Why the global milk business needs a structural shake-up

The New Zealand dairy stalwart Fonterra has sold its consumer dairy-brands (milk, butter, cheese) — including “Anchor” and “Mainland Cheese” — to French agribusiness giant Lactalis in late October 2025, in a deal approved by 88% of its 8,265 farmer-shareholders.

This move delivered a substantial windfall — roughly NZ$400,000 per farmer — but also signals deep structural issues. As argued in a recent commentary from the University of Auckland, the sale reflects persistent underperformance, value erosion and declining returns from branded-dairy operations under the co-operative model.

In real terms, while global milk-solid commodity prices (butter, SMP/WMP, cheese) as tracked by the Food and Agriculture Organization (FAO) have increased significantly between 2003 and 2025, Fonterra’s “value-per-kilogram of processed milk solids” has fallen — from USD 19.12/kg in 2003 (inflation-adjusted) to just USD 17.53/kg in 2025.

In short: global dairy-commodity markets have offered better pricing, but the co-operative failed to capture that value for its farmer-owners. This failure has seen Fonterra’s overall revenue growth from 2003–2025 barely cross 20% (equivalent to under 1% annual growth) — far below global peers such as Lactalis or other large dairy conglomerates.

The commentary calls this an “industrial disappointment,” arguing for fundamental reform: divesting non-core consumer brands, refocusing on bulk ingredients exports (milk-powder, protein concentrates, casein), dismantling costly bureaucratic overheads (some 130 managers reportedly earn over NZ$500,000/year, 20 earn over NZ$1 million), and encouraging competition among multiple independent processors.

In broader context, this critique aligns with international analyses warning that the traditional high-volume, low-margin dairy model is becoming economically and environmentally unsustainable. Pressure on production costs (feed, energy, labour), volatile global commodity markets, climate change risks and shifting consumer preferences are driving calls for a “milk-business shake-up.”

Why This Matters — Key Implications for Global & Indian Dairy

-

Value-addition over volume: The experience of Fonterra underlines that simply producing large milk volumes is not enough. Unless processing, branding and supply-chain efficiency are competitive, farmer returns may stagnate — even if global dairy markets are buoyant.

-

Need for structural reform in dairy governance: Cooperative models with heavy bureaucracy and legacy structures may struggle to compete in modern global dairy markets; more agile, competitive, independent processors may deliver better returns and value to producers.

-

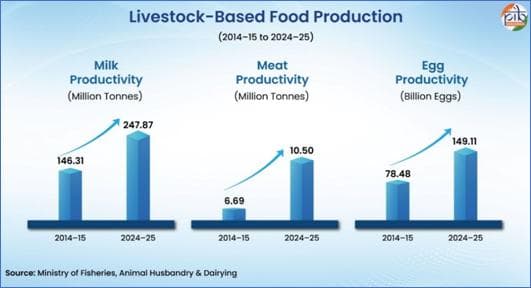

Relevance for dairy-heavy nations like India: As Indian dairy output grows, relying solely on volume and commodity-milk (or powders) could lead to similar value-capture issues. The shift toward value-added dairy (cheese, whey-protein, branded milk, nutritional products) may offer more stable, higher margins — something Indian co-ops and private dairies should proactively pursue.

-

Sustainability & cost pressures demand efficiency: As global feed, energy and input costs rise (as documented by recent global dairy-cost studies), mere scale won’t protect profitability. Efficiency in processing, lean supply-chains and value-added diversification become essential.