By Ashok Gulati & Ayushi Khurana

AMUL has just raised its milk prices for consumers by Rs 2/litre, and this has become national news. This increase is about 4% of existing prices, and well below the increase in consumer price index (CPI), which has already crossed the tolerance limit of RBI at 6%. The dairy farmers say this increase in milk prices is not commensurate with the increase in their feed and other costs, and it will squeeze their profit margins. Amul MD RS Sodhi also claims this increase is very meagre and does not recover increased cost of logistics and packaging, etc. Yet, the electronic media is debating how this will push up CPI and cause inflationary pressures, which may compel RBI to change its ‘accommodative stance’ on monetary policy.

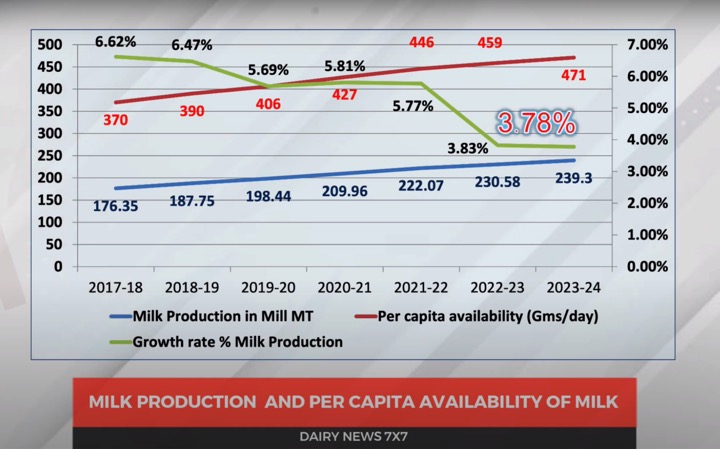

Milk is the biggest agri commodity

Milk is an important case study for our overall agriculture sector. It is the biggest agri-commodity in value terms, bigger than the combined value of paddy (rice), wheat, and sugarcane. Also, India is the largest producer of milk globally, with an estimated production of 208 million tonnes in FY2021, way above the US (with around 100 million tonnes). The Indian dairy sector is dominated by smallholders, with an average herd size of 4-5 animals. There is no minimum support price (MSP) for milk. Farmers’ price for milk is in the nature of a contract between the company and the farmers. Overall, milk price is largely determined by the forces of demand and supply. Increasing costs of production enter through the supply-side, but the demand-side cannot be ignored. As a result, the overall growth in the dairy sector for the last 20 years is between 4-5% per annum, lately accelerating to 6%. In comparison, cereals have been growing at about 1.6% per annum over the same period.

Operation Flood

It is well known that institutional innovation of cooperative model under ‘Operation Flood’ (OF) during 1970s, steered by Verghese Kurien, transformed this sector. However, even after five decades, cooperatives processed only 10% of overall milk production. The doors for organised private sector participation were opened partially in 1991 reforms, but fully in 2002-03 under the leadership of Atal Bihari Vajpayee, when the dairy sector was completely de-licensed. Milk production recorded a growth rate of 4.7% between FY04 and FY14, which increased to 6% between FY15 and FY21. As per an NDDB report, the “capacity created by private dairy companies in the last 15 years is equivalent to the capacity set up by cooperatives in over 30 years.”

Hatsun Agro Products Ltd (HAP), based in Tamil Nadu, is the largest private sector dairy company in India with milk procurement of 32 LLPD with about 20 processing plants. HAP dared to step into liquid milk marketing back in 1995, when cooperatives dominated this market. Currently, HAP produces an array of value-added products, including cheese, ice cream, and curd. Several other private dairy companies like Parag Milk Foods Ltd (Maharashtra), Prabhat Dairy (Maharashtra), Heritage Foods Ltd. (Hyderabad), Dodla Dairy Ltd (Hyderabad), Ananda (Uttar Pradesh), and Nestlè India Ltd procure 10-20 LLPD of milk.

Next generation Start ups

Many start-up “dairypreneurs” have come in promising farm-to-home experience of milk. Country Delight delivers fresh milk at the consumer’s doorstep and gives you a quality-testing kit at home.

Stellapps Technologies is working towards digitising the dairy supply-chain in India by enabling traceability across the milk supply-chain for dairy companies. They have digitalised cattle health, milk production, milk procurement, milk testing, and cold chain management through Internet of Things (IoT) and sensor-based SmartMoo cloud. The company is currently touching 11.5 million litres of milk every day and impacting 2.6 million farmers and one million cattle in about 35,000 Indian villages.

Indian Grassland and Fodder Research Institute’s Vision 2050 estimates that India will have a green fodder deficit of about 30% by 2030. “Hydrogreens”, an agri-tech startup, provides a solution to the green fodder deficit through their “Kambala”, a hydroponic green fodder unit. It allows farmers to grow fresh green fodder all year round without soil in a controlled environment and limited water resources. It has set up more than 130 units across the country to overcome green fodder deficit.

Sexed semen a frontier technology

Sexed semen technology helps in predetermining the sex of offspring by sorting X and Y chromosomes from the natural sperm mix. BAIF is steering this change by providing quality sexed sorted semen from exotic and indigenous cattle and buffalo breeds. It has conducted more than 1,50,000 sorted-semen inseminations with a conception rate of 44.3%, and 90% female births.

The upshot of all this is let prices be determined by demand-and-supply forces. Focus should be on innovations to cut down costs, raise productivity, ensure food safety, and become globally competitive. That will help both the farmers and consumers alike. Cooperatives like Amul did a great job during OF, and are still doing, but with entry of large private sector players, creativity and competition has increased.

Source : Financial Express July 5th Gulati is Infosys Chair professor for agriculture and Khurana is a researcher, ICRIER