IFCN is a global network for dairy economic research and consultancy

In 2021, researchers from over 100 countries and more than 140 agribusiness companies are members of the network. IFCN has created a better understanding of the dairy world for over 20 years.

Key insights

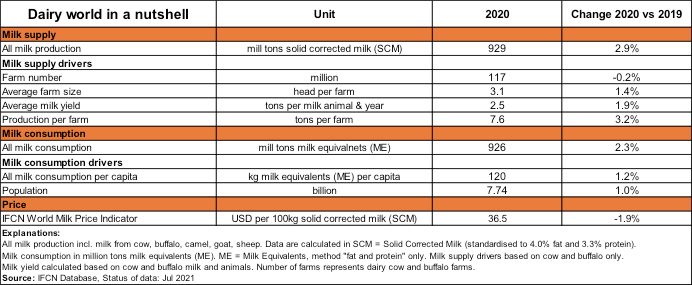

In spite of the global COVID-19 pandemic, the year 2020 was characterised by sustained milk production, which increased by 2.9%, compared with an average of 2.5% during the past decade. On the one hand, this was the result of a rebound in production after slower growth in 2019. On the other hand, a stronger focus on self-sufficiency in some countries drove higher growth.

Trade was initially impacted by supply chain and transport disruptions, but this was compensated by strong import demand from China.

Demand growth also kept up thanks to the positive image of dairy as a healthy product in many parts of the world, especially in South and South East Asia. Some emerging markets in Africa also benefitted from higher milk availability due to stronger production in comparison to 2019.

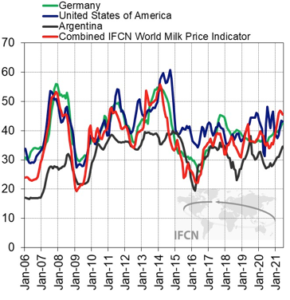

Farm economics in 2020 were stable, albeit on a modest level, not least because of additional government support. The milk price, meanwhile, decreased by 1.8% to 36.5 USD/100 kg milk (SCM) in 2020.

The IFCN Dairy Report has become a guidelinepublication for researchers and companies involved in the dairy chain, published annually since 2000. The analysis and the comprehensive data provide the background for strategic decisions and help people in the dairy world to make better decisions.

2020 production growth of 2.9%

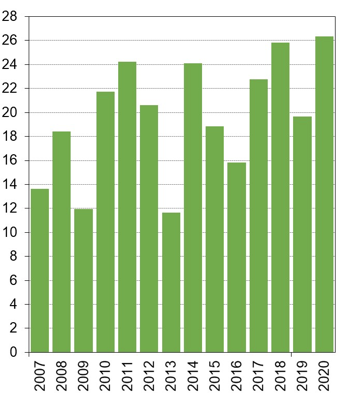

In 2020, dairy supply growth increased by 2.9% (SCM, solid corrected milk), substantially faster than the growth recorded in 2019 (Fig 1). Whereas the year 2019 was impacted by weather and climate-related issues such as drought but also natural disasters, milk production in 2020 rebounded in many of the affected regions (i.e. Oceania, South America and Africa). Meanwhile, major exporters such as the USA and the EU-27 witnessed stable growth in 2020 while importers like China and Russia increased their production at a faster pace than in the previous year.

2020 demand higher than expected

The main impact of the COVID-19 crisis is expected to be on dairy demand. Many consumers suffer from reduced purchasing power because of job losses and reduced GDP growth. Nonetheless, dairy demand growth (measured in milk equivalents) appears to have been maintained at a level of 2.3% in 2020 as dairy benefitted from its healthy image during the pandemic in many parts of the world. Consumption in some emerging markets also increased because of improved milk availability thanks to stronger production.

That said, a shift in demand occurred due to the many lockdowns which resulted in foodservice outlets having to close, a consequent shift to the retail channel and more at-home consumption. In the USA, for example, this had a detrimental impact on demand growth, even though the government food box programs prevented a decline. Consumption in East and South East Asia however, continued to increase.

Milk price development in 2020

The IFCN World Milk Price Indicator (Fig. 2) represents the theoretical world farmgate milk price, which stood at an average level of 36.5 USD/100 kg milk (SCM) in 2020, down -1.8% on the previous year. This slight decline can be interpreted as the consequence of strong milk supply in 2020 coupled with jittery markets and concerns over milk demand holding up in light of the COVID-19 crisis. Many consumers will also continue to have to watch their budget, which might constrain higher prices in the future.

Farm economics and the impact on price and production

IFCN models 170 typical farms in 64 dairy regions and 52 countries to understand and analyse the cost of milk production and to measure the impact on milk production growth and price, in order to help players in the dairy to devise the right strategies.

While farm economics were stable on average in 2020, farmers’ profitability is under pressure as the margin over compound feed costs is showing a declining trend in 2021 because of the increase in feed costs at the start of the year (Fig. 4).

2021 milk price development

Following the decline in 2020, the world milk price rallied to its highest level since May 2014 with a price of 46.8 USD/100 kg milk in April 2021. The average world price for the first half of 2021 is +20% higher than the same timeframe in 2020.

The reasons are high import demand for dairy commodities from the Asian region, especially China, a seasonal decline in milk volumes in Oceania, as well as logistical challenges for exports from the EU and the US, which trade below Oceania prices.

Even though there are some factors that are likely to push world market prices further down at the moment, the average world milk price for 2021 is estimated to be above 40 USD/ 100kg milk, its highest level since four years.

Production outlook for 2021

Still, 2021 points to a slight slowdown in milk production growth compared to 2020. Feed prices increased by more than 50% during the first half of 2021, caused by climatic conditions and strong demand. This puts further pressure on farmers’ margins that have been either stable or decreased for the most part in recent years.

In addition, national farm-gate milk prices have not followed the world milk price as closely as usual (Fig. 3). The impact of squeezed margins has not impacted production growth significantly during the first half of 2021. However, it is foreseen that this will increasingly come into effect until the end of 2021 and world milk supply growth will slow down, which should support a higher milk price in turn.

Overall, the COVID-19 pandemic appears to have stimulated dairy demand, especially in the Asian region and national dairy programs have been settled and boosted milk production growth.