Dairy prices have started 2023 on a soft note, However, analysts are banking on China ending its Covid-zero policy to lift prices in the coming months.

Westpac’s senior agri economist Nathan Penny says the bank is sticking to its forecast milk price of $8.75/kgMS for this season.

“Prices in late 2022 had been weaker than we had factored in,” he says.

“At the same time, the change in Chinese Covid policy has come sooner than we had anticipated. On balance, that leaves our forecast unchanged.”

Fonterra narrowed its forecast milk price range last year to $8.50 – $9.50/kgMS, with a midpoint of $9/kgMS. ASB has been forecasting $9.40/kgMS and is expected to review its forecast this month.

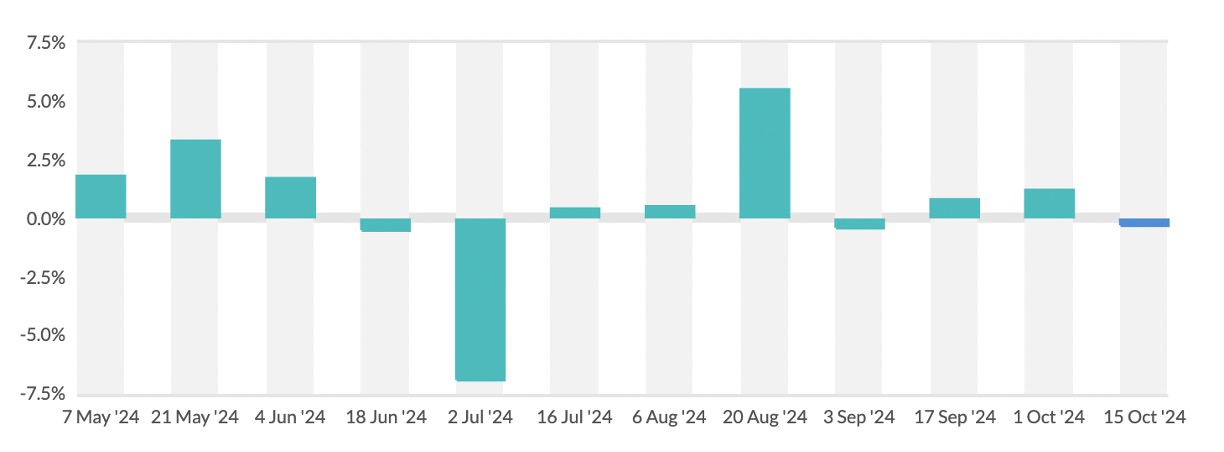

Penny notes that over the first two auctions of 2023, overall prices slipped 2.8%.

“However, we anticipate that this weakness will not last,” he says.

“Indeed, the abrupt end to China’s Covid-zero policy should see its economy rebound rapidly.

“For example, we expect the Chinese economy’s growth to double to 6% over calendar 2023, from around 3% growth over 2022.”

More impotantly, Chines consumers are now free to move about. That will lead to a rebound in demand, particularly for dairy products (such as butter) used in restaurants and other food service outlets, he says.

Notably, by the end of 2022, the share of New Zealand’s dairy exports going to China had dipped below that of the rest of Asia.

But as Chinese dairy demand rebounds, this trend should reverse.

Penny points out that the counter argument to this view is the rapid rise in Covid cases in China.

And on this basis, Chinese consumers could limit their movements in order to avoid infection.

“However, the anecdotes that we’ve seen to date suggest that Chinese consumers are by and large preferring to embrace their newly found newly found freedoms at the risk of contracting Covid,” he says.

“Moreover, international experience has shown that the Omicron variant moves so rapidly through the population that the associated Omicron wave passes quickly.

“In terms of timing, we expect dairy prices to begin to rebound over the next month or two.

“The Lunar New Year and existing stock levels may muddy the waters in the short term, but beyond that we expect underlying Chinese demand to lift.

“With that in mind, from around late February or early March we should have a clearer indication of whether our view holds either way.”