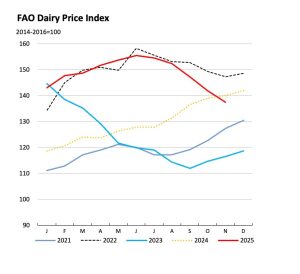

Global food prices ease; FAO dairy index slips — impact looms

The FAO Dairy Price Index averaged 137.5 points in November, down 4.4 points (3.1 percent) from October and 2.4 points (1.7 percent) from its value a year ago. International dairy prices fell for the fifth consecutive month, with declines recorded across all major dairy commodities. The continued easing stemmed from rising milk production and abundant export supplies in key producing regions, supported by ample butter and skim milk powder inventories in the European Union and seasonally higher output in New Zealand. Softer import demand for milk powders in parts of Asia also weighed on prices. Butter and whole milk powder registered the sharpest declines, driven by increased export availability and stronger competition among major suppliers, while skim milk powder prices fell only moderately amid ample supplies and limited buying interest. Cheese prices declined the least, as generally adequate supplies in both the European Union and Oceania were partially offset by firm demand in Asian and Near Eastern markets; even so, the cheese price index remained nearly 10 percent above its level a year earlier.

Global food commodity prices eased further in November 2025 as the international price of dairy products dropped for the fifth month in a row — a development that may begin to reshape milk-product margins, export dynamics and farm-gate returns for dairy-producing nations, including India.

According to the latest release, the FAO Food Price Index (FFPI) averaged 125.1 points in November, down 1.5 points (1.2 %) from the revised October level of 126.6. This marks the third consecutive monthly decline, and places the FFPI 2.1 points (2.1 %) below its November 2024 level — while remaining 21.9 % lower than the March 2022 peak, when food-commodity prices soared worldwide.

The decline in global dairy prices has been a major driver of the overall drop. The FAO Dairy Price Index (covering commodities such as butter, whole and skim milk powder, and cheese) averaged 137.5 points in November — down 3.1 % from October and down 1.7 % compared with a year ago. The slide affects all major dairy sub-categories: global butter, milk-powder and cheese quotations have fallen amid abundant supply and weak import demand. While cereals bucked the trend — with the FAO Cereal Price Index rising 1.9 points (1.8 %) in November due to renewed demand for grains and tight Black Sea-region supply concerns — these gains were insufficient to offset declines in dairy, meat, sugar and vegetable oils.

What the slide in dairy (and overall) prices means — Key Takeaways

-

Global dairy commodity margins under pressure: The repeated drop in the FAO Dairy Price Index suggests that global demand is failing to absorb growing dairy supply. For exporting countries — powder-, butter- and cheese-exporters — this contraction in international prices may compress margins, reduce profitability, and lower incentives for expanding production volumes.

-

Export-dependent dairy producers vulnerable, domestic-market players may gain: Countries and firms relying heavily on exports of SMP/WMP, butter or cheese may feel the pinch. Conversely, exporters oriented toward domestic markets — especially those producing value-added liquid-milk, branded cheese, yogurt, paneer etc. — could benefit if global oversupply depresses international prices but domestic demand remains stable or grows.

-

Implications for Indian dairy / milk producers: With global dairy prices softening, Indian exporters may face tougher competition in commodity-dairy markets — which may translate into reduced export revenues. This could in turn pressure farm-gate prices, especially in surplus states that supply powder or butter for export. On the other hand, the softness may incentivize domestic processors to push value-added, retail-oriented dairy products for India’s growing consumption base, offering a cushion to raw-milk producers.

-

Volatility for food inflation and household consumers worldwide: Lower global dairy prices may ease cost pressures for food-consumer–facing businesses (butter, cheese, baby formula, processed dairy). For consumers in importing countries, this could translate into more stable or lower retail prices — if supply-chain savings are passed on.

-

Need for strategic response among stakeholders: Dairy cooperatives, private dairies, and governments in producing countries need to re-assess strategy — shifting focus from export-oriented bulk-milk products to value-addition, domestic retail, niche dairy, and supply-chain diversification to maintain resilience.

What to Watch Next — Key Risks and Indicators

-

Whether global demand rebounds (e.g., due to export demand spikes, new markets, or policy changes in major importers) — a sustained demand uptick could reverse the current slide.

-

Production trends in major exporting regions: continuing high output (especially in EU, Oceania) may maintain price pressure; any disruption (weather, feed cost, livestock health) could support a rebound.

-

Domestic demand growth and consumer shifts — especially in emerging economies like India, where rising incomes are boosting demand for value-added dairy (cheese, yogurt, packaged milk), which may offset export headwinds.

-

Exchange-rate fluctuations, energy & feed costs — these affect farm-gate production cost globally; sharp rises may negate benefits of lower commodity prices for producers.