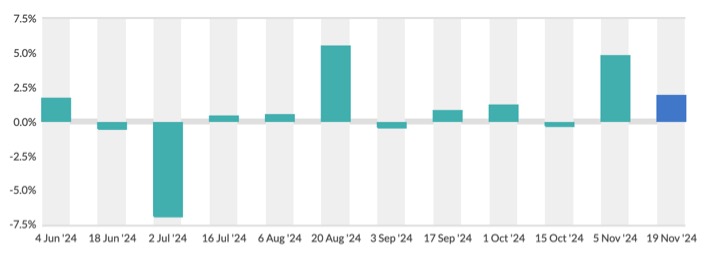

Diwali was observed on November 12th this year, a shift from its date in 2022 on October 24th. Over the past 384 days, the dairy industry has experienced a roller coaster of events. This year witnessed a positive trend with continuous milk availability throughout. During the summer of 2023, the utilization of dairy commodities reached unprecedented lows for producing fermented milk products. As the industry enters the flush season, there’s a substantial accumulation of SMP and Butter, somewhat comparable to 2020 levels.

Dairy players were optimistic about a bullish trend in SMP and Butter during the lean period from April to July 2023. Larger entities successfully processed milk after procuring it at higher rates during the winter of 2022-23. Casein manufacturers profited from exports due to elevated export prices. However, SMP and Butter converters awaited the summer season to improve their fortunes. While global commodity prices began to stabilize from last October, Indian manufacturers overlooked the trend, persisting with their aggressive approach.

Demand-less aggression

The Indian dairy industry experienced an unusual downturn in demand for dairy commodities in FY 24. Right from the year’s commencement, the market exhibited considerable aggression, with both manufacturers and stockists adopting a highly bullish stance. Ghee producers, on one side, maintained pressure by refraining from rate reductions, while SMP players set their sights on achieving target rates of Rs 500 per kg in the summer. Butter stocks were being treated as valuable as gold. However, the market saw an accumulation of stocks even in the absence of demand. This situation brings to mind a quote from Paulo Coelho’s book “The Alchemist” (1988): “Greed blinds us from recognizing the true value of what we already possess.”

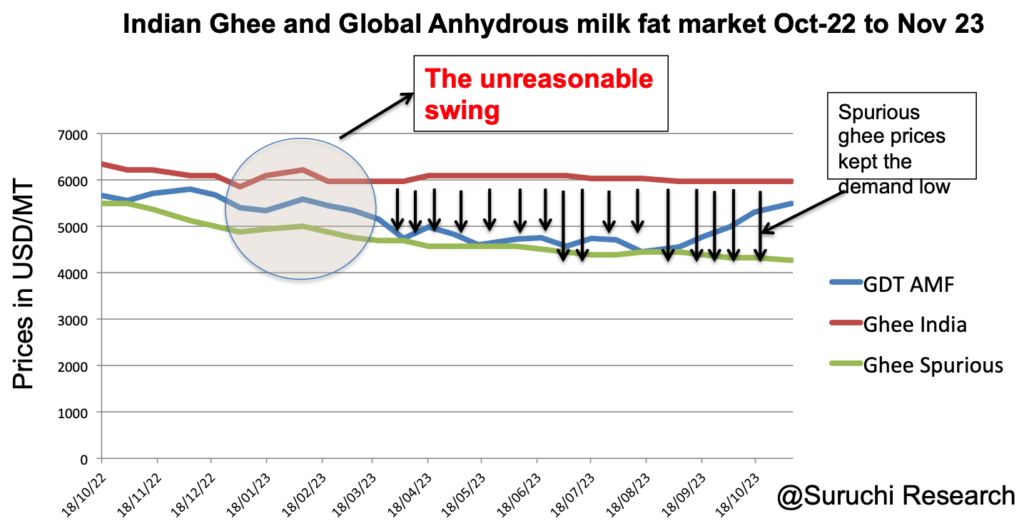

Ghee or Anhydrous milk fat market- The unreasonable swing

Commencing with the Ghee market, the demand surge for ghee in Q4FY23 fuelled optimism among processors, resulting in increased stocks and sustained high prices. Despite positive export conditions, the industry disregarded the gradual decline in global prices.

In the Indian context, counterfeit ghee was exerting influence over both the demand and pricing of ghee in the mainstream market. Despite widespread discussions on this issue, the industry had not taken collective action or formally raised the matter with the government. The rationale behind stockpiling and maintaining high ghee prices in the last quarter of FY 23 remained elusive. This mystery persisted, especially considering that the demand for ghee typically dwindles to very low levels from April until the onset of the festival season in August.

