Value added dairy products share may touch 45% in FY 27

Food Processing Sector Seen Growing 11–13% in FY26–FY27 on Value-Added Demand: CRISIL India’s food processing sector is expected to grow at a strong 11–13% CAGR in FY26 and FY27, up from ~10% in FY25, driven by rising demand for value-added products such as butter, ghee, paneer, curd and ice cream, according to CRISIL.

A key growth driver is the rising share of value-added dairy products such as butter, ghee, paneer, curd and ice cream, which helps improve sector operating profitability and expands the product mix. By FY27, value-added products are expected to account for about 45% of the processed food segment, up from 42% in FY25.

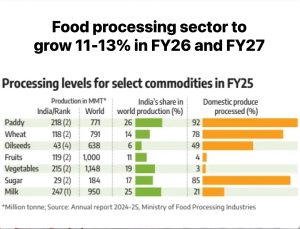

India remains under-penetrated in food processing despite being a leading global producer of agricultural commodities. Overall processing levels are ~10%, with sharp divergence across commodities—high in milk, sugar, paddy and wheat, but very low in fruits and vegetables, leading to post-harvest losses and missed value capture.

Food processing companies are expected to invest ~₹6400 crore over FY26–FY27 to expand value-added capacities, strengthen supply chains and add milk-processing infrastructure. Credit profiles remain stable, even with capex, supported by healthy cash accruals, improving cash flows and strong balance sheets.

FMCG-food companies also benefit from steady demand and GST rationalisation. For dairy and basmati rice players, profitability and leverage metrics are expected to remain comfortable, with controlled reliance on debt and manageable working capital needs.

Processing levels for key commodities like dairy and oilseeds were only ≈ 21% and 49%, respectively, based on a 2021 Ministry of Food Processing Industries study, while fruits and vegetables processing hovers below 5% — highlighting scope for scaling value addition.

The overall food processing share across agricultural commodities currently stands at about 10%, underscoring persistent challenges such as post-harvest losses, limited farmer returns, and under-utilised export potential.

Crisil’s outlook also expects healthy credit profiles for major food processors through FY26–27, supported by strong balance sheets, improving cash flows, and moderate leverage levels, with interest coverage ratios above 8x and total outside liabilities to tangible net worth around 2.6x. Dairy firms’ credit profiles in particular are anticipated to remain stable thanks to resilient operating performance.

The broader expansion in processing aligns with India’s position as a global leader in agricultural and dairy production, presenting a substantial opportunity to enhance value capture, employment, and export competitiveness by deepening processing infrastructure and product innovation.

Source : Dairynews7x7 Dec 28th 2025 Crisil and Business Standard