Source: IANS

- Dairy demand is seeing an uptick as procurement prices are coming down, leading to margin expansion, say analysts.

- As spending power increases, demand for other value added products like ice creams, paneer, cheese and whey are growing.

- Arihant Capital says that there is huge upside in stocks like Parag Milk Foods, Dodla Dairy and Heritage Foods.

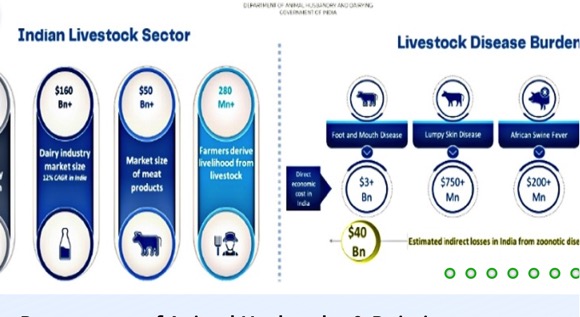

It wasn’t as if the last financial year (FY23) was without disruptions for the dairy sector. Fodder prices shot up and the cattle health and thus productivity was affected due to a skin disease. Yet, three sectoral stocks have given over 50% returns in the last one year – and have been on an upswing since March.

Heritage Foods and Dodla Dairy are up over 57% in the past six months. Parag Milk has done only better seeing a rise of 62% in the same period. What’s more, analysts opine that there is more to milk from these stocks as the sector is headed for a smoother pasture as procurement prices fall in the second half of the current financial year (FY24).

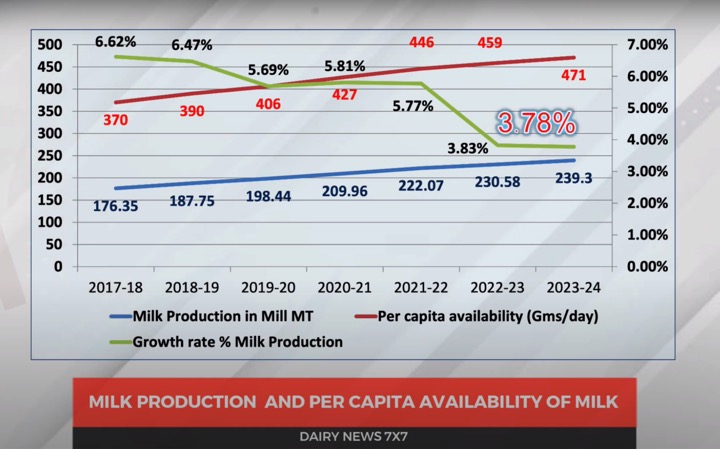

“The industry is seeing brighter times with the anticipation of a healthy flush season which will lead to high milk production in the country, and subsequent softening in the procurement prices of milk from now lower feed costs. The impact of lumpy skin disease is starting to fade away,” said a report by Arihant Capital Markets.

Indian companies are making steady investments in cattle feed, improving the breeds, and moreover cattle population is growing at a rate of around 1.5% per annum. The incoherent monsoons that disrupted farmers, might not have a large impact on dairy farmers.

“Farmers tend to invest more in cattle rearing during weak monsoon years as they fear lower agri (farming) income. However, we believe there is only one potential concern of higher food-grain prices which may inflate cattle feed prices and result in higher milk procurement prices for dairy companies,” says ICICI Securities.

| COMPANY | ONE YEAR RETURNS |

| Heritage Foods | 85% |

| Dodla Dairy | 59.6% |

| Parag Milk Foods | 53.1% |

| Hatsun Agro | 26.5% |

Curdling opportunities: Margin growth ahead

India’s dairy industry is vast and most of it has been traditionally unorganised, consumer preference is moving towards organised players.

“Rising incomes of consumers resulted in an increased demand for protein-rich dairy products. These products play a vital role in meeting the nutritional requirements of a large vegetarian population,” say Abhishek Jain and Anushka Chitnis of Arihant Capital.

An Elara Capital report also says that they see robust sales growth for the sector. “Demand continues to see an uptick, led by rising mobility towards urban and educational centres,” it says.

Moreover, the sector’s margins are set to recover after gross margins fall to a cyclical low in FY23. There has been a correction in milk procurement prices in May and June months and it would also get better during the second half of the year.

“We model the spread between selling prices and milk procurement price to increase in FY24 and model 100-200 basis expansion in earnings before interest tax depreciation and amortisation (EBITDA) margin for the dairy companies under our coverage,” says ICICI Securities which covers three companies – with a buy rating on Heritage Foods and Dodla Dairy; and hold on Hatsun Agro.

The dairy companies are working towards building a value added products (VAP) portfolio beyond curds – which will only increase margins. For most companies, over two thirds of their VAP sales come from curds whose margins are twice as that of liquid milk. But they are also working on flavoured milks and yoghourts, paneer, ice creams and more.

Huge upside ahead, say analysts

Thanks to the structural growth in the sector, there is a huge upside in stocks like Dodla Dairy, Heritage Foods and Parag Milk Foods, says Arihant Capital.

Telangana based Dodla Dairy already gets around 27% of its revenues from VAP products, and are constantly churning out new products and intend to grow its VAP share by 1-2% every year, going forward. It’s also investing in advertising and promotion and setting up retail parlours, while expanding aggressively into untapped markets and is also net debt free.

“We believe that Dodla is well poised to grow ahead of the industry to cement itself as a market leader in the years to come. It does not shy away from organic and inorganic expansions. We assign a target price of ₹1,366, indicating an upside of 121%,” says Arihant.

Andhra Pradesh-based Heritage Foods boasts of a wide distribution network across 11 states, both offline via franchises, retail reach and more – and is also now on e-commerce sites. It has plans to invest ₹100-125 crore per annum for the next three years to build procurement and processing infrastructure. It intends to fund capex with cash flows and is also net debt free.

It also has aggressive plans to grow its VAP revenue contribution from 25% currently to 40% in four years. “Volumes will return as harvests improve, and the higher VAP sales will drastically improve realisations and margin profile going ahead. We assign a target price of of ₹448 valued, indicating a 88% upside,” says Arihant.

Parag Milk Foods that runs the Gowardhan brand, boasts of one of the largest distribution reach in the country. It’s one of India’s leading private dairies, with a 20% market share in ghee, and a 35% market share in cheese as of FY23.

They pioneered the concept of farm-to-home premium dairy and have been advertising aggressively over the last two years as their ad spends went up by 2.5 times. It’s also present in the fast-growing segment of whey protein.

Even as most other dairy players are scrambling to gain market share, Parag has well cemented its presence as an industry leader for decades.

“Parag Milk Foods is a good play in the private dairy space, considering its heightened focus on and market dominance in the value added product and premium space. We expect it to grow in the high teens. We assign a target price of ₹450 indicating an upside of 231%,” says Arihant Capital.