The United States has been shipping fewer dairy products to Southeast Asia despite strong economic growth in the region. For the first five months of 2024, U.S. exports to the Philippines, Indonesia, Vietnam, Malaysia, Thailand, and Singapore slipped 5% to 440.7 million pounds compared to the same period in 2023.

“So far, 2024 exports to the region were the lowest for that period since 2019, and nonfat dry milk and lactose shipments logged considerable losses,” said Betty Berning, analyst with the Daily Dairy Report.

Year-to-date U.S. exports of nonfat dry milk (NDM) and skim milk powder through May fell 8% to 211.2 million pounds compared to the first five months of 2023, according to USDA data. Annual data through 2023 showed that U.S. exports of NDM to the region have not grown since 2020.

“Some of the decline is due to lost market share,” Berning said. “New Zealand increased annual shipments to the region in 2022 and 2023. However, when looking at supplies from the top-15 exporters, aggregate sales of skim milk powder and nonfat dry milk to the region have been down since 2020.”

Year-over-year sales of U.S. lactose to Southeast Asia at 72.8 million pounds were also down for the January through May period. This year’s shipments of U.S. lactose to the region have fallen more than 16% compared to the first five months of 2023. The United States is a top supplier of lactose to these markets, but year-over-year sales to the area were also down in calendar year 2023, she noted.

Recent reports show that gross domestic product (GDP) has been growing in the region. In Vietnam, for example, GDP grew by more than 6.4% in the first six months of 2024, while Thailand’s economy expanded 1.5% in the first quarter of 2024. In the Philippines, a key importer of U.S. dairy products, GDP in the first quarter rose 5.7%. Economic growth was also strong in Indonesia, Malaysia, and Singapore.

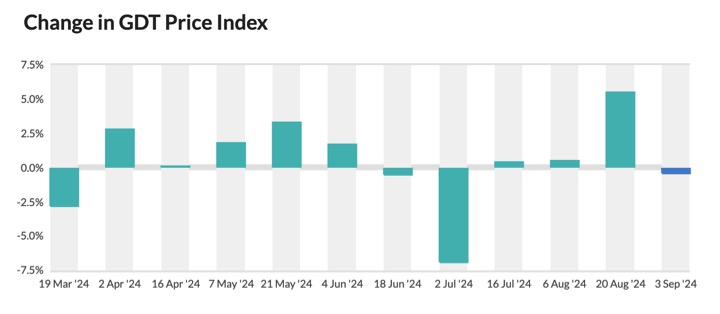

“Typically, a stronger GDP would correspond with a pick-up in dairy demand, but that hasn’t been the case this year,” Berning said. “The United States has likely lost out on sales to the region due to a stronger dollar, which has eroded purchasing power in importing nations. In addition, the lack of free-trade agreements makes buying from the United States less appealing than sourcing product from New Zealand.”

Another factor hurting U.S. dairy exports is price, according to Berning. Since January 2023, U.S. dairy products have mostly been at priced at premium to other global competitors’ products. And when they were been priced at a discount, it wasn’t large enough to influence purchasing decisions, she said.