The index is calculated using export data from Argentina and Uruguay, incorporating total export volume, protein content and final export value. SDT positions the index as a benchmark for understanding how efficiently dairy protein is being monetized in international trade, particularly from the Southern Hemisphere.

(See methodology: https://www.southdairytrade.com)

Export prices diverge, volumes tell another story

Behind the index movement, recent export performance from Argentina and Uruguay showed contrasting dynamics.

Uruguay’s dairy exports for the December 16–31, 2025 period averaged USD 3,868.09 per metric ton, shipping 9,118.73 tons to 31 destinations. Argentina, reporting for November 16–30, 2025, recorded a lower average export price of USD 3,762.11 per ton, but shipped a substantially higher volume of 17,977.01 tons to 34 destinations.

“The data shows a familiar pattern,” an SDT analyst noted. “Argentina continues to leverage scale and volume, while Uruguay maintains a price premium through product mix and market positioning.”

For U.S. dairy stakeholders, these figures matter. Argentina and Uruguay are direct competitors in key export markets for milk powders, cheese and protein-rich ingredients, especially in regions where U.S. exporters are also active, such as Southeast Asia, North Africa and parts of Latin America.

What it means for U.S. dairy markets

In the United States, dairy protein valuation is increasingly central to margins, particularly as whey, milk protein concentrate (MPC) and nonfat dry milk play a growing role in export strategies. A softening Dairy Protein Value Index abroad can signal heightened price competition for U.S. exporters — even when domestic fundamentals remain stable.

Avarage Dairy Prices in Argentina

“South American exporters tend to influence the global floor price for dairy proteins,” said a U.S.-based dairy market consultant. “When their protein value eases, buyers push harder in negotiations everywhere — including against U.S. suppliers.”

This comes as U.S. dairy exports remain historically strong, supported by competitive pricing and steady demand for high-protein products. According to the U.S. Dairy Export Council (USDEC), protein ingredients continue to anchor export growth despite volatility in butter and cheese markets.

(USDEC export insights: https://www.usdec.org)

Reading beyond the headline number

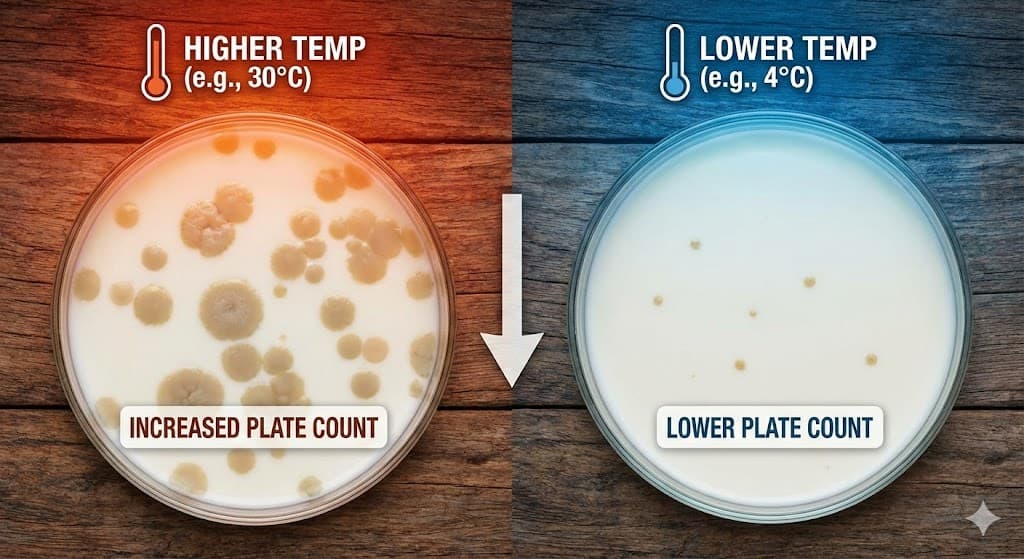

Importantly, the decline in the Dairy Protein Value Index does not indicate collapsing demand. Instead, analysts point to product mix adjustments, timing of shipments and short-term price recalibration as primary drivers.

“Volumes out of both Argentina and Uruguay remain solid,” the SDT analyst said. “What we’re seeing is more about value optimization than demand destruction.”

For U.S. producers and processors, this nuance is critical. As global buyers remain protein-focused, competition increasingly centers on efficiency, consistency and logistics, not just headline prices.

Strategic implications heading into 2026

Looking ahead, market participants expect the index to remain sensitive to changes in milk output, feed costs and currency movements in South America. Any acceleration in Argentine exports or sustained price strength in Uruguay could quickly reshape protein value benchmarks.

From a U.S. perspective, this reinforces the importance of maintaining export competitiveness while differentiating on quality and reliability — areas where American dairy continues to hold an edge.

As one exporter put it, “Indexes like this don’t move markets overnight, but they absolutely shape the conversations that decide contracts.”

Source : Dairynews7x7 Jan 18th 2026 News shared by our channel partner (eDairyNews).