India’s milk demand to surge further in 2025

India’s milk consumption is poised for further expansion in 2025, buoyed by improving incomes, changing consumption habits and stronger organised dairy infrastructure. According to FAS’s recent Global Agricultural Information Network (GAIN) report, household demand for fluid milk in India is set to reach around 91 million metric tons (MMT) in 2025, up from about 89 MMT in 2024. At the same time, factory-use consumption of fluid milk—i.e., milk processed in the organised sector—is projected at 125.5 MMT in 2025, up from 122.7 MMT in 2024.

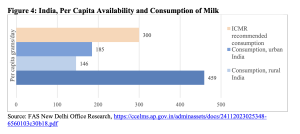

This growth is being driven by several structural factors. First, the sheer size of India’s population and its growing middle class mean that even modest upward shifts in milk consumption per household translate into large incremental volumes. Second, rising disposable incomes and heightened awareness about nutrition are leading consumers to favour branded, packaged dairy products (milk, yoghurt, cheese, butter etc.), which in turn drives the organised sector’s share. The GAIN report highlights that while per-capita consumption remains below the benchmark set by the Indian Council of Medical Research (ICMR), there is clear momentum in both rural and urban markets.

However, the report also points out that growth is not without hurdles. Despite robust production capabilities, India’s per-capita availability and consumption of milk and dairy products still lag recommended levels. There are regional disparities in consumption and supply chain constraints such as cold chain logistics, variable productivity of milch animals and feed/fodder shortages. According to the GAIN summary, these structural issues could moderate growth if not addressed.

Industry Insights

For dairy processors, cooperatives and equipment/lab service providers, the implications are clear: volume growth alone is no longer sufficient. With consumption rising, the premium will shift to quality, traceability and value-addition. The fact that factory-use consumption is growing faster than household consumption suggests the organised sector (branded, processed, value-added) will capture an increasing share. This trend places premium on investment in processing infrastructure (UHT, cheese, flavoured milk), cold-chain expansion, brand differentiation and lab/testing services (for safety, nutrition, shelf-life). Dairy labs like yours are positioned to benefit: as more processors emphasise high-quality, branded and export-oriented products, the demand for reliable analytical testing of milk, intermediates, and shelf-stable dairy products will rise accordingly.

Source : Dairynews7x7 Nov 13th 2025 The cattle site