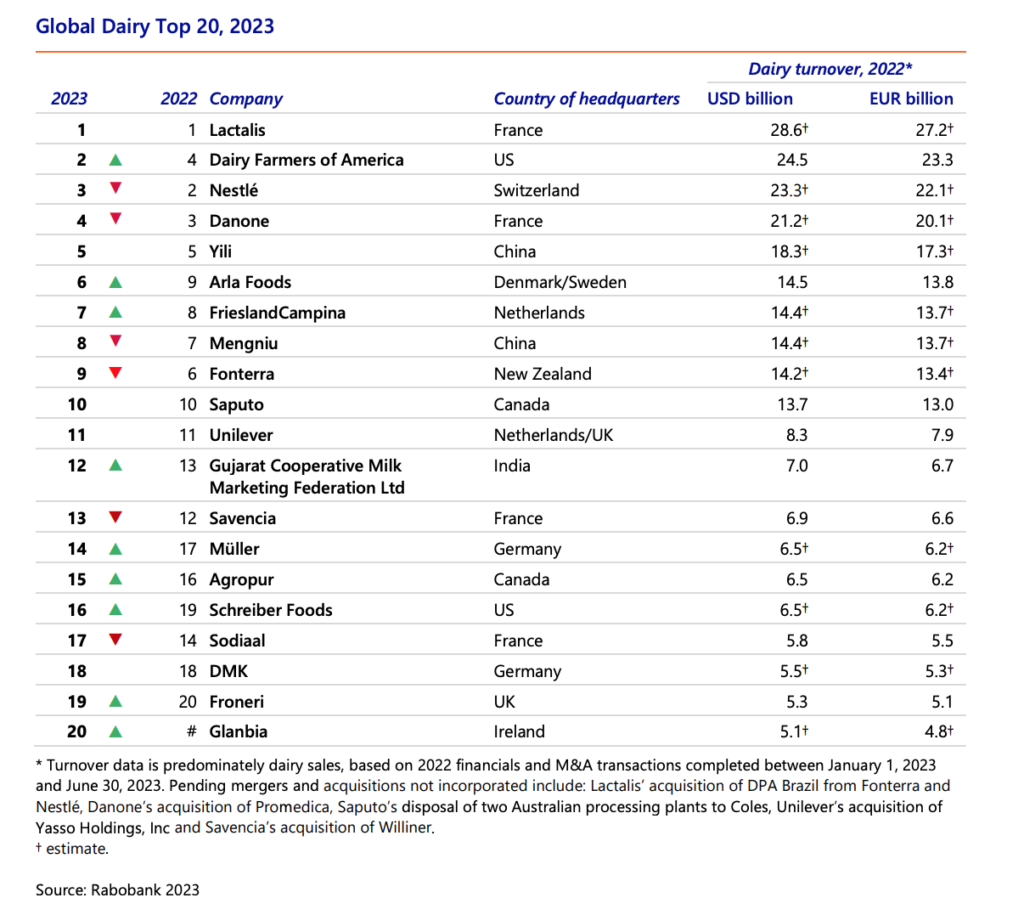

Rabobank’s annual Global Dairy Top 20 highlights the results of industry leaders in one of the world’s most valuable food sectors. The combined turnover of the Global Dairy Top 20 companies jumped by 7.4% in US dollar terms, following the prior year’s gain of 9.3%. In euro terms, the combined turnover increased by a significant 21% due to the combination of a stronger US dollar, inflation, and tight market conditions during most of 2022, with many companies reporting record-high revenues in their local currencies.

Overall, only five companies held the same position as last year, indicating a reshuffle along the entire list. In 2022, merger and acquisition activity was nearly on par with the prior year, with almost 25 deals. A slowdown in activity was noted in the second half of the year, which continued into 1H 2023, with about eight deals announced in the first half of 2023 versus approximately 12 deals in the first six months of 2022. FX developments in 2022 contributed to the reshuffle and were particularly unfavorable for dairy companies reporting in euros, New Zealand dollars, renminbi, and yen.

While the first half of the ranking is divided by nearly USD 15bn in turnover between the first and tenth positions, a difference of about USD 3.2bn separates the ten companies in the second half of the list.

Unilever, retaining its position

Unilever remains in 11th position, with the company’s newly formed ice cream division reporting a EUR 1.0bn (+14.8%) or USD 0.2bn (+2.3%) increase in sales, raising total sales to EUR 7.9bn or USD 8.3bn. The pending acquisition of US-based Yasso Holdings is expected to add over USD 200m in annual revenues.

