HUL splits off Kwality Wall’s as standalone ice-cream firm

India’s booming ice-cream market has prompted Hindustan Unilever to demerge its ice-cream business — including Kwality Wall’s, Cornetto and Magnum — into a separate listed company, Kwality Wall's (India) Ltd. (KWIL), effective December 1, 2025. The record date for entitlement was set at December 5: each HUL shareholder receives one KWIL share for every HUL share held.

The decision reflects the view that ice-cream is now one of India’s most dynamic consumer segments. According to market research cited by DSIJ, the Indian ice-cream market was valued at ₹268 billion in 2024, and is projected to reach ₹1,078 billion by 2033 — implying a compound annual growth rate (CAGR) of about 16.7%, among the fastest in the FMCG industry.

HUL itself acknowledged that ice-cream, while historically part of its Foods & Refreshments portfolio, has limited synergy with its core businesses (home care, personal care, packaged foods). The cold-chain-heavy, distribution-intensive nature of ice-cream operations demands a distinct strategy. Splitting it out into KWIL — a dedicated ice-cream firm — allows sharper focus, capital allocation, faster decision-making and growth-aligned execution.

Under the restructuring, global parent group entities (via The Magnum Ice Cream Company) are set to acquire a majority stake (~ 61.9%) in KWIL.

Market reaction was swift: HUL shares fell by about 7% on the record date (as they began trading ex-ice-cream division), reflecting investor adjustment to the business split.

Analysts believe the demerger gives investors a unique opportunity: they now get a pure-play ice-cream company exposed to rapid growth, innovation, premiumisation and cold-chain expansion — along with legacy brands and distribution reach.

At the same time, the structural change realigns HUL’s focus: away from a capital-intensive, seasonal margin business to its core FMCG staples — enabling higher operational efficiency and possibly better long-term margins in its remaining categories.

What This Means: Industry & Investor Implications

-

Ice-cream becomes a full-fledged growth segment: The demerger recognizes the maturation of India’s ice-cream market from a seasonal treat to a year-round consumption and retail-driven category. With rising disposable incomes, evolving taste profiles, and expanding cold-chain & retail outreach, demand appears robust.

-

Standalone valuation & investor clarity: As a separate listed entity, KWIL’s performance and growth potential can be appraised independently. Investors get direct exposure to the ice-cream segment without being bundled in HUL’s diversified business — improving transparency and allowing targeted investment decisions.

-

Focused capex & expansion strategy for ice-cream: With dedicated resources, KWIL can invest in cold-chain infrastructure, freezer penetration, distribution expansion (especially in smaller towns/ Tier-2/3 cities), and premium + innovation-led launches (flavours, formats, frozen desserts), better aligning with market potential.

-

Competitive environment energised: Existing ice-cream players (national and regional) will now compete with a standalone Kwality Wall’s — likely intensifying innovation, pricing battles, distribution pushes, and cold-chain investments across the sector.

-

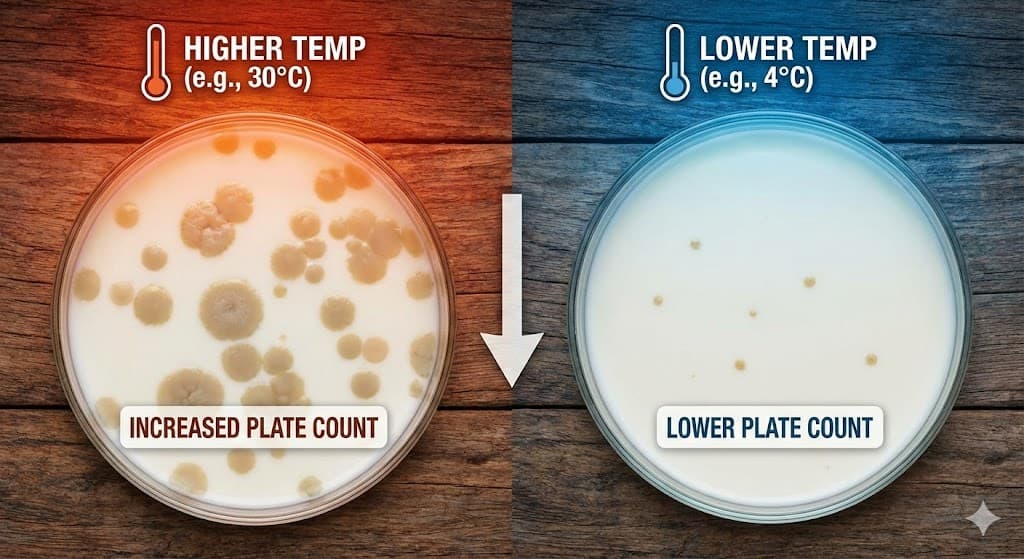

Benefit for dairy / milk supply-chain (indirect): Higher organised ice-cream demand may increase demand for high-quality milk solids / raw-milk supply (for ice-cream, cream, frozen desserts), possibly opening new procurement / supply-chain linkages for dairies and milk producers wanting to supply organised value-added chains rather than commodity-milk routes.

Dairynews7x7 Analysis- Key data & assumptions

-

The Indian ice-cream market was estimated at ₹268 billion in 2024.

-

According to industry-forecast reports, the market size could reach ₹1,078 billion by 2033, implying a CAGR ~16.7% over 2025–2033.

-

Growth drivers: rising disposable incomes; increasing cold-chain penetration and retail/freezer expansion; low per-capita ice-cream consumption (huge upside compared to developed markets); urbanisation & expansion to Tier-2/3 towns; rapid growth via quick-commerce and improved distribution networks.

Market size projection (nominal) — base 2024 = ₹268 bn

| Year | Estimated Market Size (₹ bn) | Notes / Assumptions |

|---|---|---|

| 2024 | 268 | Base (per IMARC / recent reports) |

| 2025 | ~ 312 | +16.7% growth (as per CAGR) |

| 2026 | ~ 364 | — |

| 2027 | ~ 425 | — |

| 2028 | ~ 495 | ~₹50,000 crore (~₹500 bn) — aligns with various 2028 estimate reports |

| 2029 | ~ 576 | — |

| 2030 | ~ 670 | — |

| 2031–2032 | ~ 780 – 900 | — |

| 2033 | ~ 1,078 | As per forecast projection |

Interpretation: If the ice-cream market grows as forecast, by 2030 it could nearly triple compared to 2024, and continue robust growth toward 2033. For producers, this means massive demand volume for raw-milk solids, cream/fat, and milk-based inputs.

Source : Dairynews7x7 Dec 10th 2025 Dalal Street investmnet Journal , Imarc Group and many more