Leading the whey: the synthetic milk startups shaking up the dairy industry

In 1931, Winston Churchill predicted the rise of animal-free food. Then an opposition MP in his wilderness years, Churchill wrote an essay that imagined life in 50 years’ time. “Synthetic food will, of course, be used in the future,” he wrote.

The artificial stuff would “be practically indistinguishable from the natural products, and any changes will be so gradual as to escape observation,” Churchill wrote. “Microbes, which at present convert the nitrogen of the air into proteins by which animals live, will be fostered and made to work under controlled conditions just as yeast is now.”

Though several decades later than envisaged, Churchill’s prediction has been borne out by the development of lab-grown meat and, more recently, animal-free dairy products.

Synthetic milk has emerged as a new potential alternative to cow’s milk, one that – unlike plant-based oat, nut and soy milks – purports to replicate its taste, appearance and mouthfeel. Described by experts as the future of milk, it has been touted as an environmentally friendly option that may shake up the dairy industry – and leave small-scale farmers in the lurch.

“Lab-grown milk is considered the next food frontier,” says Dr Diana Bogueva, of Curtin University’s Sustainability Policy Institute, citing the growing popularity of dairy alternatives. Compared with dairy production, synthetic milk is likely to have a smaller carbon footprint and cause less pollution, and obviously eliminates animal welfare concerns, she says.

The industry is expanding rapidly. In the US, cow-free dairy proteins produced by the firm Perfect Day are now widely used in products including ice-cream, cream cheese, chocolate and protein powders. Another American startup, New Culture, is commercialising a synthetic milk-based mozzarella, while the Israeli firm Remilk has set up a giant facility in Denmark to produce cheese, yoghurt and ice-cream.

It will be some time before cow-free milk arrives in Australian supermarkets, but startups such as All G Foods and the CSIRO spin-off company Eden Brew are racing to bring products to market within the next two years.

Yeast of Eden

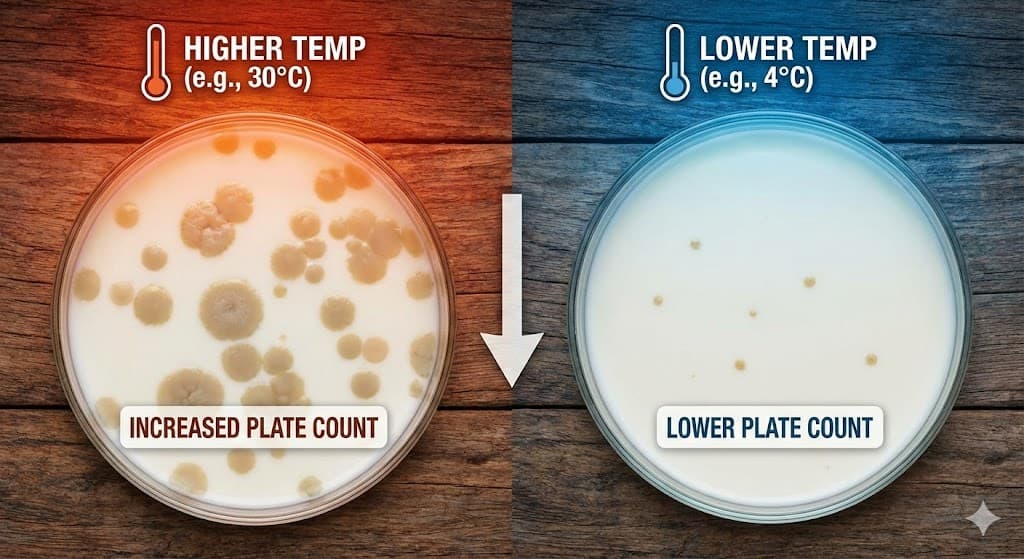

Chemically, milk is mostly water – about 87%, to be precise. Milk solids comprise the rest: fats, proteins, sugars – primarily lactose – and minerals. By Australian law, at least 3.2% of the liquid in full-cream milk must be fat and another 3% protein.Most synthetic dairy companies are focusing on producing milk proteins using a process known as precision fermentation. It involves genetically programming yeast or other microorganisms using synthetic DNA to produce a specific protein. Jim Fader, the co-founder of Eden Brew, compares the process to beer brewing.

