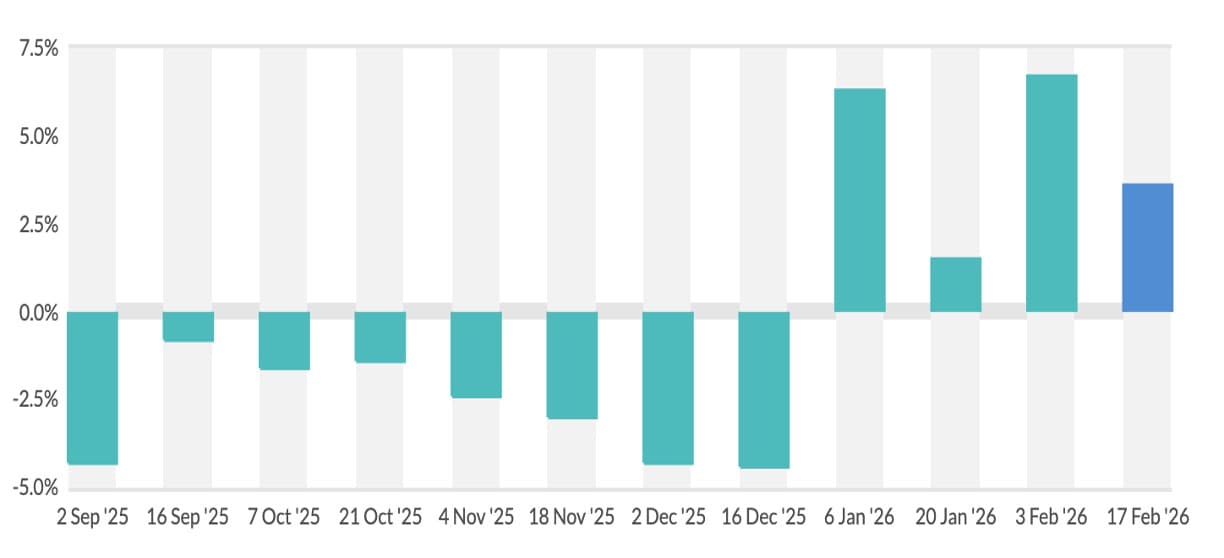

GDT 398: Dairy Prices Extend Rally as Global Demand Strengthens

Event 398 of the Global Dairy Trade (GDT) — held on 17 February 2026 — delivered another positive result for international dairy commodity markets, marking the second consecutive price increase after a prolonged downturn that lasted through much of 2025. The overall GDT Price Index rose by 3.6 %, lifting the average winning price to USD 4,028 per metric tonne, with 22,240 t of product traded, signalling renewed buyer confidence and firm global demand.

The auction’s participation and trading dynamics showed strong engagement: 167 registered bidders entered the sale, of which 105 were successful, and the competitive bidding over 23 rounds in nearly four hours reflected sustained interest in dairy powders and fats — the backbone of export pricing benchmarks.

Price Moves Across Key Commodities

According to broader market reporting, the rally in early 2026 has been broad-based across dairy products:

-

Butter continues to demonstrate robust strength with gains that outpace other categories.

-

Skim Milk Powder (SMP) and Whole Milk Powder (WMP) have both been rising steadily on the back of firm demand.

-

Other fats and speciality products also show structural support amid tightening stocks in key regions.

While GDT 398 did not publish detailed per-product figures in its official release, recent auctions have shown double-digit rises in SMP and mozzarella, and strong momentum in fats like butter and anhydrous milk fat — indicators that buyers are prioritising essential dairy ingredients against a backdrop of moderated supply.

Why Prices Are Rising Despite Prior Weakness

The rebound in GDT prices in early 2026 marks a notable shift from the late 2025 slump, when the index experienced a sequence of declines driven by global oversupply and subdued buyer participation. In events through mid- and late 2025, excess milk production in major exporting regions — New Zealand, Europe and the United States — weighed on the auction, pushing prices lower.

In contrast, the recent upturn appears to be supported by several emerging dynamics:

-

Seasonal and Strategic Stock Replenishment: Buyers in North Asia and Middle Eastern markets are returning to auction platforms to secure coverage ahead of consumption peaks, reflecting a demand pull rather than purely speculative activity.

-

Reduced Available Inventories: As 2026 begins, seasonal supply tightening in the Southern Hemisphere and shifting allocations — like more milksolids being diverted to cheese production — reduces powder availability relative to earlier in the cycle.

-

Strong Pumps in Fats and Powder Segments: Commodities central to Fonterra’s and other exporters’ pricing baskets — like butter and SMP — have seen significant year-to-date rises (~17 % or more for WMP and ~22 % for SMP), indicating buyers are willing to pay up for critical inputs.

-

Buyer Optimism and Price Anchoring: Since GDT 395’s rebound of +6.3 % in early January and the subsequent 6.7 % jump at Event 397, market psychology may be shifting from pessimism to cautious optimism, fuelling positive expectations.

Short to Medium Term Forecast (2–3 Months)

Near term: Continued upward or stable pricing is likely if demand momentum persists and strategic buyers remain active. Seasonal factors in producing regions — where milk production slows — could further underpin prices, especially for powder categories.

Medium term: Over the next 2–3 months, price direction will hinge on a few key factors:

-

China’s import behaviour: Any resurgence in import volumes from China, historically the world’s largest dairy importer, could sustain upward price pressure.

-

Global inventory levels: If stock build-ups in developed regions ease as older inventories clear, this may tighten supply relative to demand.

-

Currency and freight dynamics: Exchange rates and shipping costs will continue to influence price discovery indirectly via buyer participation and cost competitiveness.

In summary, GDT 398’s positive result reinforces an emerging price recovery in global dairy markets after the major slide of late 2025, driven by tightening real-world supply, strategic restocking and returning demand. While not a structural reversal yet, the series of successive increases — from early January through mid-February 2026 — suggests a new pricing phase that dairy exporters, processors and farmers will want to monitor closely in the weeks ahead.

Source : Dairynews7x7 Feb 18th 2026

#GDT398 #GlobalDairyPrices #MilkPowder #SMP #Butter #DairyMarketOutlook #CommodityRally