India–Russia deepen dairy & food-trade ties under 2025 summit

India and Russia have agreed to significantly expand bilateral cooperation in fisheries, animal husbandry and dairy trade, with focus on opening export access, listing Indian processors in Russian registries, and launching joint aquaculture, veterinary-health and value-addition programmes.

At a high-level meeting on December 4, 2025 — coinciding with the 23rd India–Russia Annual Summit — India’s Minister for Fisheries, Animal Husbandry & Dairying, Rajiv Ranjan Singh (Lalan Singh), held talks with Russia’s Agriculture Minister Oxana Lut to chart a roadmap for expanded trade across dairy, meat and fisheries.

📦 What’s on the agenda

-

India exported fish and fishery products worth US$ 7.45 billion in 2024–25 — of which US$ 127 million went to Russia. The Indian delegation proposed expanding this trade to include dairy, meat and a broader range of marine products (shrimp, prawns, mackerel, tuna, squid, cuttlefish, etc.).

-

Russia expressed readiness to import not just fish but also meat and dairy items from India, subject to expediting market-access and regulatory approvals.

-

India has requested fast-tracking of registration/listing of Indian dairy and food-processing plants under Russia’s regulatory veterinary/phytosanitary framework (FSVPS). Over a dozen Indian dairy processors — including major players such as Amul / GCMMF — are reportedly awaiting clearance.

-

Beyond trade, the cooperation plan includes technology transfer, research collaboration and capacity building — covering advanced aquaculture systems (RAS, Biofloc), deep-sea fishing vessels, cold-water fisheries (trout), genetic improvement programmes, veterinary-vaccine development, and institutional cooperation (academia/research institutes exchanges).

Why this matters — Implications for Indian dairy & allied sectors

-

New export market for dairy: Dairy processors in India, especially those with export-ready capacities, may now access a large market in Russia — potentially reducing dependence on traditional export destinations.

-

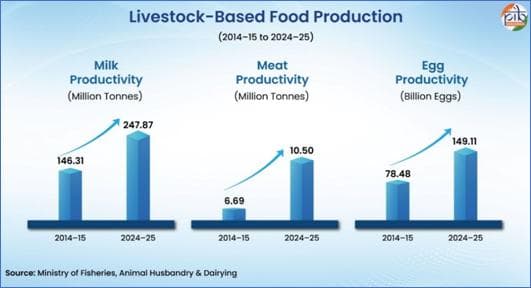

Relief from domestic oversupply pressure: Given India’s rising milk production, a new export outlet could help absorb surplus milk solids, improving farm-gate value and price stability.

-

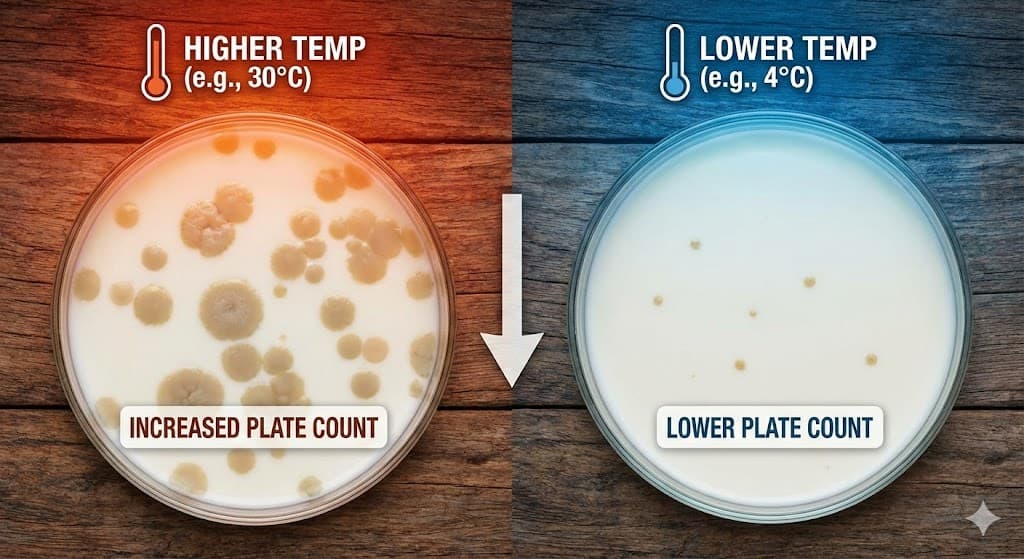

Push toward value-addition & quality compliance: To meet Russian import requirements, Indian dairy firms will need to meet stringent phytosanitary, processing and labelling standards — likely accelerating modernization, quality control, packaging and cold-chain enforcement in India’s dairying value-chain.

-

Livelihood and growth opportunities for fisheries, dairy & livestock farmers: Expanded market access for seafood, meat and dairy enhances demand for raw-milk, marine harvests, value-added processing — offering stronger income potential for producers and fishers, especially in coastal and hinterland zones.

-

Strategic diversification of export basket: With global dairy commodity markets unstable (powder, SMP/ WMP, butter), a diversified export basket including fresh/premium dairy, fishery, meat and value-added products reduces vulnerability to price swings.

What to watch going forward

-

Regulatory approvals: Expedited listing of pending Indian dairy & food-processing units on Russia’s FSVPS registry will be key. Delay or rejection would stall export ambitions.

-

Quality compliance & cold-chain readiness: Exporting perishable dairy, meat and fishery products to Russia demands high hygiene, traceability, cold-storage — Indian firms must upgrade accordingly.

-

Demand response in Russian market: Russia’s import demand and pricing competitiveness vis-à-vis other suppliers (local or global) will ultimately determine whether Indian exporters get sustainable offtake.

-

Currency, logistics & geopolitical risks: Payment terms, freight logistics, trade-settlement currency/ compliance — these remain potential obstacles in expanding bilateral trade.

-

Domestic supply-demand balance: As Indian dairy sectors divert more produce for export, domestic supply vs demand equilibrium must be managed to protect domestic consumers and retail prices.

This development marks a potentially transformative phase in India–Russia agri-trade relations — with dairy and allied sectors placed front and center. If implemented smartly, the cooperation could inject fresh momentum into India’s export-orientated dairying and allied marine / livestock sectors, while offering producers much-needed market diversification and income stability.

Source : Dairynews7x7 Dec 9th 2025