Can entrepreneurs learn anything from plants? “Definitely, there is a priceless lesson,” reckons Basan Patil. “Patience, patience and patience,” says the 28–year-old who co-founded oat milk brand Alt Co last year. Patil, who along with Rithwik Ramesh, Sumair Sachdev, Sasha Jairam and Rohit Kalro, started the plant-based alternative dairy brand—is realistic about the pace of growth of his venture, and the oat milk segment. The Indian market, he reckons, is at a very nascent stage. “Next five to 10 years is where we are targeting our story,” he says. Oat milk, he adds, is the fastest growing alternative milk segment in the world.

A bootstrapped venture based out of Bengaluru, Alt Co offers alternative lifestyle options to substitute dairy products with guiltless and healthy options. “We want to give consumers taste, health and sustainability,” says Patil, who had a tough time during the soft launch of the oat milk last year. The normal, and expected, question was: Aren’t oats a breakfast cereal? How can you get milk out of oats? Patil spent hours educating the target users across modern trade outlets in Bengaluru. Oat milk, he underlines, is created when oats are soaked in water, ground into a flour-like consistency, and strained. This results in a creamy, nutty-tasting drink which is perfect for those with allergies or sensitivities to dairy and soy, he adds.

Interestingly, Patil’s sensitivity was shaped by his education and global exposure. Graduating from Pennsylvania State University in the US, and completing a diploma in international relations from Geneva made the third-generation entrepreneur from a family of educationists realise the need to focus on a business which can impact the planet. In the US, plant-based milk, he reckons, has about 14 percent share of the milk consumption. To reach such a scale, the nutritional and environmental impact has to be there. Oat milk, Patil underlines, doesn’t have cholesterol, lactose, or saturated fat. “Oats are also naturally gluten-free and one of the most environmentally sustainable crops,” he says.

Back in India, awareness about plant-based milk is still negligible. “It’s only those who have travelled abroad that have an idea of such products,” says Patil. There was a silver lining, though. Wide awareness about oats as a healthy breakfast cereal made people receptive, and helped Alt Co rapidly expand its footprint. From Bengaluru, it has fanned out to Mumbai, Pune, Surat, Hyderabad, Mysore, Kolkata, Noida, Manipal and Nashik across modern trade and cafes. “It’s also available on all ecommerce platforms,” he claims, declining to share the data on sales clocked. “We are now launching almond and soy milk,” he adds.

Food and beverage experts reckon that the dynamics of the post-Covid world will nudge people to gradually try such options.

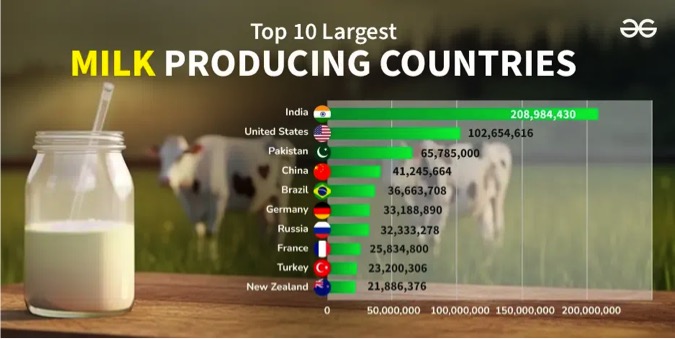

The interplay of many trends like concern for nature and climate, more conscious consumption of healthier food and awareness of the need to consume health supplements has catalysed the trend of plant-based products replacing animal-origin products across the world. “And India is no exception,” says KS Narayanan, a food and beverage expert. As milk and dairy products are high in saturated fatty acids, consumers will slowly shift to plant-based beverages, and the industry is bound to grow. An explosive growth in the US market bodes well for the players in India. In 2019, Narayanan points out, retail sales of oat milk stood at $29 million. The numbers jumped to $213 million in 2020.

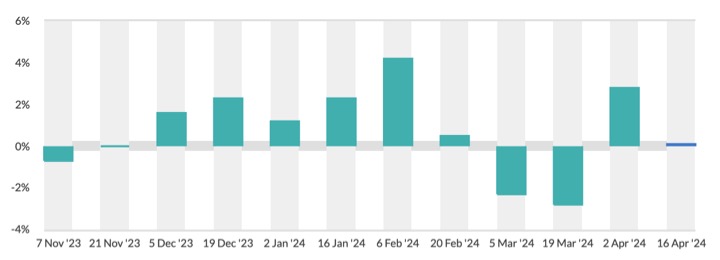

Then there is the success of Swedish giant Oatly, the world’s largest oat milk company. Look at the revenue. From $118 million in 2018, the company posted sales of $421 million in 2020. The third quarter revenues LTM (last twelve months) in 2021 stood at $584 million.

Back in India, though, the growth trajectory may not mimic the global pattern. Narayanan explains the bottlenecks in mass adoption. First, people love to drink their milk fresh with minimal processing and a lot of consumption is for hot beverages. There have been several players in the Indian market with their milk in tetra packs for more than 20 years. “But they still are a niche category, and they are priced at a significant premium as well,” he says, adding that India is a value-conscious market. The median of oat-based beverages is in the range of Rs 250 per litre, whereas the dairy price is in the range of Rs 60 per litre. Though there is a scope of reducing the price as the companies reach economies of scale, the product for a long time might remain niche among vegans and mass adoption might be elusive.

Patil, on his part, is aware of the grind. “I know it’s a patience game. Wide adoption will not happen overnight,” he says. The plus side of starting early, he adds, is that whenever there is an inflection point, Alt Co would be best placed to make the most of the tailwinds. “Plant-based milk is not a fad. It is here to stay,” he says.