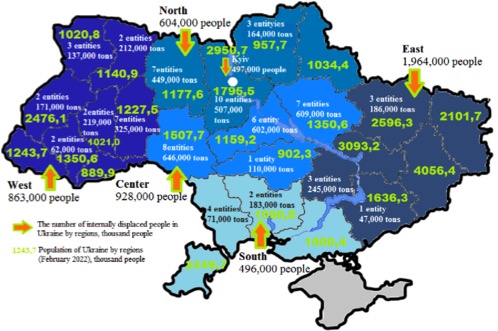

The Russian invasion of Ukraine could also have an impact on the dairy supply chain. In addition, inflation in dairy markets could begin to weaken consumption, especially in Russia and low-income nations. The analysis coming from Betty Berning with the Daily Dairy Report.

According to Rabobank, Russia and Ukraine are responsible for 18% of global corn exports, which is a key feed ingredient in dairy rations around the world. And that’s where the domino effect begins. As input prices rise, so do milk and dairy prices. Higher dairy prices could then threaten global consumption.

Some dairy companies, such as Lely, have stopped operations in Russia. Danone has closed one of its two plants in Ukraine, which could also have an impact.

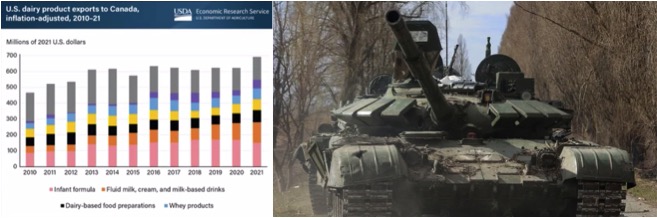

Canada Exports

Canada is an important market for U.S. dairy products. How important? Exports to our neighbors to the north have grown by nearly 50% in just over a decade. That shows in this graphic from USDA’s Economic Research Service.

From 2010 to last year, total dairy exports from the U.S. to Canada rose 48% from just over $466 million to more than $691 million last year. The country’s proximity to the U.S. aiding in the export of items such as food, milk, cheese and infant formula.

By value, infant formula has been the top U.S. dairy product exported to Canada representing about 22% of the total.