What the global “Wall of Milk” means — recent developments

What the global “Wall of Milk” means — recent developments

-

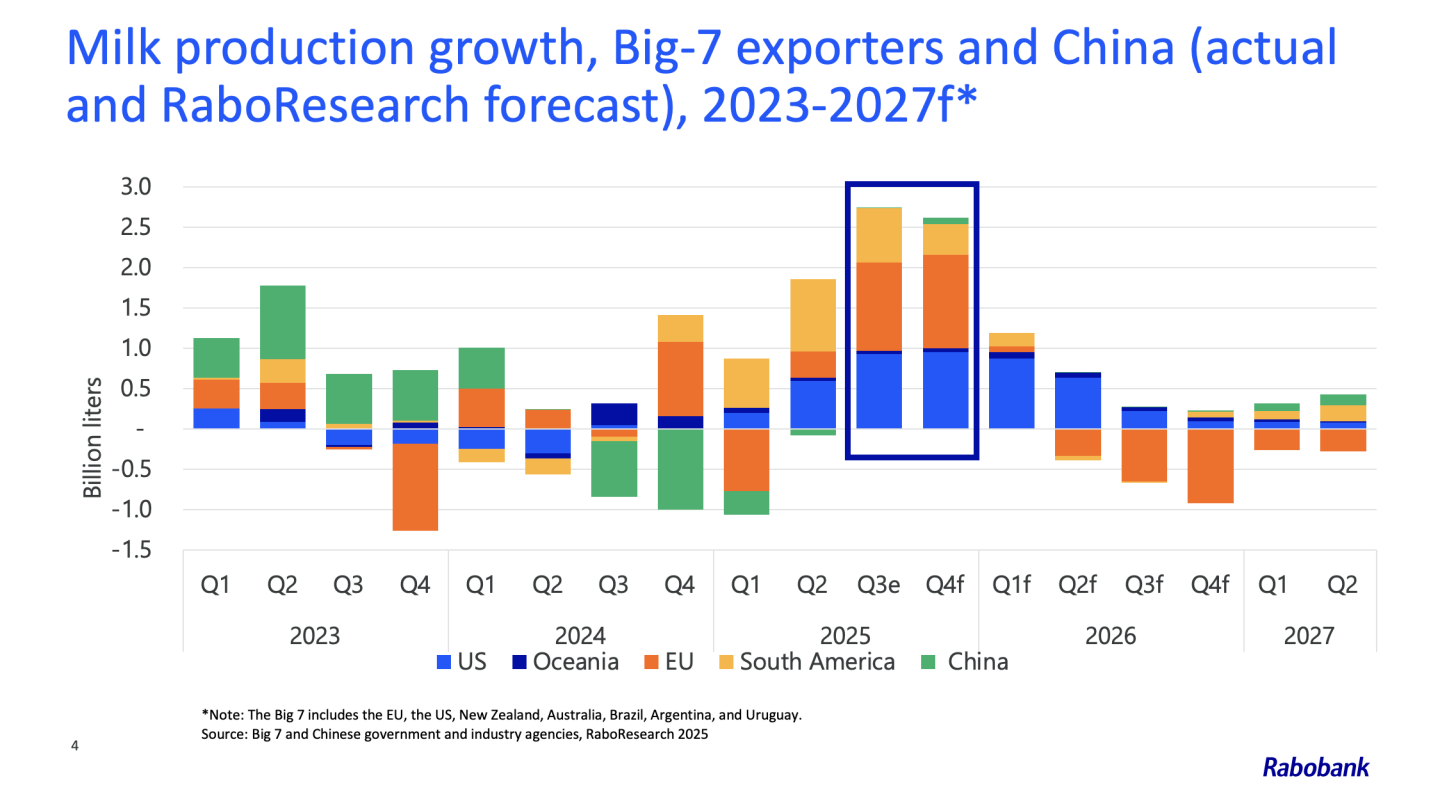

Global milk production across major dairy-exporting regions has surged in 2025. According to an analysis cited by DairyHerd, year-to-date (through July) output among the top export markets is up by about 1% compared to 2024, adding approximately 3.7 billion pounds of milk to global supply.

-

That surplus is big enough to produce hundreds of millions of pounds of additional dairy commodities — extra cheese, butter, milk powder etc.

-

But global demand — both domestic consumption and international trade — is not rising at the same pace. Export markets are showing signs of fatigue, and many regions are already reporting growing inventories and falling or volatile commodity prices.

-

As a result, the “glut” is pressuring prices across the board — butter, SMP/WMP, cheese, whey, etc — squeezing margins for both producers and processors.

In short, the global dairy market is facing a structural oversupply — what analysts are calling a “global milk glut” or “wall of milk” — which is raising serious concerns about sustainability of dairy incomes and price stability.

What this means for Indian dairy (and Indian processors / farmers)

Even though this is a global phenomenon, it has important implications for India, because:

-

India is a major global producer, and Indian processors often compete (directly or indirectly) with global commodity markets for exports (e.g. SMP, WMP, butter, cheese, etc.).

-

If global commodity prices remain depressed due to oversupply, export-oriented dairy producers in India may find margins squeezed — especially in SMP, WMP, butter, cheese.

-

Domestically, while liquid milk consumption may remain stable (due to population & demand growth), value-added segments might suffer if export-driven demand slows, or if global oversupply depresses international reference prices (which often influence local wholesale rates).

-

For investors / entrepreneurs looking to build large-scale dairy processing plants (cheese, SMP/WMP etc.), the surplus means heightened market risk — oversupply could erode returns, especially if demand doesn’t pick up as expected.

At the same time:

-

For domestic-market–oriented dairy, this could mean lower raw-milk procurement costs (if global price pressure drags domestic prices down), which could benefit processors focusing on value-added products for the Indian market (cheese, paneer, ghee, etc.), assuming domestic demand holds.

-

But for farmer incomes — especially those relying on commodity exports or on cooperatives active in global supply chain — the “glut” may erode their profitability unless supply is managed or value-addition is promoted.

What to watch / strategies amid the “milk glut”

Given this global scenario, stakeholders — especially in India — would do well to:

-

Focus on domestic demand growth and value-addition, rather than relying heavily on commodity exports. Products like cheese, whey-based ingredients, specialized dairy foods (high-protein, fortified, functional dairy) for the domestic market may offer better resilience.

-

Diversify product mix: combining commodity (milk powder, butter) with value-added and niche products to reduce exposure to volatile global prices.

-

Push for supply moderation and milk production management (through seasonal strategies, smarter herd management, production planning) to avoid contributing to global oversupply at peak flush.

-

Strengthen supply-chain and cost control, to remain competitive even if global prices are depressed — including efficient processing, lower wastage, rational raw-milk procurement costs, and closer integration between production and demand.

-

Leverage policy support and domestic demand tailwinds (population growth, increasing per-capita consumption, rising demand for dairy proteins) to create stable long-term growth even if global export markets are shaky.