Drawing from data provided by APEDA and Indian Customs, we present an in-depth look at the trends and dynamics shaping the dairy export landscape. Note that Casein and Lactose are excluded from this analysis and will be covered separately. For India to fully leverage its substantial milk production, processors must prioritize export markets, facilitating better value addition and enhancing the sustainability of the nation’s 80 million small and marginal dairy farmers.

Total dairy exports

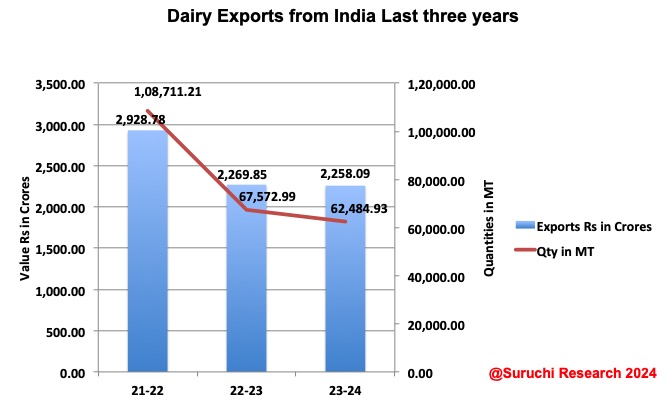

This year, India’s dairy exports across six key categories (HS codes 0401 to 0406) fell short of last year’s value by Rs 10 crores, totaling Rs 2258 crores. Despite the lower export volume of approximately 62,500 MT—down by 5,000 MT from last year—the average realization per MT improved to Rs 361, compared to Rs 335 in the previous year. This indicates a favorable shift towards higher value realization for Indian dairy products in international markets.

Liquid milk exports

Liquid milk exports from India have shown a steady increase in their share of total dairy exports, rising from 3% to 4% and now 5%. The latest export value for liquid milk has surpassed Rs 100 crores, reflecting a positive trend in this segment’s contribution to overall export figures.

Milk Powders

Milk powders, which held a promising 37% share of exports in 2021-22, have seen a significant decline to 25% and further down to 8% this year. The total export value for milk powders remains just shy of Rs 200 crores, highlighting a substantial drop in their market performance.

Fermented milk products

Fermented fresh products such as yogurt and curd have maintained a consistent share of around 1% in total exports, with a total export value of approximately Rs 28 crores. This category faces significant challenges due to the necessity of cold chain maintenance and the short shelf life of the products.

Whey based products

Whey-based products are showing gradual progress, inching towards a 0.5% share with an export value of less than Rs 10 crores. Although the growth is sluggish, it indicates a slow but steady demand in the international market.

Butter and Milk Fat

Milk fat products have captured a substantial 65% share of total dairy exports, amounting to around Rs 1500 crores. This segment is pivotal in achieving high value realization for Indian dairy products globally, underscoring its significance in the export portfolio.