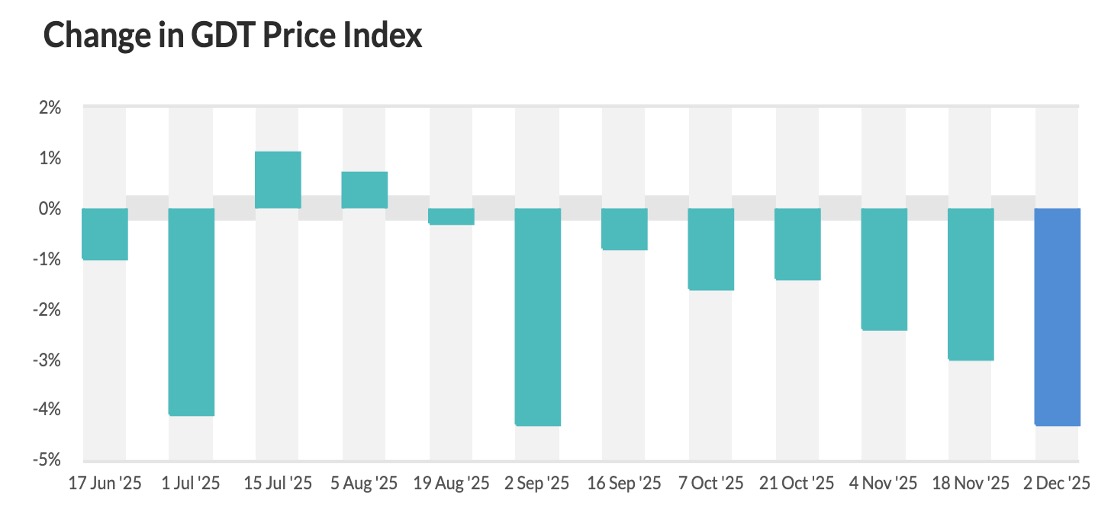

GDT Index Falls 4.3% — Powder Slide Rattles Markets 2025

Global dairy markets turned distinctly bearish in the 393rd Global Dairy Trade (GDT) event, where the GDT Price Index dropped 4.3%, pulling the weighted average winning price down to around USD 3,507 per tonne. The auction moved nearly 34,282 tonnes, confirming that today’s decline was driven by meaningful trading volume rather than thin-market volatility. The correction was led overwhelmingly by powders—Whole Milk Powder (WMP) and Skim Milk Powder (SMP)—which together dictated the tone of the event.

WMP, which carries the largest weight in the GDT basket, softened towards the mid-USD 3,400/tonne range, reflecting a combination of higher seller offerings from Oceania and a noticeable cooling-off in demand from China and parts of Southeast Asia. Seasonal milk availability in the Southern Hemisphere has improved, and processors appear more comfortable releasing larger volumes into the market. Buyers, having stocked earlier, avoided aggressive bidding and opted for a wait-and-watch approach. This shift in sentiment is likely to persist for the next 6–8 weeks, keeping WMP in a sideways-to-softening range, unless China returns with stronger tenders.

SMP prices followed the same trajectory, broadly aligning with the low-to-mid USD 2,500/tonne range, as seen in GDT references. SMP demand—which is more dependent on industrial users, infant nutrition players, and feed-blend manufacturers—remained weak, with buyers preferring short-term coverage. The underlying structural driver remains the same: when processors find butterfat margins unattractive or cream balances tighten, they redirect milk towards SMP/WMP lines, creating additional supply pressure. SMP is expected to mirror WMP over the coming weeks with slightly higher volatility, as tactical Asian buyers may step in only at deeper dips.

Butter and Anhydrous Milk Fat (AMF), which tend to behave differently from powders, had mixed cues in this auction. Volumes were limited, and AMF offerings ahead of the next event signal a potential shift in liquidity. These fat commodities remain influenced by Western European cream balances, holiday-season demand cycles, and manufacturing margins. Their near-term path (next 6–8 weeks) is expected to be more range-bound compared to powders, with possible divergence depending on EU cream availability and global foodservice demand.

Cheese categories such as cheddar displayed a mixed picture. Unlike powders, cheese does not react immediately to global surpluses, as it is more regionally consumed and supply chains are less fungible. With lower contract volumes and scattered buying interest, cheddar is likely to trade sideways in the immediate term, with export flows to Southeast Asia and the Middle East determining its direction.

Across the board, the overall decline in TE393 reflects four important global triggers: higher supply insertion, buyer caution, a mild global milk surplus, and FX-driven purchasing hesitation due to a stronger US dollar. These factors will continue to dominate market sentiment through the next two months, unless disrupted by unexpected buyer re-entry from China or a sudden tightening of Oceania supply.

For India, today’s GDT results carry important implications. The immediate effect will be felt in import parity, as the 4.3% fall in the GDT index—particularly in WMP and SMP—will translate into cheaper landed prices for Indian processors, assuming freight and the INR/USD exchange rate remain stable. A 2–4% reduction in import offers over the next several weeks is plausible. This will offer temporary relief to categories dependent on imported powders such as nutrition blends, bakery supply chains, dairy beverages, and reconstitution-based processors. Domestic liquid milk prices, however, will not be influenced by this GDT outcome, as India’s farmgate prices are driven by procurement competition, festival-season demand, and state cooperative interventions.

The bigger impact is strategic: Indian traders and importers may now delay fresh bookings, anticipating continued softness in global powder markets over the next 6–8 weeks. Export competitiveness for Indian SMP also improves marginally if the domestic market does not harden in parallel. However, the transmission to farmgate prices will be negligible; India’s dairy ecosystem remains insulated from short-term global shocks.

Going forward, markets must watch the composition of TE394, especially new AMF offers and seller additions on GDT, which could shift liquidity and price discovery. All eyes will also be on China’s buying patterns, freight volatility, and INR/USD movements—which collectively determine whether the decline seen today becomes the beginning of a multi-event correction or a short-lived dip in an otherwise stable year.

Source : DAirynews7x7 Dec 2nd 2025 Global Dairy Trade