“We use yeast to make a protein to make a drink. They use yeast to make alcohol to make a drink,” he says.

There are at least 20 proteins in cow’s milk, about 80% of which are casein proteins, found in the curds; the rest are whey proteins, perhaps most familiar as a component of powdered protein shakes.

Aggregates of casein, known as micelles, give milk its characteristic appearance and heat stability.

“The micelle plays a fundamental role in many parts of milk,” Fader says. “For example, when it binds with calcium, it makes the milk look white. If you want to froth your milk and put it in your cappuccino, the ability for the milk to withstand that heat and the bubbles to be able to form … is also down to the micelle.”

A key investor in the firm is the New South Wales dairy cooperative Norco, which will be responsible for rehydrating and blending the proteins. At this stage, other components such as minerals and coconut-based fat will be added. The end product will be lactose-free, with a small quantity of table sugar used to approximate the sweetness of cow’s milk.

Fader says the firm will launch an ice-cream – simpler than milk because it can be made with just two proteins – around December next year. Milk will follow, likely in August 2024.

All G Foods is focusing its efforts on whey proteins. The firm’s plant-based meat products are already served in commercial burger chains and sold in some supermarkets.

The company’s chief scientific officer, Jared Raynes, says the ultimate goal is to produce yoghurts, cheese and fresh milk. But the firm’s focus for now is on beta-lactoglobulin, the main protein in whey.

“We are going to be applying for regulatory approval with our protein powder,” he says.

Parallels with synthetic fabrics

Milena Bojovic, who is completing a PhD at Macquarie University, says while the promise of cow-free fresh milk has been widely trumpeted, the impact of synthetic dairy is likely to be greater on products such as milk powder.“Fresh milk consumption is on the decline,” she says and consumers may be wary of drinking a synthetic version of a natural product. She points out that traditional dairy production is also “very much technologically mitigated, from conception to the birth of calves to the milking process”.

“If synthetic milk really takes off, the biggest disruption I think will be if it can be powdered and used in the ingredients space … as an additive like milk solids, which is in a lot of processed foods,” Bojovic says. “I don’t think most consumers are questioning where the milk solids in their KitKat came from.”

“If and possibly when that happens, that will be one of the major disruptions for dairy industries that are producing exclusively for export in the form of powdered milk.”

Bojovic, who has analysed global dairy trends as part of her research, is concerned that technological advances may leave farmers behind. Large dairy players such as Norco and Fonterra, a New Zealand multinational cooperative, have begun to invest in synthetic protein production.

“Small-scale operations are really going to struggle in the context of global dairy consolidation,” she says. “There’s more pressure on farmers to innovate and also to invest in technology to make sure that they’re at the standard that bigger corporates are at.”

Bojovic sees parallels with the rise of synthetic fabrics. “When synthetic fibres hit the market, that decimated the wool industry in a lot of regions,” she says. “It’s not the first time that farmers have been faced with the threat of synthetics, but they’ve adapted, they’ve innovated.

Melissa Cameron, Dairy Australia’s human health and nutrition policy manager, says it is yet to be seen how consumers will respond to a synthetic product. She points to statistics suggesting that 58% of Australian households exclusively buy fresh and long-life cow’s milk.

“People are not abandoning dairy,” she says. “The commercialisation of synthetic proteins and products to a scale that makes these products available widely to consumers is yet quite a while off. As our populations grow around the world, synthetic products will deliver complementary protein and products. There will be room for all.”

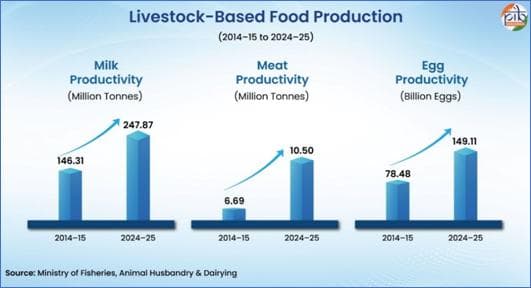

Dairy demand worldwide grew by 36% between 2007 and 2017 and is expected to keep rising as the world’s population increases and per-capita consumption grows.

Fader says the technology that companies such as Eden Brew are developing is “less about trying to displace cows everywhere from dairy”. Rather, “it’s about augmenting the current supply because demand is forecast to go up by so much”.