Carbon insetting vs carbon offsetting: what you should know

The UK government strategy for reaching net zero by 2050 is ever more at the forefront of discussion within the agricultural industry, particularly with the NFU setting its own targets for achieving net zero by 2040 in England and Wales.

Net zero means not adding to the amount of greenhouse gas (GHGs) emitted into the atmosphere. It involves reducing GHGs as much as possible, then balancing out any remaining emissions by removing an equivalent amount. Not all emissions can be reduced to zero, which is where the opportunity for offsetting comes into play, as an option for compensating for these shortfalls. Many private sector companies are becoming increasingly reliant on voluntary offsetting to achieve this status.

Carbon insetting and offsetting are two important approaches for mitigating the effects of carbon emissions and helping the UK reach net zero. Both are options for companies to take the reduce their overall carbon emissions. We discuss the difference below.

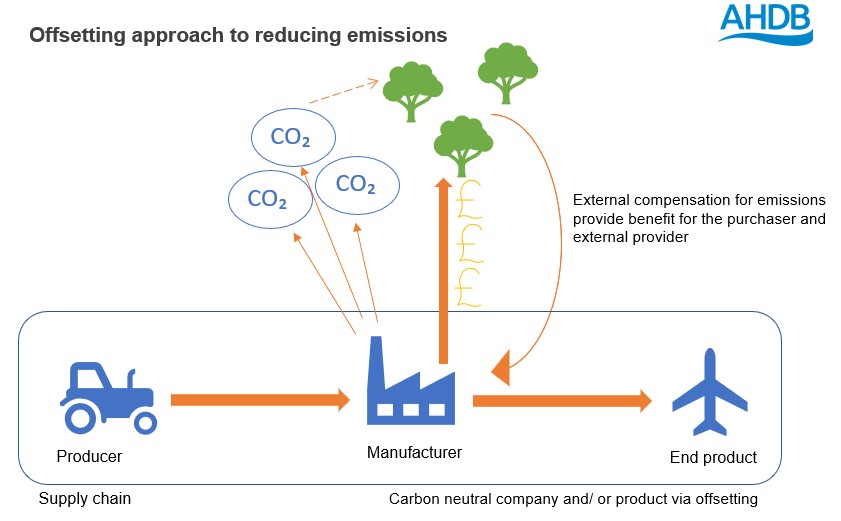

Carbon offsetting

Offsetting allows companies to invest in environmental projects around the world as a means to offset their own emissions.These projects are usually designed to focus on compensating for GHGs already emitted. Many are based in developing countries, and most focus on forestry, conservation, renewable energy, community, and waste energy projects.

Benefits of offsetting include ease of purchase, convenience, improving energy efficiency and the use of renewable energy, as well as helping reduce both direct and indirect emissions.

Figure 1. An infographic indicating the offsetting approach to reducing carbon emissions

Adopting an offsetting approach to manage emissions is inherently beneficial for both the projects (who may not have the funds otherwise to undertake these environmental schemes) and the purchasers (who receive the credits to offset their own emissions). But they are not addressing or changing the actual emission of the purchaser. This is one of the largest draw backs to the use of offsetting, as it does not address the initial emissions and has led to some coining the phrase ‘green washing’ to describe and discredit its use.

Without these emissions being addressed there may still be environmental damage, and if this approach is undertaken by the majority of emitters, then no real environmental benefit is likely to be seen. So while an essential tool, offsetting should not be used as a substitute to improving and reducing a company’s own emissions.

Carbon insetting

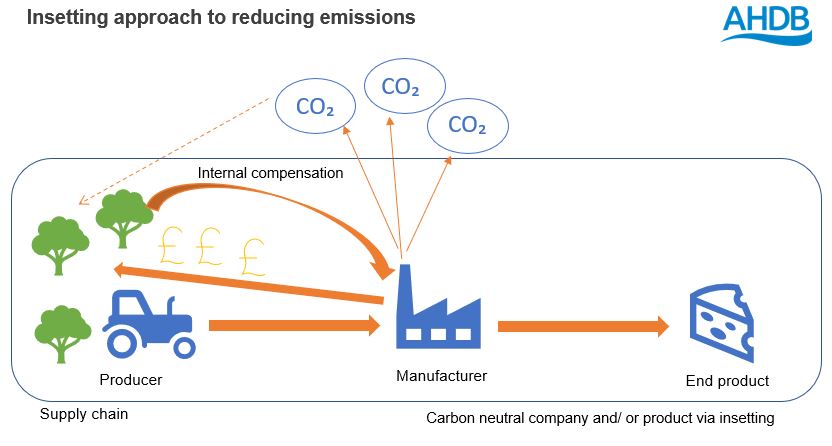

Insetting is when companies invest in carbon reduction projects within their own supply chain.By engaging in carbon insetting, companies are investing in making their own products, practices and supply chains more sustainable. This means the investment can be in areas specific to a company’s precise needs, such as a company which relies heavily on agriculture implementing agroforestry practices to minimise soil erosion and sequester carbon.

By adopting an insetting approach to decarbonisation, businesses can build stronger relationships with suppliers, as it encourages reductions of indirect emissions throughout the supply chain.

Changing practices requires some planning, from undertaking simple changes through to a total overhaul of processes, and as such require a proactive, rather than reactive, approach to reducing emissions.

Figure 2. An infographic indicating the insetting approach to reducing carbon emissions

GHG emissions

There are three ways of categorising emissions, referred to as Scope 1, 2 and 3:- Scope 1 refers to the GHGs emissions a company makes directly e.g. running vehicles

- Scope 2 are the ones they make indirectly, e.g. electricity or energy bought for cooling buildings

- Scope 3 refers to all GHGs emissions in an organisations supply chain, similar to Scope 2; however, Scope 3 also include emissions produced by customers using a company’s products, as well as the emissions produced by the suppliers feeding into a company’s supply chain

While there are many benefits to insetting, there are also some points for consideration. At present there is limited opportunities to inset, and these are very specific to each supply chain and sector. There also needs to be consideration and awareness around the potential for double-counting emission reductions.

Which is best?

There is a place for both insetting and offsetting carbon emissions. Fundamentally utilising a combination of both is best for helping reach net zero.Insetting allows companies to reduce emissions within their supply chain. By prioritising this, companies can reduce their carbon footprint in a sustainable and cost-effective manner, while improving their own communities and ecosystems. This is because insetting can require a more holistic approach to reducing emission in a tangible way.

Offsetting is frequently seen as a first step for many companies in their move to decarbonise, as it works in a retrospective manor. It helps fund environmental practices in areas where otherwise costs would be prohibitive.

By adopting a mix of both, companies would be able to work towards reducing their own emissions, that of their supply chain, as well as direct and indirect emissions through contributions to carbon offsetting projects.

Why is it important for farmers to know the difference

We have discussed the types of carbon markets available to farmers. Currently there is potential that they could fall under both insetting and offsetting opportunities.A number of schemes which generate carbon credits or certificates operate within the voluntary market for offsetting. This means that they are open to anyone to purchase who is looking to offset their carbon footprint regardless of industry. If this happens, the farmer’s carbon improvements can no longer be claimed by the farmer or their supply chain partners.

However, if an insetting approach is followed, as carbon footprints within supply chains are overlapping, any reduction in emissions can also be claimed individually and by the supply chain to some extent (Scope 3).

Being aware of how schemes are marketing and selling emission reductions is therefore key, and if unsure, farmers should hold on to enough credits or certificates to cover any claims that they may need to make for their business, or that of their supply chain, and only sell on surplus.