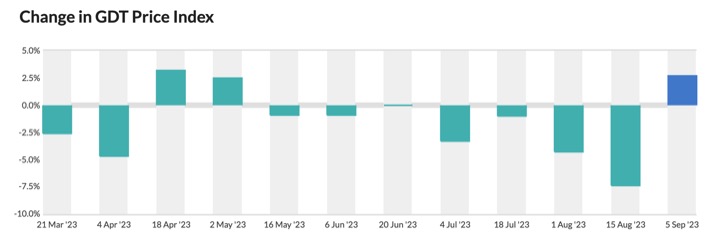

Dairy prices have risen in the Global Dairy Trade auction for the first time in four months.

The average price increased 2.7 percent to US$2888 per tonne after hitting a near five-year low at the last auction in August.

The all-important whole milk powder price – which affects the payout for local farmers – rose 5.3 percent to US$2702 per tonne.

It comes after whole milk powder prices plunged 10.9 percent at the last auction two weeks ago, driven by dropping demand from China.

North Asia held the top buyers spot, purchasing some of all the commodities on sale.

There were also minor lifts for anhydrous milk fat and butter, but slight drops in cheddar and skim milk powder prices

Hardest hit was butter milk powder which fell 6.5 percent to US$2215 per tonne.

Event Results

Key Results

AMF index up 2.7%, average price US$4,561/MT

Butter index up 1.1%, average price US$4,588/MT

BMP index down 6.5%, average price US$2,215/MT

Ched index down 0.6%, average price US$4,102/MT

LAC index not available, average price US$608/MT

SMP index down 1.6%, average price US$2,286/MT

WMP index up 5.3%, average price US$2,702/MT

NZX dairy analyst Alex Winning said the rising whole milk powder price would be a relief for New Zealand farmers.

“The last three weeks have added a level of uncertainty to the future of whole milk powder prices, with the US$2600 per tonne floor price that had held for five years having been breached.

“However, last night’s auction will provide the market with a level of certainty to that floor price,” she said.

“Interestingly, it appears China wasn’t the key driver in this lift, with Southeast Asia Oceania buyers taking out top buyers spot for the commodity for the first time in a while.”

Winning said while a lift was typically an indicator of a trend, the market is yet to point in a clear direction.

“Prices have continued to bounce around, peak and trough over the last year, and with the inventory and supply story remaining supported globally and economic woes continuing to impact spending capacity, it is difficult to see a full rebound in prices in the near future.”

Source : RNZ Sep 6th 2023