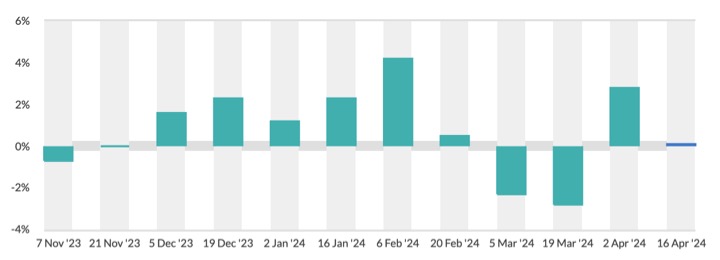

Dairy staples like milk, yogurt, and cheese continued to dominate the dairy segment in 2022, though numbers aren’t at pre-pandemic levels yet. Still, innovations in many dairy products are helping the category see increases as 2023 approaches.

In its latest report, the International Dairy Deli Bakery Association (IDDBA) showed dairy sales were up 20% at the start of winter, even as prices on key items continued to rise. Eggs, for instance, saw prices rise more than 61.5% versus the same time last year, yet units sold were similar.

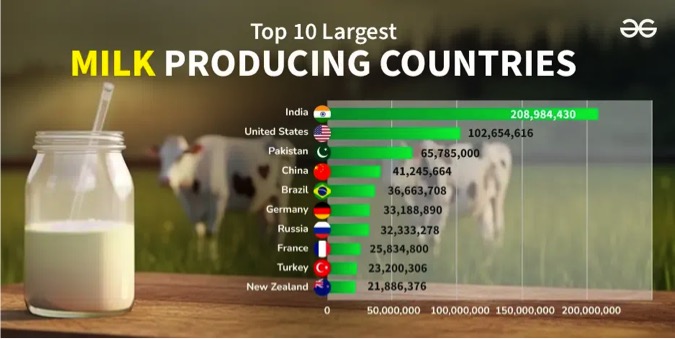

Milk was the top dairy seller, surpassing the $1.6 billion mark in November.

“We continue to see the interplay between managing the total shopping spend in the light of high inflation versus the love for dairy and the important role it plays across all meal occasions,” said Heather Prach, IDDBA’s director of education.

“I also think we have to give credit to the tremendous innovation in dairy that is tying into many of the mega trends—from plant-based integration, health and wellbeing, personalization, convenience and premiumization,” she added. “It is this focus on innovation that is keeping the dairy aisle strong.”

Dairy staples like milk, yogurt, and cheese continued to dominate the dairy segment in 2022, though numbers aren’t at pre-pandemic levels yet. Still, innovations in many dairy products are helping the category see increases as 2023 approaches.

In its latest report, the International Dairy Deli Bakery Association (IDDBA) showed dairy sales were up 20% at the start of winter, even as prices on key items continued to rise. Eggs, for instance, saw prices rise more than 61.5% versus the same time last year, yet units sold were similar.

Milk was the top dairy seller, surpassing the $1.6 billion mark in November.

“We continue to see the interplay between managing the total shopping spend in the light of high inflation versus the love for dairy and the important role it plays across all meal occasions,” said Heather Prach, IDDBA’s director of education.

“I also think we have to give credit to the tremendous innovation in dairy that is tying into many of the mega trends—from plant-based integration, health and wellbeing, personalization, convenience and premiumization,” she added. “It is this focus on innovation that is keeping the dairy aisle strong.”

ADVERTISING

In IDDBA’s December webinar, “The Outlook for the Dairy Industry in 2023,” Mike McCully, president of a consulting firm focused on dairy and food companies, noted that butter prices have set record highs this year, milk production is experiencing growth, and cheese has been nothing but positive with continued heavy demand by consumers.

“Demand for the most part has been strong,” he said, adding that even with a possible recession on the horizon, dairy historically performs well in recessionary times.

Trending up

Susan Durfee, director of dairy, frozen, household, baby, pet, health and beauty care, and general merchandise at Williamsville, N.Y.-based Tops Friendly Markets, noticed dairy alternatives grew in 2022, especially plant-based drinks, cheese, yogurt, and healthier alternatives like low-sugar yogurts and creamers, as customers continue to enjoy trying new flavors in their coffee.

“There is a continued desire to find healthy convenient options for all meal and snack occasions,” she said. “Dairy really complements any meal occasion. Investments in commodity items will continue to help customers afford the key items they need.”

David J. Vana III, grocery category manager for Southern California grocer Gelson’s Markets, noted oat milk continued its surge to the top of the dairy alternative segment, despite oat shortages and a number of quality control concerns among some of the larger brands.

“Brands continued to stretch their presence into other aisles, like creamers, ice cream, novelties, and even shelf stable milks,” he said. “Single serve/ready-to-consume solutions saw a strong year of sales, both as consumers went back to the office and sought items with built in portion control.”

Vana said he feels the typical consumer is getting a lot more of their information from the internet, often via social media, rather than doing their own extensive research. As a result, new trends or fads pop up and spread quickly.

“It’s tough to say which will stick, but I think it’s important to be on the frontline when it comes to getting that info, so that we can give those customers what they are looking for,” he said. “Look for more digestive health claims beyond dairy-free. Lactose free, A2, low carb, no/low/less sugar, high protein, etc.”

Improving sales

Keeping up with sales trends within the marketplace, in addition to keeping the freshest product stocked on the shelves are both key to keeping the dairy department strong.

“While dairy trends show consumers are shopping for value, shoppers are purchasing premium items, especially during the holidays,” Vana said. “The important thing is to keep these numbers up as the year unfolds. That means having the items consumers demand and staying on top of the latest trends.”

Cross merchandising, Durfee noted, helps customers with ideas, whether for dinner (shredded cheese with meat products), breakfast (juice, eggs and bacon), lunch (cheese slices with deli meat), snacks (chunk cheese and crackers) or desserts (cream cheese, whipping cream).

“People consume dairy any time of the day, but the store can help remind customers of how to get more dairy into their lifestyles—whether it’s on a charcuterie board, as a snack or even a topping for a favorite dessert,” she said.

Sustainability matters

Sustainability and climate-conscious callouts continue to be relevant, and there’s no place quite like the dairy section to bring these to the attention of consumers.

“I expect to see more brands highlighting their environmental impact in 2023,” Vana said. “At this point, I think most consumers are aware of the relatively high environmental footprint that the dairy industry has, but it remains to be seen how much of an impact this will actually have on their purchase decisions.”

And brands that partner with, or source from, small or local dairies will also provide the consumer a sense of supporting something larger than themselves.

“Though with supply chain constraints continuing to be a challenge, it will be interesting to see what kind of impact it will have on this type of callout,” Vana said. “Bigger brands, with more broad sourcing capabilities, seem to be at a significant advantage when it comes to keeping product on the shelf consistently.”