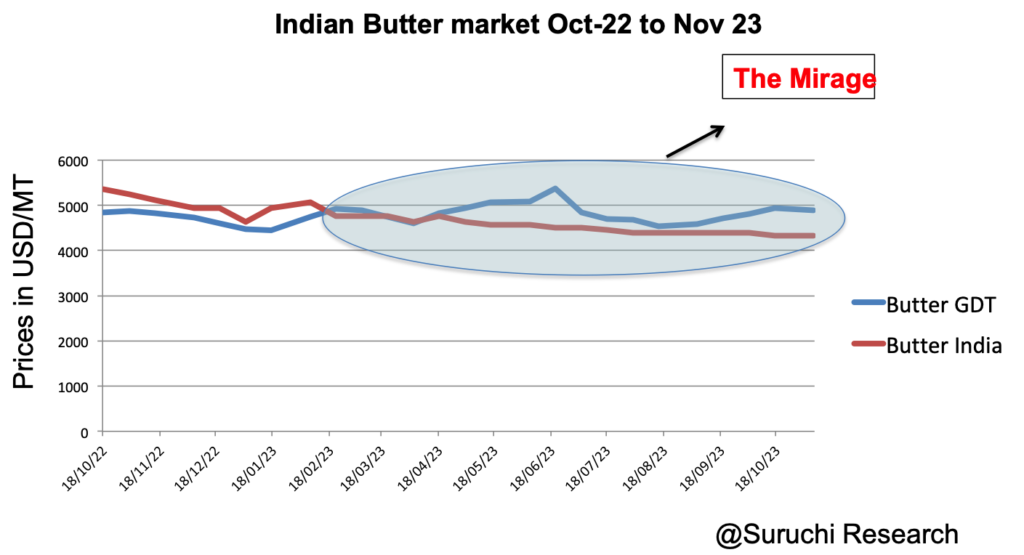

Butter Market- The Mirage

In February 2023, milk production in India experienced a notable surge, surprising many who had initially lost hope for significant production during the flush of 2022-23. As optimism waned for that period, preparations shifted towards the lean phase of FY 24. Butter stocks continued to accumulate, even at elevated rates of raw milk. The allure of higher Ghee prices, with the anticipation of a 15 kg tin surpassing the Rs 10,000 mark, acted as an enticing prospect for all industry players. Consistent exports in the Butter category further fuelled optimism, creating an atmosphere of enjoyment among participants, unaware that the destination they were aiming for was, in fact, a mirage.

During this period, those involved in the spurious ghee market extended their reach into the butter market, peddling their counterfeit products. Even cooperatives with lower stocks ventured into buying butter from the private sector. The National Cooperative Dairy Federation of India (NCDFI) played a central role, emerging as a credible platform for trading dairy commodities. Unfortunately, untimely showers in the summer dashed hopes for butter demand, affecting both recombination and use in ice cream plants. The rains, starting in mid-March just after Holi, had a downside for dairy processors, despite their positive aspect of cooling the summer heat. Despite these challenges, the trading of butter continued with many players seemingly oblivious to the unfolding situation.

