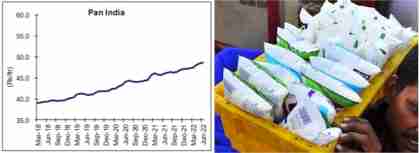

Milk prices, which have been rising steadily in the past year, may hit new highs in the year ahead, as production suffers due to insufficient fodder and fewer new lactating cattle, and farmers raise prices to make up for losses in the last two years.

Fodder availability has declined thanks to increased exports of wheat used in cattle feed and damage to fodder crops from heat waves and surprise rains; at the same, there have been fewer inductions of lactating cattle, in a lag effect of fewer artificial inseminations during the worst of the pandemic days.

“As the farmers were being paid lower than their production cost in many states—excluding Gujarat, which is a stronghold of cooperatives—farmers reduced the induction of new animals,” said R.S. Sodhi, president of the Indian Dairy Association and former managing director of Amul. “Farmers have also fed cattle less to cope with their losses amid high feed and fodder costs,” he added. This also led to a fall in yield.

Wholesale price inflation in milk stood at 6.99% in December and 8.96% in January and hit 10.33% in February, rising for a third straight month.

According to Sodhi, retail milk prices have gone up by 13-15% in the past 15 months amid a worldwide increase in cereal prices, which has started stabilizing now.

While demand has rebounded since the easing of pandemic curbs, supply has lagged due to production constraints.

The outbreak of covid-19 in India in April-June 2020 and an explosion of cases in mid-2021 triggered mobility curbs, disrupting artificial insemination services, consequently leading to fewer calf births in FY21 and FY22. “Given that calves typically take two-and-a-half years to be ready for insemination, this fiscal year has seen a shortage of animals available for insemination. Thus, fewer cows are expected to be lactating in FY24, leading to lower milk production and availability,” said Pushan Sharma, director of research at Crisil Market Intelligence and Analytics.

“Slower growth in retail prices compared to procurement prices in FY22 and FY23 affected the profitability of key dairy players. In FY24, with a likely 6% rise in milk procurement prices, industry players are seen increasing retail prices of milk by 7% to make up for losses from the past two fiscals,” Sharma said.

Lower production due to heat waves during the summer of 2022 and unseasonal rainfall in most fodder-growing states brought down the availability of fodder. The government has already banned wheat exports and restricted rice exports.

As small and marginal dairy farmers were unable to afford fodder at increased prices, they reduced fodder procurement for their cattle, which resulted in lower milk yield and lower fat and solids-not-fat (which play an important role in physico-chemical, sensory, textural characteristics and also the shelf life of any milk sweet) content of the milk in FY23.

Feed and fodder cost, which has a 70-75% share in milk production, has shot up 20-25% due to higher exports of fodder crops such as wheat, barley and maize amid a supply shortage in the global market caused by Russia’s invasion of Ukraine. This has pushed up the wholesale price index for fodder to 220 in FY23 from 180.5 in FY22.

“The expected El Niño drought conditions in FY24 could lower kharif crop production, limit fodder availability and affect milk production and yields. Thus, milk procurement prices are expected to increase in FY24 as well which would trickle down to milk retail prices,” said Sharma of Crisil.

However, not all expect a sharp rise in milk prices in FY24. “Milk prices may go up slightly in the summer months of May-June when supply remains tight, and demand is high, and these may start declining around Diwali,” said Sodhi. “I don’t see fodder prices running up further, influencing domestic prices of milk and dairy products sharply in anticipation of good rabi crops this season,” he added.

Rabi crops have faced damage from unseasonal rain and hailstorms in March. However, the agriculture ministry does not expect any quantity loss in its total rabi production of 170 million tonnes (mt) amid an increase in cultivation area.

Shravan Kumar, a Lucknow-based dairy farmer, said the wheat he had sown on 7-8 bighas were damaged. “Quantity may not get affected if weather improves, but straw has turned black due to the weather. It will require extra effort to crush and feed cattle,” he said.