Revenue of the organised dairy sector in India, after churning to a decadal-low growth of ~1% last fiscal, is expected to grow 5-6% to Rs 1.5 lakh crore this fiscal. Healthy demand revival in value added products (VAP, 30-35% of organized sector revenue) post pandemic effect last fiscal, lower restrictions as compared with the earlier covid wave, and steady demand for liquid milk (65-70% or organized sector revenue) will help support overall growth in the current fiscal.

With increasing demand, milk procurement prices are expected to increase; albeit higher sale of VAP will buttress material impact on profitability. Besides, skimmed milk powder (SMP)1 inventory will also decline by end of this fiscal from the peak seen last fiscal, easing working capital borrowings. Almost stable profitability, controlled working capital and prudent capital spend will keep credit profiles of dairies ‘stable’.

Analysis of 65 Crisil rated dairies

This is as per an analysis of 65 CRISIL-rated dairies, which account for over two-thirds of the organised segment revenue.

Also read : Profitability of dairy industry to reduce by 0.50-0.75% : Crisil report

VAP will see ~7% growth this fiscal compared with a contraction of ~3% last fiscal. Demand for most VAP products such as ghee, butter, cheese and milk powder is expected to remain healthy.

Says Anuj Sethi, Senior Director, CRISIL Ratings, “VAP revenue de-grew last fiscal because of the complete shutdown in the first quarter, which impacted the hotels, restaurants and café segment (~20% of organised sector revenue). This fiscal, we expect it to rebound on the back of increased home consumption and continuing food-delivery services even in regions seeing lockdowns.”

That said, local restrictions could delay demand recovery in certain VAP categories such as flavoured milk, buttermilk, lassi and ice cream, where sales had rebounded to 70-80% of pre-pandemic levels in March 2021. Sales of these products, which typically peak in summer, are likely to be affected if restrictions are prolonged the way it was last fiscal. Even so, the impact is unlikely to be significant on overall growth, as these comprise only 14% of overall VAP sales.

Also Read : Covid-19 corollaries on the dairy sector by CRISIL

Milk sales to surge this year

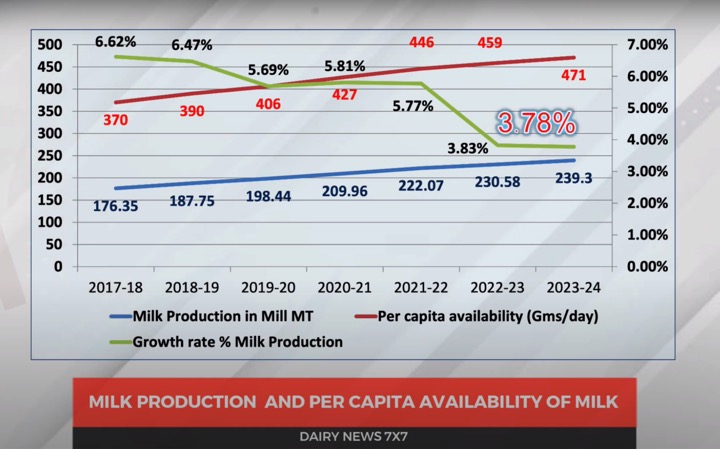

Liquid milk sales is expected to grow ~5% on-year this fiscal compared with ~3% last fiscal, backed by increased consumption by households and non-households, supporting overall growth.

As for milk procurement prices, they are expected to be 5-7% higher on-year. Subdued demand had weighed on the prices last fiscal. Overall, operating profitability of dairies will moderate slightly to 5-5.25%, from ~5.7% estimated for last fiscal.

Says Tanvi Shah, Associate Director, CRISIL Ratings, “With demand for VAP and liquid milk improving, SMP inventory, which had increased 7% on-year last fiscal, is expected to moderate this fiscal. About 70-75% of the working capital requirement of dairies consists of SMP inventory. As a result, we expect their working capital requirement to normalise by the end of this fiscal.”

Capital spending in dairy sector

Capital spending by dairies is expected to be prudent, though higher than last fiscal, resulting in only a modest increase in overall debt levels. That will help keep credit profiles stable. Key debt metrics such as gearing and interest cover are estimated at 1.34 times and ~5.0 times, respectively, this fiscal, compared with 1.25 times and ~6.32 times last fiscal.

How the pandemic and restrictions pan out, and their impact on VAP sales will bear watching in the road ahead.

1 Milk is consumed in two forms – liquid milk and by converting into VAP. Dairies also convert liquid milk into skimmed milk powder (SMP) for use in the lean season, when milk supplies decline. SMP can be reconverted into liquid milk or VAP, and has a shelf life of 12-18 months.

2 Interest coverage last fiscal was supported by up to 4% interest subvention on working capital loans to dairy co-operatives