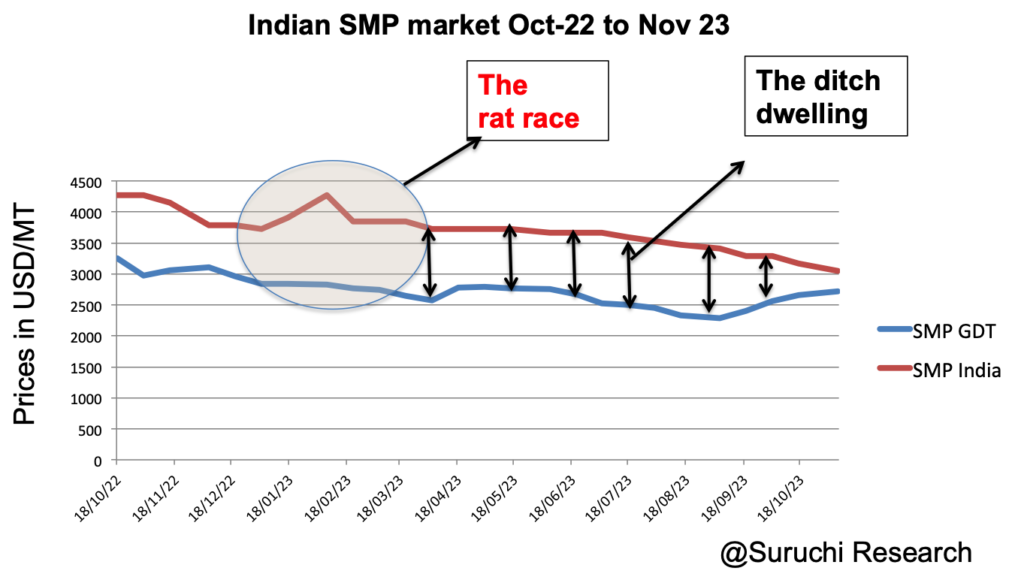

SMP Market – The Rat Race

In mid-March, it became evident that the rains would adversely affect the demand for ice cream, curd, buttermilk, and flavored milk. By April, the industry received indications that milk availability was not diminishing. Nevertheless, processors and traders continued building stocks, anticipating a bullish scenario in the middle of summer. The ample availability of milk at a lower price disrupted reconstitution opportunities for fresh milk as well.

Amul’s strategy of selling their high-quality produce at a reasonable premium through auctions ensured the availability of milk powders across the country. Despite the age of the stocks, they remained accessible. However, the exports of SMP plummeted to almost zero levels by the second half of FY 24. The gap between global SMP prices and Indian prices was widening, yet the Indian dairy industry seemed indifferent to this fact. Almost everyone was behaving like a bystander, ignoring the growing disparity.

Information Failure

Currently, the Indian dairy industry is gearing up for the flush season with a higher level of milk production. Some large cooperatives have experienced double-digit growth in milk production, raising concerns about the influx of milk during the peak flush season in January or February. States like Rajasthan, Bihar, and Gujarat have achieved record levels of milk procurement.

According to reliable sources, India is likely sitting on a substantial pile of SMP, estimated to be between 175,000 to 200,000 MT, and Butterfat at around 100,000 MT. Exporting Indian stocks may be viable for fat, but not for SMP at current rates. Assuming a minimum loss of Rs 50 per kg on SMP and butter, the industry has already incurred a loss of Rs 1,500 Crores on this stockholding.

Identifying the most critical factor behind this situation, I would attribute it to information failure. The Indian dairy industry operates with a high level of information asymmetry, where four types of information circulate in the market.

a. Information with the cooperatives or the government

b.Information with the private players at regional levels

c. Information with the Traders and Institutional buyers, and

d. The reality

The size of the industry is bigger than the size of the problem

India’s dairy industry is a nearly 100 billion-dollar sector, contributing 23% to the global dairy market. It has outperformed major clusters like the EU, North America, and Oceania. To ensure stability in dairy markets, India requires a more extensive platform. An immediate structure that comes to mind is akin to the “Common Organisation of Agricultural Markets in the EU.” In the Indian context, we could establish a distinct market information platform for dairy. Given that dairy constitutes almost one-third of the total agriculture value, it cannot be treated as just another commodity.

The man objective of this Common organisation of dairy market will be as follows ( Taken from the EU regulations ) :

It aims at stabilising markets and preventing market crises from escalating by providing a safety net to agricultural markets through the use of market intervention tools (public intervention* and private storage aid) and exceptional measures. It also provides for the necessary market transparency measures to allow agricultural producers to better make their production and investment decisions in view of market developments.

CODMI- The only way forward

The organised dairy sector in India comprises 80 million farmers and approximately 2000 medium and large-sized plants. We cannot afford to let our markets be influenced by speculative decisions due to an information vacuum. Ignoring the issue or assuming it is resolved would be a mistake. The imminent challenge awaits us in the upcoming summer, where we are poised to have no less than 300,000 MT of SMP. In such circumstances, relief may only come from extreme heat and a shortage of milk in the next summer. However, this won’t be a win-win situation for all. I earnestly urge all stakeholders, including the DAHD, NDDB, Indian Dairy Association, Commodities Trade Associations, NCDFI, etc., to unite on a common platform and establish the “Common Organisation of Dairy Markets in India” or CODMI.

State level milk subsidy or Central level export subsidy may be considered as a short term solution but not a long term strategy. Opinions and suggestions from readers on this topic are welcome. You may directly mail me at dairynews7x7@gmail.com

Source : Dairy blog by Kuldeep Sharma Chief editor Dairynews7x7.com