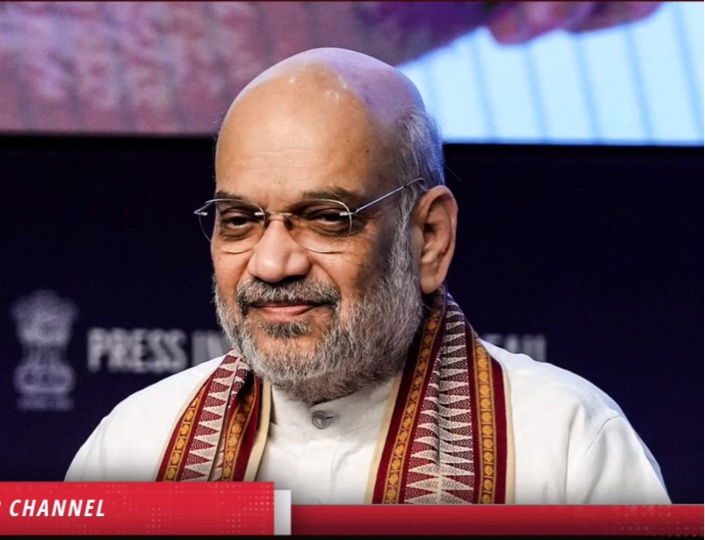

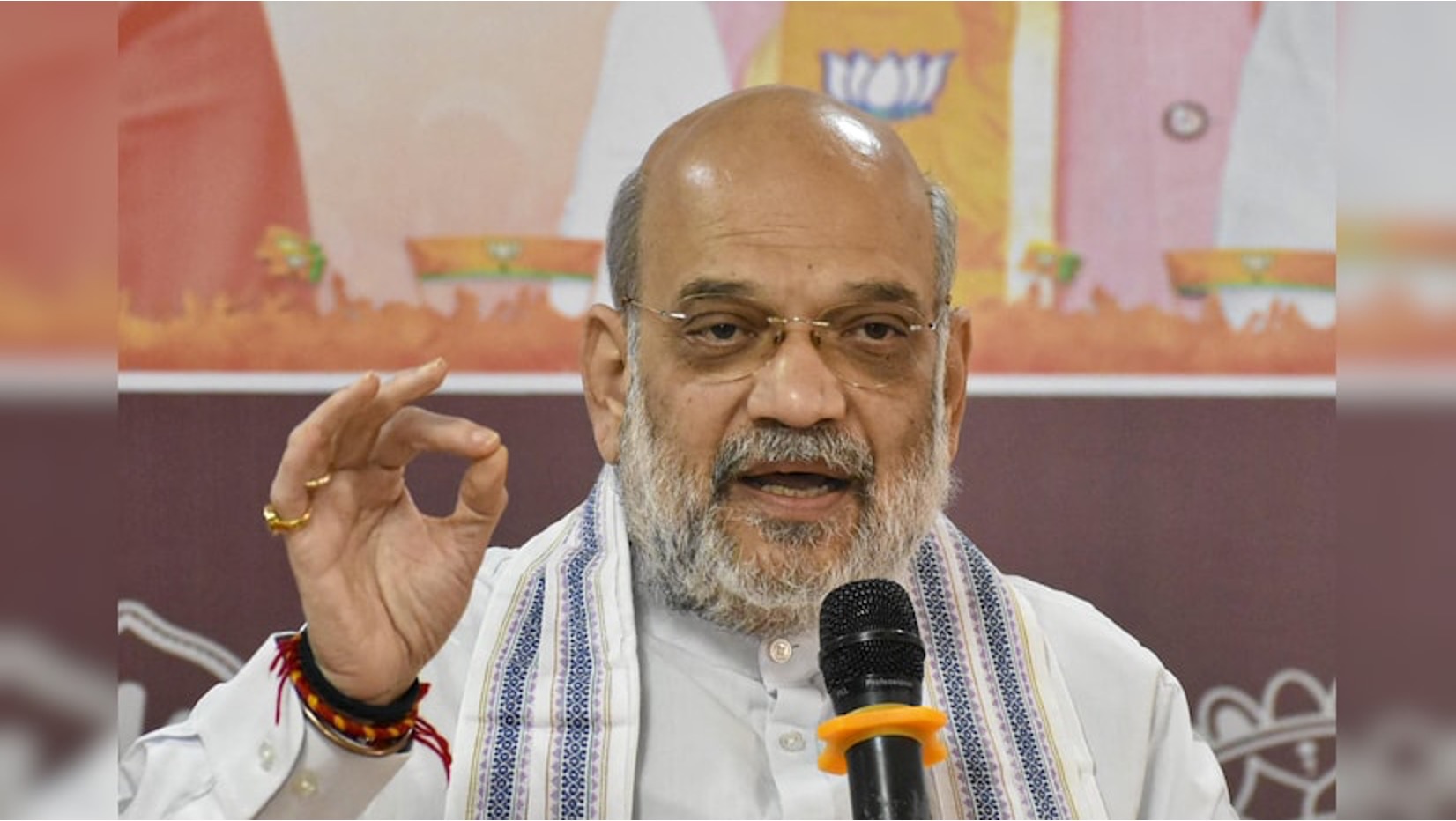

Amul has moved up by one step in 2023 becoming 12th largest dairy

Behind Unilever, India’s Gujarat Cooperative Milk Marketing Federation (Amul) (12th) and France- based Savencia (13th) swapped positions, but they remain closely paired with a difference in turnover of about USD 100m. Savencia’s announced acquisition of Argentina-based Williner in April 2023 is estimated to add about USD 250m in revenues once closed.

Dairy Alternatives: Focus Shifting to Protein Ingredients, Precision Fermentation, and Partnerships

Dairy alternatives have become part of the product portfolio of most Dairy Top 20 companies, but still account for a small share of revenues. In recent years, the focus has been on launching plant- based products as alternatives to liquid milk and fresh products like yogurt, but attention has shifted to using precision fermentation to develop alternatives for dairy proteins. The last 12 months saw the announcement of a streak of partnerships, (small) equity positions, and funding directed toward startups. This includes the partnership between Nestlé and early pioneer Perfect Day; FrieslandCampina and biotech company Triplebar’s collaboration; Fonterra and Dutch DSM’s joint venture, Tasman B.V.; and Danone’s investment in Israeli startup ImaginDairy.

Looking ahead, we expect weakening dairy and retail prices will make 2023 a challenging year in terms of profitability for some companies in the ranking. Farmgate milk prices remain relatively high in some regions, which squeezed margins in 1H 2023. In terms of turnover, we expect more muted growth in 2023, with some companies unlikely to match the double-digit percentage revenue gains they experienced in 2022.