GST Council Recommends a Uniform Rate of 12% on all Milk Cans Meaning Steel, Iron, Aluminium

The 53rd GST council has recommended uniform rate of 12% on all meaning steel, iron, aluminum which are irrespective of the use. The Finance Minister Nirmala Sitharaman presided over the 53rd meeting of the GST Council today (22nd June 2024) at New Delhi with Revenue Secretary and CBIC Chairman. M Sitharaman said, “Council recommended to […]

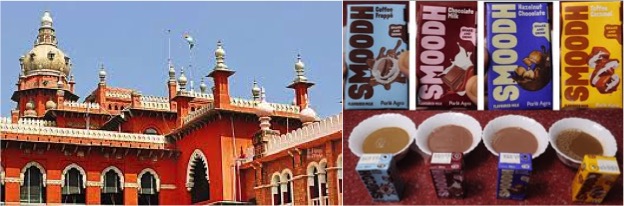

GST Council Cannot Classify Goods under GST on Flavoured Milk

While giving relief to Parle Agro on taxability of flavoured milk, the Madras High Court has held that GST Council cannot determine the classification, A single judge bench, in its recent ruling, held that flavoured milk would attract GST at the rate of 5 per cent. The GST Council, in its meeting on December 22, […]

No plans to eliminate milk and milk products from GST net

There is no proposal to eliminate the Goods and Services Tax (GST) on milk products as the rates are based on the recommendation of the GST Council, Union Minister of State for Finance, Pankaj Chaudhary, said on Tuesday, August 1, 2023. Mr. Chaudhary said fresh milk and pasteurised milk are exempt from GST. The rates […]

Dairy Farmers to Stage Dharna in front of Parliament on 27 Jul on GST

The Dairy Farmers Federation of India (DFFI), which is part of the All India Kisan Sabha, has called upon dairy farmers across the country to join a dharna and a demonstration in front of the Parliament on July 27. The organisation has asked dairy cooperatives and traders to participate in the campaign against GST imposition on dairy […]

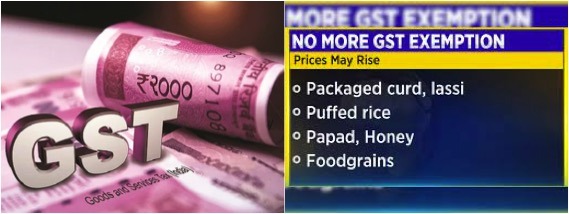

Impact on recent increase on GST on dairy industry by 47th GST council

The GST Council at its meeting held on July 1, 2022 have removed the exemptions on GST on repackaged, relabeled and packaged butter milk, curd, lassi and paneer. The decision states that the above products will be charged GST @ 5%. GST Council have also raised the GST on dairy machinery and milking machines from […]

Prices of Curd, Lassi and Buttermilk likely to rise after imposition of 5% GST

In the 47th meet, the GST Council chaired by Finance Minister Nirmala Sitharaman under withdrawal of exemptions, said, “hitherto, GST was exempted on specified food items, grains, etc when not branded, or right on the brand has been foregone. It has been recommended to revise the scope of the exemption to exclude from its prepackaged and pre-labeled […]

Dairy industry : “Change before you have to.”

Today is July 1st , 2022. A day which is bringing a big change in the Indian dairy and food industry through regulatory measures.. There are three major departments which regulate all food business in India . These are Food authority ( FSSAI), Goods and Service tax ( GST) and Central Pollution Control Board ( […]

Paneer, Meat, Papad Will Cost You More From July 18.

The tax rates on certain goods and services will rise from July 18, including some new products brought into the the tax net, under the Goods and Services Tax (GST), according to the finance ministry after the GST Council meet. The GST Council has accepted the recommendations of a panel of State Finance Ministers and […]

GST rates levied on healthy dairying : buttermilk, curd, lassi and paneer

The Goods and Services Tax (GST) Council on Tuesday decided to remove a host of tax exemptions and hike rates for an even larger number of mass-consumption items. It approved a proposal to impose a 12% tax on hotel rooms costing below `1,000 per day and a 5% levy without input tax credit on hospital […]

Govt planning to remove gst exemption on dairy products in phases

The Group of Ministers (GoM) formed for GST rate rationalisation met on 17th June 2022, making some key proposals. It shall be placing an interim report before the GST Council, scheduled to meet on 28th and 29th June 2022 at Chandigarh. Sources to media publications claim that the interim report mentions that any of the […]