This year started with a lot of hopes for commodity traders. Raw milk prices were high due to scarcity and the companies were building stocks of SMP and Butter. We gave a checklist of 23 questions in the first dairy blog this year to find out the future trends. Subsequently all the factors were in favour of more milk with lesser chances of a bullish trend in dairy commodities.

However no one gave heed to the same and kept on buying commodities in anticipation of a Utopian future. The market was bullish till mid March and as usual the prices started to moderate from second week onwards due to two reasons. Firstly due to change in weather and secondly the companies released stocks and optimised their cash flows during year ending.

April made a fool this year

This year April came with lots of rain. Disturbed crop of Rabi in certain areas led to more milk availability and moderation of fodder prices. Maharashtra and South India which were showing shortages started to show improvement in milk collection. The so-called mini flush finally arrived in the South by April end. There was an impact of delayed calving in north India and the milk availability remained good even till mid of May this year. The milk prices started to move down and even milk price correction is continuously happening everywhere in North, west and South India.

Ghee and SMP prices also started to become softer in the absence of any demand . It is evident that ghee demand normally goes down post February and regains in July -August at the outset of festival season. However, Ghee demand gets some spikes during festivals and marriages in the above mentioned period. SMP demand is linked to the acuteness of summer and traction in demand of ice cream, dahi, buttermilk, Lassi , etc during summer season. Everyone was waiting for the marriage season at the end of April after Eid. To everyone’s surprise the demand for Ghee and SMP didn’t move as expected.

Ghee less marriages

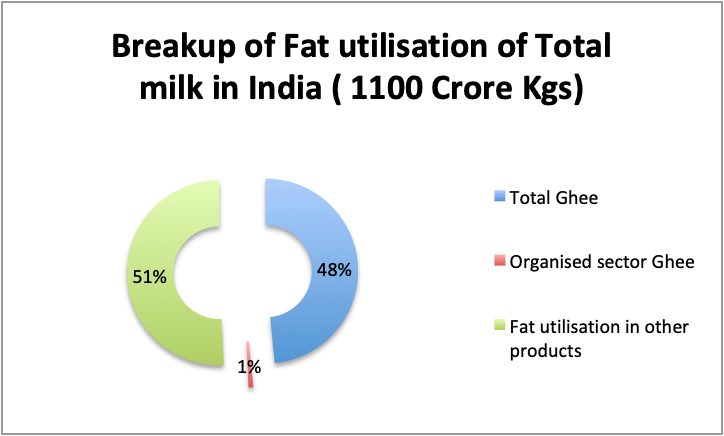

Let us focus on Ghee only in this discussion. Ghee is an important element for adding value to the dairy industry. If we follow a very popular report and their numbers then the Ghee market in India is around 240000 Rs Crores and out of that organised sector is around Rs 44000 Crores. I tried to deep dive into these numbers. India produces around 22000 Crore litres of milk per annum. At 46% buffalo milk (6%) and 54% cow milk ( 4 % fat) we produce around 1100 crore Kgs of Fat every year.

If I follow this report then considering the average price of Rs 450 per kg of Ghee, the organised sector produces only 9 crore Kg of ghee as against 525 crore Kgs as produced in total. In other words the report is trying to say that nearly 48% of total fat in milk in India is converted into ghee and out of that 8% is by the organised sector.

Source : Suruchi Research 2023

If we follow these numbers then the size of total organised dairy in India is around Rs 365000 Crores. Crisil ratings follow around 60 top companies from the organised sector. As per them the total turnover of these 60 companies is around 100000 crores which is two third of the total organised sector dairy turnover. It means that the total turnover of organised sector dairy is around 2-2.50 lakh crores currently. This number is shared regularly by various sources.

Is the size of the Ghee market bigger than the size of the Organised sector dairy ?

