Future Milk Availability: 4 Critical Challenges Facing the Global and Indian Dairy Industry

Recently, I came across an insightful infographic by A Insights highlighting four pivotal challenges facing the global dairy industry. Intrigued, I delved deeper to understand the impact of these challenges on our ambitious forecast of around 660 billion liters of milk production and 800 ml of per capita availability by 2047, coinciding with India's centenary of independence. It became evident that these challenges are not only applicable to the global dairy sector but resonate profoundly with the Indian dairy industry as well. While global demand for dairy products is poised to grow, companies in the sector are grappling with increasing difficulties in staying competitive due to these formidable challenges. Let's explore these challenges from both a global and Indian perspective.

Challenge 1: Availability of milk

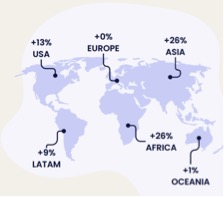

The availability of raw milk is a growing concern for dairy companies worldwide. In Europe, dairy companies are struggling to secure a consistent supply of milk from farmers, largely due to stringent environmental regulations. These regulations put pressure on dairy farmers, leading to reduced milk production. Additionally, in Southeast Asia, the rising popularity of plant-based proteins is posing a threat to the dairy sector, potentially hampering the growth trajectory of milk production in the region. Growth in Asia and Africa looks promising but they have not yet implemented climate friendly farming initiatives.Milk supply growth between 2022 and 2032 globally

Source : A-insights

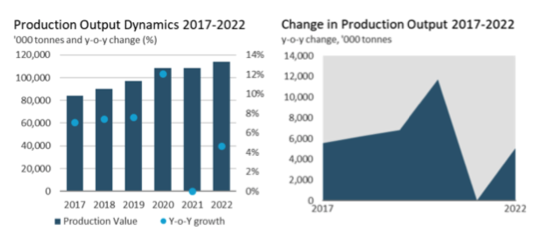

From Indian context there has been a restrictive growth being seen in milk production in last few years. The data from 2017-2022 suggest the following pattern.

Indian Perspective

The scenario in India is equally, if not more, complex. The recent Monthly Per Capita Expenditure report released by the National Sample Survey Office (NSSO) has cast doubts on the official milk production data. An analysis on our blog dated March 1, 2024, revealed that the actual milk production might be nearly 40% lower than the government estimates.

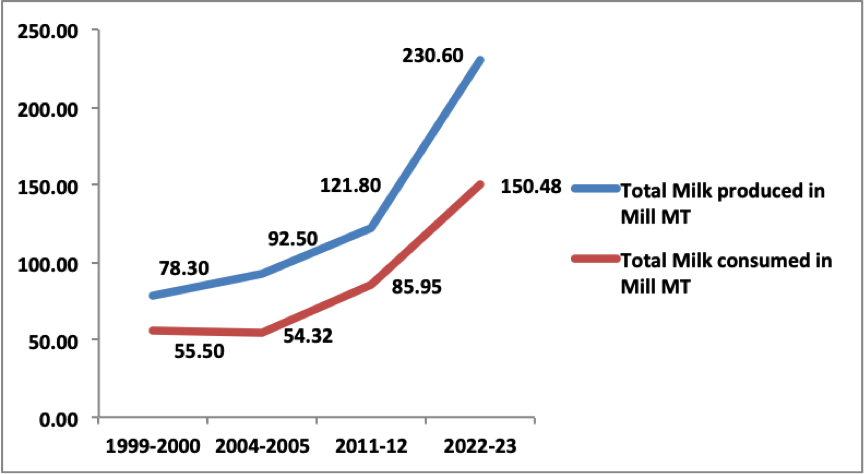

Source :Decoding the Dairy Dilemma: India’s Milk Discrepancy Blog by Kuldeep Sharma

This discrepancy was further validated by esteemed economist Sh. Harish Damodaran during his keynote address at the Dairy Industry Conference in Hyderabad in March 2024. Damodaran used NSSO estimates to show that the per capita availability of milk is 243.5 grams per day, contrary to the government’s figure of 459 grams. After accounting for institutional sales of dairy products, this figure adjusts to around 304.31 grams per day. Based on the Indian population of 138 crores, this translates to a total milk production of approximately 152.8 million metric tons (MMT), significantly lower than the government's claim of 230.6 MMT for 2022-23.

Interestingly, the past two years have witnessed better milk availability during summer in India, leading to a surplus. However, the reasons behind this increased supply remain unclear. This surplus, coupled with excessive stocks of dairy commodities and sluggish global market conditions with lower milk powder prices, is challenging policymakers to reassess their pro-milk production strategies. This scenario calls for a balanced approach to ensure sustainable growth and stability in the dairy sector.

