Earlier this week, Mother Dairy hiked the price of full cream milk by ₹1. This means a litre of milk will now cost ₹64. This was the fourth hike in price this year by the leading milk supplier in New Delhi.

A month ago, the Gujarat Cooperative Milk Marketing Federation, which sells milk under the brand Amul, raised the price of full cream milk by ₹2. On November 3, Aavin, the brand owned by the Tamil Nadu Co-operative Milk Producers’ Federation, also raised the price of full cream milk by ₹12 a litre, which makes the price of one litre ₹60.

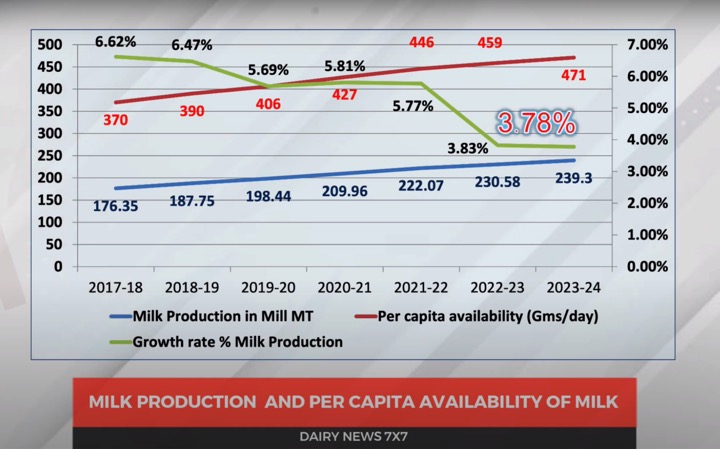

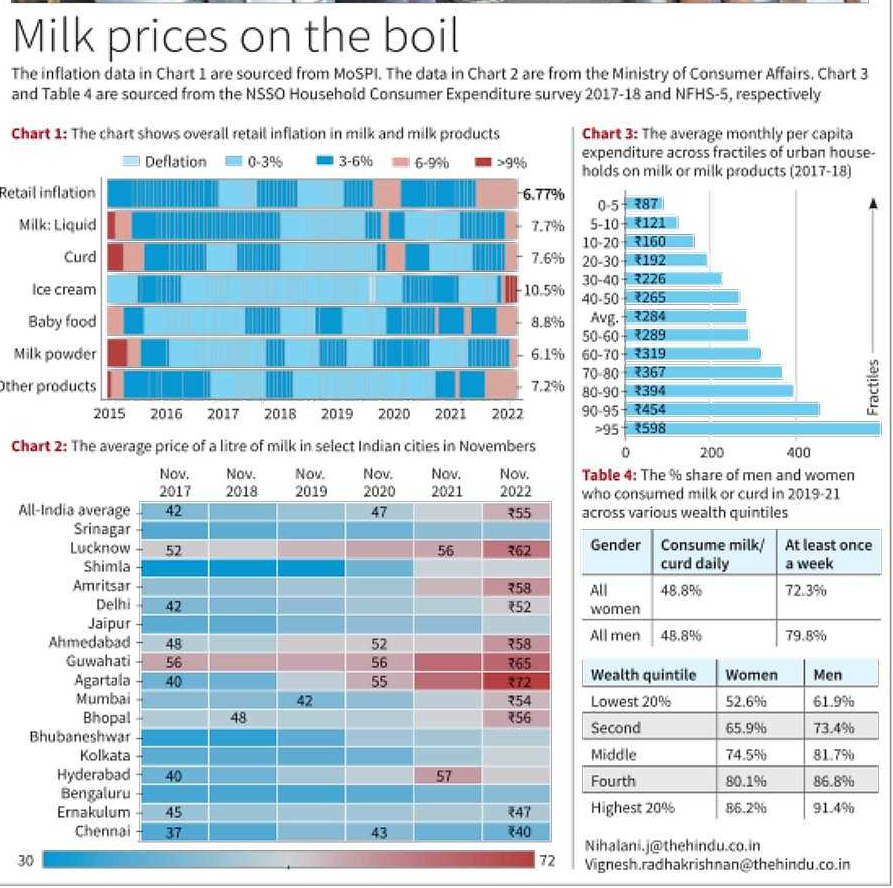

Inflation of milk and milk products has continued to go up even though India’s overall retail inflation came down in October. Milk inflation accelerated to 7.7% in October, the highest level seen in 7.5 years. Inflation of ice cream accelerated to 10.5% in October — the highest level in at least eight years. Curd inflation was at 7.6%. And baby food inflation at 8.8% was again the highest in at least eight years. Chart 1 shows the inflation levels of milk, milk products and general retail inflation since 2015.

In November, the average price of a litre of milk in India was close to ₹55. In November 2017, it was ₹42 — about ₹13 cheaper. The rise in the price of milk was not uniform across all cities. Chart 2 shows the average price of a litre of milk in select Indian cities in November 2022 and the five past Novembers.

The chart shows a distinct pattern: the average prices increased mostly in the northern, western and north-eastern cities of India. While there were mild increases in milk prices in eastern cities, the average prices did not rise much in the southern cities of Chennai, Bengaluru and Ernakulam. Hyderabad was an exception in the south as it showed a sharp rise in average milk prices.

The average price of milk in November 2022 was lowest in Chennai at ₹40 per litre. In Ahmedabad, the price was ₹58 per litre and in Lucknow, it was ₹62 per litre. In many north-eastern cities such as Guwahathi and Agartala, it crossed the ₹65 per litre-mark.

While comparatively, milk prices have not increased much in the south, this trend may not hold too for long. While Aavin increased the price in early November, the Karnataka Milk Federation also planned a hike a few days ago, but did not implement it.

The rise in milk prices will hit the poorest the most. Chart 3 shows the average monthly per capita expenditure of urban households on milk and milk products in 2017-18. The data are presented for all the fractile classes: from the lowest spending to the highest. An average urban household spends ₹284 on milk per month. The households in the lowest spending fractile (the poorest 5% households) spend only ₹86 on milk and milk products in a month, whereas the highest spending fractile (the richest 5%) spends ₹598 — a gap of over ₹500. Thus, the price rise will have a greater impact on poorer households, which already have a high share of those who have not been drinking milk.

Only 52%-62% members in the poorest 20% households consumed milk or curd, whereas 86%-91% did so in the richest 20% of households. Table 4 shows the percentage of men and women who consumed milk in 2019-21 across various wealth quintiles. Also, there is a noticeable gap in milk consumption between men and women, especially in poorer households. So, the price rise will disproportionately impact women in poorer households more as they will be the first to give up drinking milk to compensate for the price hike, widening the inequality further.