GST Rate on Milk, Paneer & Dairy Products with HSN Code

Contrasted with different businesses, the dairy segment has coordinated branches on the drain makers in India. In spite of the fact that most recent data is demonstrative that GST (Goods and Services Tax) has been applied with 12% on all items.

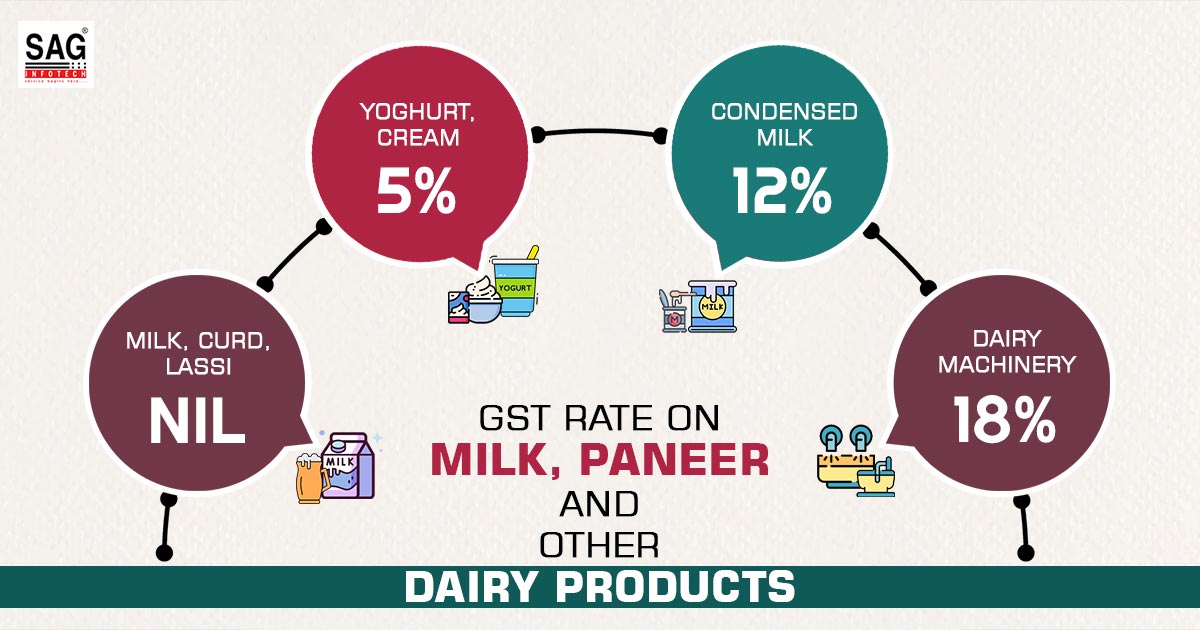

During the 47th GST Council meeting held in June 2022, there were some modifications recommended concerning GST rates on the supply of different goods and services. In these modifications, dairy products were also included. Pre-packed and labelled curd, UHT milk, paneer, honey, and jaggery, among other things, were exempt from GST, however, the council removed them. Therefore, 5% to 18% of GST rates apply to these products.

GST Applicability on Production and Sale of Milk, Curd and Paneer

The exemption allowed on certain dairy products to justify the levy of GST and prevent tax evasion was removed by the GST Council. The declared modifications came into effect on 18th July 2022.Consequently, at present, 5% GST rate is not levied on pre-packaged and labelled milk products such as paneer, curd, lassi, and buttermilk. Moreover, Ultra-High Temperature (UHT) milk is also covered under the 5% category. However, other dairy products come under a 12% GST rate and in this condensed milk, cheese, butter, and ghee are included.

Under the GST regime, fresh milk and pasteurized milk will completely remain in the exemption. Likewise, there is no GST applicable as long as paneer, curd, and buttermilk are sold loose, i.e., without any pre-packaging and branding.

GST Rate and HSN Code on Dairy Products (Milk, Curd, Paneer)

Chapter 4 of the GST Act, 2017 deals with milk products including cheese, cream, and curd. The table given below will help you understand the applicable GST rates on dairy products and their HSN codes-| Dairy Products | GST Rates | HSN Codes |

|---|---|---|

| Fresh Milk and Pasteurised Milk, Milk and Cream, Including Separated Milk, but Not Concentrated nor Sweetened, Excluding Uht Milk | NIL | 0401 |

| Ultra-High Temperature (UHT) Milk | 5% | 0401 |

| Milk and Cream (concentrated or sweetened), Including Skimmed Milk Powder, but Excluding Condensed Milk | 5% | 0402 |

| Yoghurt, Cream, and Other Fermented or Acidified Milk and Cream (concentrated or otherwise) | 5% | 0403 |

| Lassi, Curd, and Buttermilk (pre-packaged and labelled) | 5% | 0403 |

| Buttermilk, Curd and Lassi (excluding pre-packaged and labelled) | NIL | 0403 |

| Products Consisting of Natural Milk Constituents (concentrated and sweetened or otherwise) | 5% | 0404 |

| Paneer or Chena (pre-packaged and labelled) | 5% | 0406 |

| Paneer or Chena (excluding pre-packaged and labelled) | NIL | 0406 |

| Condensed Milk | 12% | 0402 91 10, 0402 99 20 |

| Dairy Machinery and Milking Machines | 18% | 8434 |

How GST is Calculated on Dairy Products (Milk, Curd, Paneer)?