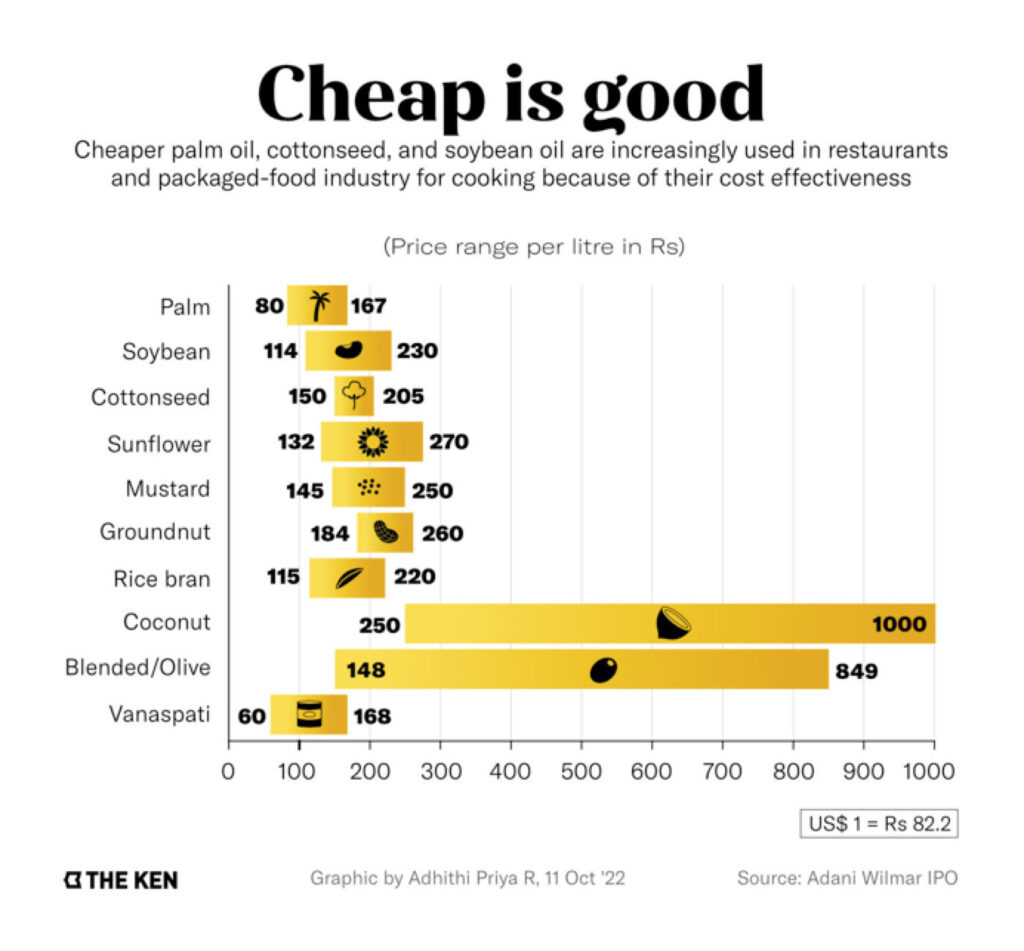

I think something is drastically wrong somewhere in these numbers. We have been blindly following these numbers. The government also quotes numbers from similar reports at various forums. Now let us look at the current scenario of ghee in the country. There has been a change in the trend of consumer purchase of ghee. Trust in the quality of ghee is becoming a bigger issue. Ghee is synonymous to purity. Desi ghee or khalis ghee have been the terms being used to indicate integrity of a person or a system. Over the last few years the prices of Edible oils are moving up. There were certain periods in the last 3-4 years when the gap between good brand edible oil got closer to Desi ghee. Edible oil shows a great bandwidth in pricing. See below.

Source : Article The slick claims of India’s ‘healthy’ oils in Ken on Oct 12 2022 by Maitri Porecha

Interestingly when the ghee demand increased in the country in the last 2-3 years , the range of desi ghee prices also widened. There were three reasons behind that as belows:

Regulatory

a. Regulation is weak in both surveillance and enforcement against spurious ghee quality as well as nomenclature , as the current standards are unable to differentiate between pure ghee and adulterated ghee. Though a notification exists but that is still not implemented. Even businesses went up to an extent of selling hydrogenated fats at prices higher than Desi ghee and calling them as Vegan Ghee. The regulator had to issue a notification in this regard a few weeks back.

GST

b. The GST of ghee is 12 % while on edible oils ( which are having lower nutritional values) are charged 5% only. This gives a direct benefit of around 60-70 Rs per liter to those selling it without bill.

Duplicate brands

c. There has been a flood of private ghee brands particularly from the states of Gujarat, MP and Rajasthan. They are clearly selling ghee at very low rates. Every other day there is news of duplicate ghee factories being busted by the authorities which also forms a bigger share of the ghee market.

Ghee less Marriages

Currently desi ghee is sold in the market in the range of Rs 360-Rs 630 per liter. Interestingly you may get any brand of ghee within this range. The ability of consumers to evaluate the purity of ghee is highly compromised. A consumer getting poor quality ghee in a known brand is also creating a lot of aversion from buying branded ghee. This way another set of farm ghee suppliers are building their markets in different names like A2, Bilona ,Cow ghee etc. Their range is from Rs 900 – Rs 4000 per liter. In the absence of any regulatory framework on A2, Bilona or cow ghee , their market is also flourishing.

Marriages are controlled by the caterer and he will buy the cheapest available option. Our governance lacks acumen as well as logic. No one sitting at the top is actually trying to go deep down on understanding the economics of ghee making. Today I presume that our organised sector is sitting over 30-40000 MT of ghee and almost an equal quantum of butter. No one knows what will happen to their stocks. The happy days of ghee are still 4-5 months away.

As I always say, the industry is still silent over it. However this time this silence is going to cost dearly. There must be an internal drive from all the stakeholders of this industry to come together and launch a campaign against spurious ghee. I recommend the following Hashtag to be used by everyone in the industry and tag it in all your social media promotions from now onwards.

#BeSureGheeIsPure

We may run consumer awareness campaigns jointly on behalf of the dairy industry with the dairy associations. It is your fight and no one will fight for you. I welcome more suggestions from everyone to be together in this noble cause of giving Desi ghee its right to be considered as pure.

Source : A blog by Kuldeep Sharma Chief editor dairynews7x7