Early onset of summers will bring strong ice creams sales during season

The ‘warmest’ February and an early onset of summer is bringing cheer to ice-cream makers in India. After a nearly 90 percent drop in sales in 2020 due to COVID-19 pandemic, ice-cream makers are pinning their hopes on a strong summer season this year and have lined up new product launches.

The lockdown, which was imposed in March 2020, hampered the peak season for ice-cream makers in terms of sales. This year, with demand setting in early, ice-cream makers are hoping to make up for lost business from 2020. Companies such as Amul, Vadilal, Hindustan Unilever, Mother Dairy and Havmor have witnessed nearly double-digit growth in February compared to last year.

Rajesh Gandhi, MD of Vadilal Industries said that the industry is gearing up for ‘bumper sales’ this year. “The industry is observing an early onset in demand. Everyone is bullish on demand, which they expect to be upwards of 20-30 percent compared to last year and it seems like whatever sales we lost partially last year, could be recovered this season,” he told CNBC-TV18.

Vadilal saw about 18-20 percent growth in February in 2021 compared to last year and expects 20 percent more sales in March compared to last year.

In February 2021, Amul said that it saw 20-25 percent higher demand compared to the same month in 2020, it expects demand to double compared to last year, as the impact of the pandemic started reflecting on sales from March 2020. Compared to March 2019, it expects about 30 percent higher demand. For the current fiscal (FY21), it anticipates sales to fall by 30 percent compared to FY20. In FY22, it is hoping to make up for the 30 percent fall, and further registering a 30 percent growth.

Mother Dairy too, is seeing about 25 percent growth over last February, thanks to rising temperatures, especially in northern states, while Havmor saw 8-10 percent year-on-year growth this February. Havmor is expecting to clock early double digit growth during the summer months, which is March-May.

Hindustan Unilever, which is one of the largest players in the segment — with its Kwality Wall’s brand – said that it is seeing a resurgence in demand across price points. “During the lockdown, while it did suffer a setback, with the recent increase in mobility, we are seeing significant improvement in discretionary and out-of-home categories. In this context, we believe our ice creams portfolio is well-positioned. We will continue to drive innovation in the category. Our new premium flavour in Cornetto is receiving a fabulous response across markets,” a company spokesperson said.

Ice-cream makers line up launches

In a bid to cash in on the early-onset of demand and recover lost sales, ice-cream makers are lining up several new products, variants and flavors of ice-creams to cash in on the increased demand. Companies have also used the COVID19 pandemic and lockdown time to ramp up distribution and hope to reap benefits during summer.

Amul has lined up a major expansion plan for its kulfi range with new flavours such as Mumbai Kulfi, Rasgulla Kulfi, Kesar Haldi Kulfi among others, along with three new flavours in the cone range. “We are also launching several new flavors in the carry-home segment. All these were developed over the last few months and will hit the market in next 1-2 weeks,” said RS Sodhi, MD, GCMMF (Amul).

Vadilal, on the other hand, will be launching around 20 new products across categories. Of this, it says two-three will be premium products, while the rest would be in mass market segments.

The focus for ice-cream makers, however, is on in-home consumption (family packs, tubs) categories, which they saw as a growing trend over the past year. “We saw consumers moving towards tubs during the pandemic so the take-home and in-home portfolio is where we are launching products. These are ice-cream tubs, typically 750ml to 1 litre tubs in both Indian and western flavours. We want to strengthen this portfolio with about 40-50 SKUs,” said Sanjay Sharma, Business Head India — Value Added Dairy Products — Mother Dairy Fruits and Vegetables told CNBC-TV18.

Havmor too, will be launching about 12 new in-home and online-only products.

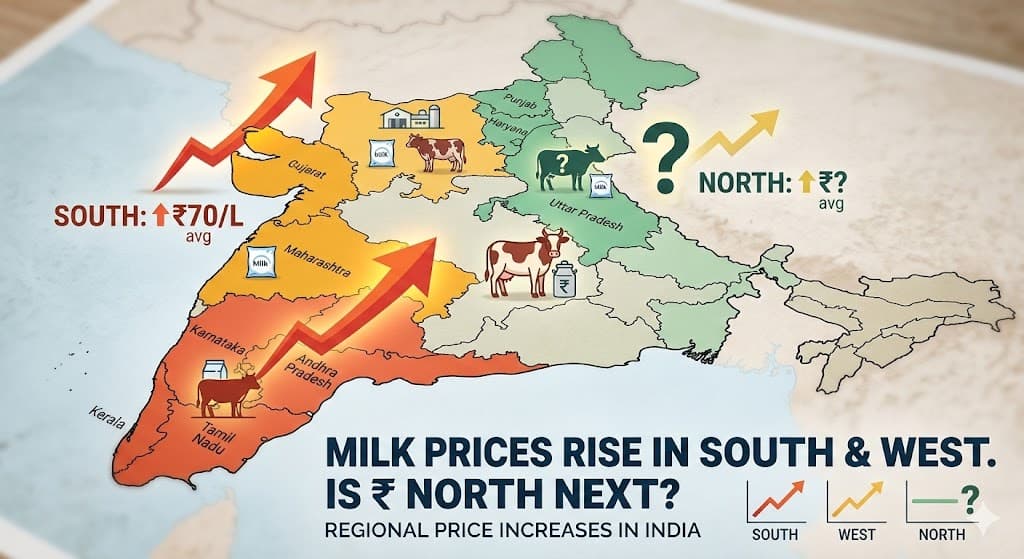

Rising input costs could dampen growth

The threat of high input costs hangs over the heads of ice-cream makers that could dampen their growth plans, especially in the unorganised sector. Anuvrat Pabrai of the Indian Ice-cream Manufacturers Association said that the unorganised sector is a worried lot because they operate in a price sensitive market and therefore, is likely to be impacted more due to rising raw material costs.

Apart from raw material, logistics and energy make up a large chunk of costs for ice-cream makers. With rising crude oil and domestic fuel prices, the average transportation costs for ice-cream makers has gone up 15-16 percent, packaging costs are up 35 percent while energy costs — cold chain and deep-freezer storage — are up 30 percent.

Amul is seeing an overall increase of 10 percent in costs.

Vadilal’s Gandhi highlighted that prices of dairy products are up substantially. “There has been a lot of pricing pressures over the last two-three months. Skimmed milk powder prices went up from Rs 200 to Rs 280-300, while price of fat has gone up from Rs 260-280 to Rs 300-360. Plastic and paper are in shortage. I was told waste paper import is also not coming in, which is further creating shortage,” he said.

Vadilal is currently reviewing the cost pressures before it takes a call on rising prices. According to Gandhi, a price correction would be apt before the peak season sets in. However, the company has not yet taken a decision and is likely to do so in another 15 days.Amul’s Sodhi and Mother Dairy’s Sharma said that they have no plans of increasing prices of ice-creams and will absorb the costs as they want to focus on catering to the demand during the season. Post the peak summer season, if input cost pressures sustain, they are likely to review the situation and take a call accordingly.