Fresh and pasteurized milk that is unsweetened or concentrated will not be subject to any GST tax from 18th July 2022. However, UHT milk will have a 5% GST tax. To provide an example, if the MRP of UHT milk is Rs. 60, then the GST amount would be:GST = Rs. 60 * 5% = Rs. 3

Similarly, pre-packaged and labelled dairy products including paneer and curd will have a 5% GST tax applied. For instance, if a branded packet of paneer or curd costs Rs. 120, then the GST amount would be:

GST = Rs. 120 * 5% = Rs. 6

How to Claim GST Credit on Dairy Products (Milk, Curd, Paneer)

According to Section 16(1) of the CGST Act, a registered taxable individual can claim an input tax credit (ITC) on goods and services used to support the business as a seller of these dairy products. However, Section 17(5) of the CGST Act specifies several conditions under which ITC cannot be claimed.GST Rate Changes on Dairy Products (Milk, Curd, Paneer)

Since the GST law came into existence, milk products, including paneer and curd have been exempt from tax. However, GST rates on milk have been reviewed in the 47th GST Council meeting because of issues over rate justification, with the compensation procedure in the states to be finalized.The issue was intensified further as the reports mentioned the exemption of GST on some pre-packaged food products and considered it one of the prominent reasons for revenue leakages. Many businesses that were not registered but were selling products under their brand name, had been selling goods without paying any GST. Resultantly, the GST Council suggested a GST levy on these pre-packaged and labelled products.

Moreover, some of the previous explanations and modifications made to the GST levy on some milk products are summarised below:

Fortified Toned Milk

According to the CBIC Circular No. 52/26/2018-GST, dated 9th August, fortified toned milk with vitamins including Vit A and D, will not be subject to any GST. HSN code 0401 covers fortified toned milk.Khoya/Mawa

According to F.No. 332/2/2017-TRU, dated 7th December 2017, Khoya or Mawa is categorized as concentrated milk under HSN code 0402, hence there will be a 5% GST levy applicable.Actually, in many nations the dairy industry widely prevails and the most astounding extent of the buyer that is collected does not surpass 35% of the sum paid by the purchaser. It is caught that 12% GST would actuate the business to decrease the drain costs paid to the milk extracting units. The 12% rate of GST may likewise build the shopper costs of dairy items significantly. The buyer would tend to lessen the utilisation of prepared dairy nourishment.

In the event that a shopper moves more towards the conventional seller, the composed dairy segment that has been struggling in the market of merchants, would contract in size and significantly lessen its span to the milk producer. This would end the extension and interest in the sorted-out dairy part including the cooperatives.

It is notable that milk creation in India has been reliably developing at 4-4.5% every year. This is on the grounds that the milk yielded in India has a consistent ranch to fork linkage through direct access to the constantly expanding market for milk and milk items. The 12% GST taxation may switch this cycle as this would bring a decrease in the crude industry expansion as paid to the milk producer. The milk units would think that it’s hard to oversee dairy animals and wild oxen. They may short of making interest in buy of animals resources for expanding milk creation.

Earlier, the southern part of the nation was paying 14.5% on the Ghee while in the northern part, it was 5 percent applicable. After the implementation of GST, it has seen a uniform 12 percent tax scenario across the nation which took the position inverse.

Now the southern part of nation will be availing 2.5 percent relief on the Ghee while the northern part will have to bear an added tax load of 7 percent. The talks are higher in voice due to the festive season as Ghee constitutes as the second largest dairy product after liquid milk which is capturing around 65 percent of the dairy sector.

It is basic that a milder view is taken while forcing GST administration on the dairy business. The administration should have an extension-driven approach. Recuperation of low tax through the dairy segment ought not to be considered as a misfortune to the national exchequer, however, a speculation that would goad development in drain creation, guaranteeing national nourishment and dietary security and improving rustic thriving.

It ought to make an uncommon class for the dairy business by exempting a wide range of fluid milk, cleaned milk, dahi, chhachh, lassi, shrikhand, paneer and Items like unprocessed Milk, Butter Milk, Curd, Bread has attracted 0 percent. GST rate on the processed Cream, Skimmed Milk Powder, Branded Paneer are in 5 percent slab rate. While other branded products like Butter, Cheese, Ghee, Milk Beverages are included in 5 percent while Condensed Milk in 12 percent.

The dairy sector was always seen as major nourishment in a country like India which credits in the health motto is the first motto. The GST is seen as better as much for each and every sector and this is the same fact which ministry also expresses.