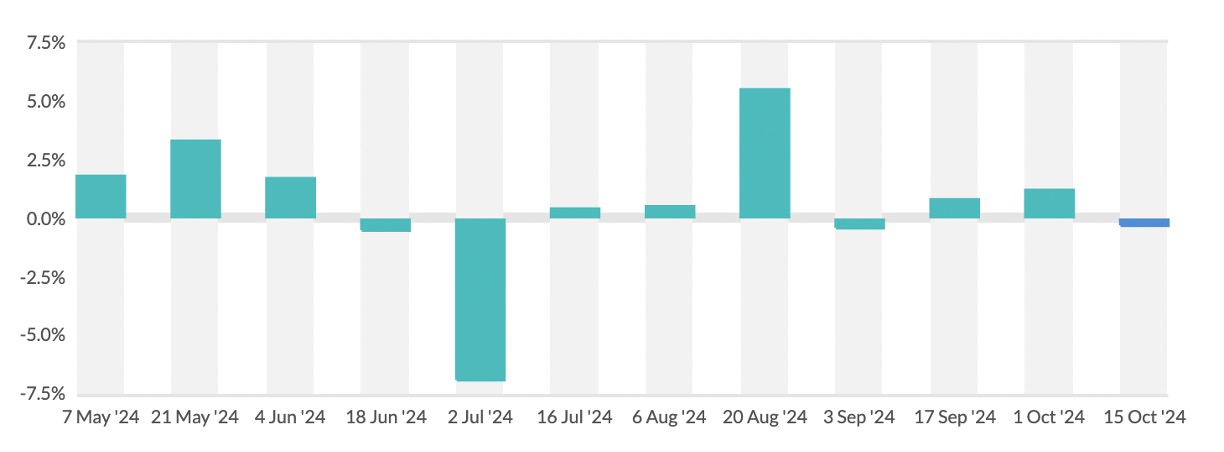

Block Cheddar-cheese survey prices increased from June to July, but barrel prices decreased, leaving the weighted-average cheese price slightly less for the month. The other three survey prices all increased moderately, as did the Federal Order class prices they collectively determine.

Following the inflationary price runup during 2022, retail prices of natural Cheddar cheese have fairly consistently receded from their peak level. Prices of fluid milk and butter initially did so, but are now beginning to increase again – especially for butter. But prices of processed cheese, ice cream and yogurt have continued to increase, at rates that increase in that order. The Consumer Price Index for all items increased 2.9 percent from a year earlier in July, which is the measure widely reported in the media as the overall rate of inflation. At the same time, the Consumer Price Index for all food and beverages increased by 2.2 percent. The Consumer Price Index for dairy and related products decreased by 0.2 percent.

The June Dairy Margin Coverage margin added $2.06 per hundredweight during the past two months, to reach $11.66 per hundredweight, as the all-milk price added $2.30 per hundredweight while the Dairy Margin Coverage feed cost increased by a net of only $0.24 per hundredweight during those two months. The June all-milk price was $22.80 per hundredweight, an increase of $0.80 per hundredweight from May, and the Dairy Margin Coverage feed cost decreased by $0.34 for the month, mostly on a reduced premium-alfalfa-hay price.

Looking ahead

In its World Agricultural Supply and Demand Estimates report for August, the USDA reduced its monthly forecasts of U.S. milk production during both 2024 and 2025 calendar years from a month earlier, on both reduced cow numbers and less production per cow. It currently projects 2024 production at just 100 million pounds more than 2021 production. The USDA is also beginning to temper its milk-production-growth forecast for 2025, currently 0.8 percent better than 2024, at 228.2 billion pounds.

The August report also increased its forecasts for all but one of the dairy-related prices it reports, which comprise the four National Dairy Products Sales Report product prices – the Class III, Class IV and all-milk prices – for both 2024 and 2025 calendar years. From July’s report, the USDA increased its 2024 price forecasts by an average of 1.5 percent and its 2025 forecasts by an average of 2.1 percent. It decreased only its 2024 butter forecast by 0.5 percent. The all-milk price forecasts increased by $0.05 per hundredweight to $22.30 per hundredweight for 2024 and for 2025 by $0.25 per hundredweight to $22.75 per hundredweight. At the same time as the report, the Chicago Mercantile Exchange dairy futures were indicating average all-milk prices for 2024 at $22.50 per hundredweight and $22.25 per hundredweight for 2025. Those are all significantly better than the 2023 average all-milk price, which was $20.30 per hundredweight.