GDT 397: Dairy Prices Rally in Surprise Turnaround

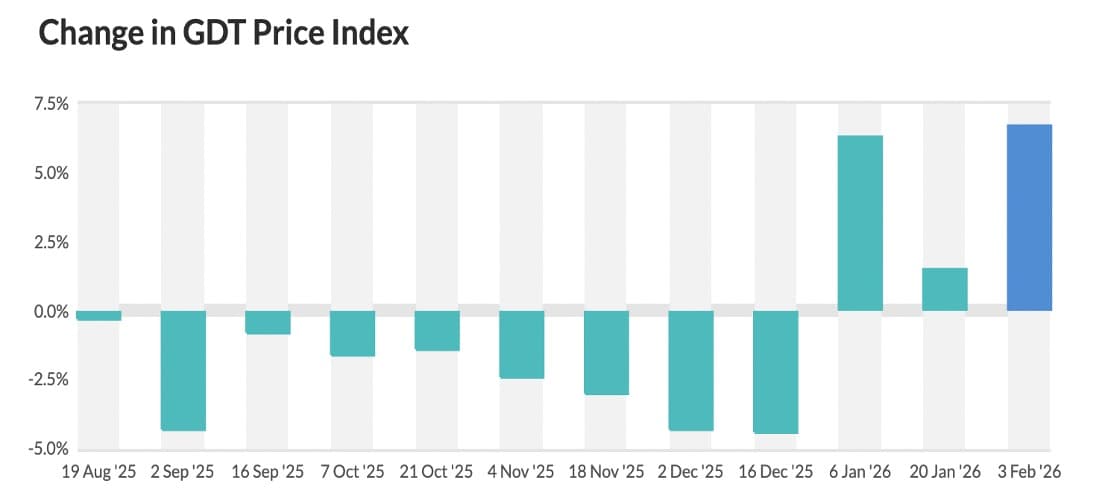

In a surprising contrast to the weak global milk prices and inventory glut seen through late 2025, the Global Dairy Trade (GDT) auction held on 3 February 2026 delivered a strong positive outcome, with dairy commodity prices rising across key product categories. The overall tone of the event echoed market confidence not seen since early 2025.

According to early market reporting, every product category recorded price increases, with Whole Milk Powder (WMP) climbing about 5.3% to around US $3,614/tonne, Skim Milk Powder (SMP surging ~10.6% to roughly US $2,874/tonne), and Butter posting a solid ~8.8% gain to about US $5,773/tonne. Other key fats and powders such as Butter Milk Powder (up ~6.4%) and Anhydrous Milk Fat (AMF up ~5%) also saw robust gains, underscoring broad-based buyer interest at this auction.

The stronger GDT results follow a recovery trend that began in January 2026, when the price index rose for the first time after a long slide, and continued into the mid-January auction with modest gains across milk fat and powder products.

Why Prices Rose Despite Global Oversupply

This rebound is notable given the backdrop of oversupply and soft demand that pressured prices late in 2025: global milk output remained high in all major exporting regions and the GDT index had been on a downward trajectory as buyers held back amid ample inventories.

Analysts point to several reasons for the renewed price strength at this early-February sale:

-

Seasonal tightening of supply in major Southern Hemisphere exporters as peak production phases out, reducing immediate availability.

-

Emerging pockets of renewed demand from regions that had paused purchases during late-2025 adjustments — particularly in parts of Asia and the Middle East seeking to replenish stocks ahead of seasonal consumption cycles.

-

A possible shift in buyer behaviour toward securing coverage for later delivery periods as market participants assess supply stability into mid-2026.

This combination appears to have supported bidding activity across powder and fat categories, outweighing the longer-term pressure from inflated inventories globally.

Demand Side Signals & Emerging Markets

Although overall global dairy demand has been soft — especially in markets like China where consumption growth has lagged relative to production — buyers in North Asia and the Middle East continue to participate actively in commodity auctions, which likely contributed to the strong participation observed in this GDT event. This suggests that while traditional demand drivers remain sluggish, regional demand pockets are emerging as influential buyers.

Higher-income markets that are increasingly integrating dairy into food service and nutrition segments (e.g., high-protein products, fortified nutrition) may also be contributing to underlying support for price discovery at the auction level.

Short-Term Forecast (Next 2–3 Months)

Looking ahead:

-

February–March 2026: With inventories still large but buyer participation broadening, dairy prices may stabilise at elevated levels relative to late-2025 lows, especially for WMP and SMP, which are sensitive to replenishment demand. Seasonal supply moderation in southern producers may continue to support this trend.

-

April–May 2026: If supply begins to grow again with the onset of Northern Hemisphere production peaks while demand does not accelerate sufficiently, price momentum could soften again later in the spring, though not necessarily returning to the steep declines seen in late 2025.

In summary, the early-February GDT rally reflects a market correction rather than a structural supply squeeze — buyers appear willing to pay firmer prices in anticipation of balancing abundant inventory with ongoing seasonal demand needs. Continued monitoring of import demand in North Asia and the Middle East will be key to sustaining this new price trajectory beyond the near term.

Source : DAirynews7x7 Feb 4th 2026 GDT and other sources