The challenges faced by the global dairy industry resonate strongly with the Indian context. Addressing these challenges requires a nuanced understanding of both global trends and local dynamics. For India, this means not only re-evaluating production estimates and strategies but also preparing for potential market fluctuations and shifts in consumer preferences. By doing so, the Indian dairy industry can position itself to remain competitive and sustainable in an increasingly challenging global landscape.

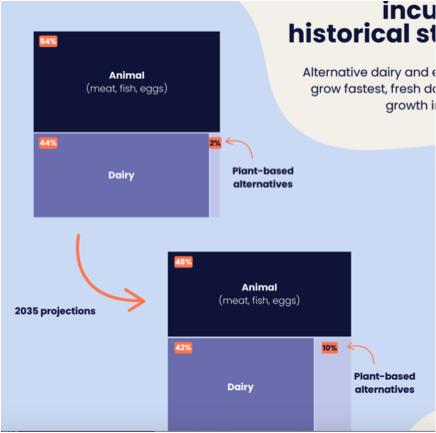

Challenge 2: Most demand growth is outside the core of incumbents’ historical strengths.

Alternative dairy and emerging markets grow fastest, fresh dairy takes up most growth in traditional dairy.The market for vegan and non-dairy products in India is experiencing significant growth, driven by health, environmental, and ethical concerns.

Source : A-insights

The plant-based milk market in India is expected to grow at a compound annual growth rate (CAGR) of around 20% from 2020 to 2025, according to a report by ResearchAndMarkets. The Indian plant-based dairy market, valued at approximately USD 21.82 million in 2019, is projected to reach USD 63.9 million by 2025, growing at a similar CAGR of about 20% as per Market Data Forecast.

Several Indian startups and established companies like Epigamia, Goodmylk, So Good, and Urban Platter have introduced various plant-based dairy alternatives, contributing to the rise in vegan product availability. These vegan products are increasingly available in supermarkets and online platforms like BigBasket and Amazon India, reflecting growing consumer interest.

The market for plant-based meat alternatives in India is also expanding. The Good Food Institute India reports that this market is expected to reach USD 150 million by 2025. Additionally, a 2020 Ipsos survey indicated that about 63% of Indians are willing to replace meat with plant-based alternatives, showing significant interest in vegan products.

The number of vegan food startups in India is on the rise, with companies like Imagine Meats, Good Dot, and Vezlay Foods gaining traction in the market. These figures underscore the expanding market for vegan and non-dairy products in India, driven by increased awareness of health benefits and the environmental and ethical issues associated with animal agriculture.

India, with its youthful demographic, faces a heightened risk of reduced dairy consumption in the future, more so than any other part of the world. The new-age doctors, health and fitness experts, and dieticians, whom the urban population trusts implicitly, consistently discourage the use of milk and milk products. Citing lactose intolerance, millions are eliminating milk from their diets. Even organizations like the ICMR, which shape dietary guidelines, are not fostering a favorable perspective by recommending the avoidance of milk in tea. To secure the future of dairy consumption in India, it is crucial to address these perceptions and reinforce the nutritional value of milk, ensuring it remains an integral part of the nation's diet.

Challenge 3: Production Networks Are Inflexible and Aging

The inflexibility and aging of production networks present significant challenges. In the short term, these issues hinder utilization and valorization, while in the long term, they reduce the margin for error in investment decisions.

Source : A-insights

To adapt to these challenges, Indian dairy companies are increasingly shifting towards non-dairy products, driven by changing consumer preferences, lower valorization potential in milk products, and the need to exploit their distribution networks for higher topline growth.

Amul, one of India's largest dairy cooperatives, has significantly expanded its product range to include non-dairy items. For instance, it has been investing in chocolate production and exploring new segments like dark chocolate to cater to evolving consumer tastes. Additionally, Amul has diversified into bakery products, organic groceries, ready-to-eat snacks, and honey.

Mother Dairy, which already had a portfolio of edible oil, fruits and vegetables, and groceries, has now added a bakery range to its offerings. This diversification reflects the company's efforts to adapt to the changing market landscape.

There is a noticeable trend towards animal-free dairy products in India. Startups like Epigamia, which initially focused on dairy-based products, are now developing and launching plant-based and synthetic dairy alternatives to meet the growing demand for lactose-free and vegan products. For example, Indian startup Better Bet is producing plant-based drinks from sprouted millets, fortified with essential vitamins and lower in calories and fat.

Country Delight, known for its direct-to-home milk delivery service, has expanded its non-dairy portfolio to the extent that milk might now hold a minority share of their total sales. This significant shift highlights the increasing consumer interest in non-dairy products.

This trend is being followed by many other large dairy companies, including Ananda, Heritage Foods, Hatsun, Keventers Agro, and various dairy cooperatives, which are also venturing into the bakery sector. These companies recognize the need to adapt and diversify to stay relevant in a rapidly changing market.