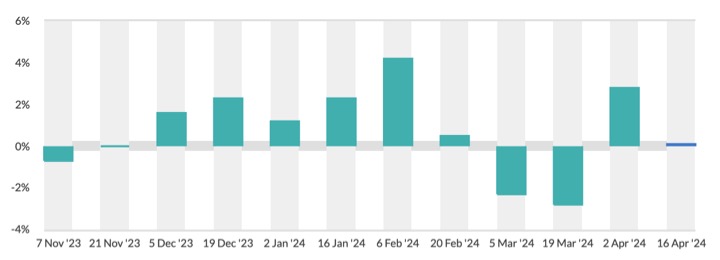

The two companies filed their preliminary papers with Sebi on February 15 and obtained its observations on April 23, an update with Sebi showed on Monday.

Non-banking financial company Arohan Financial Services and Dodla Dairy, a leading dairy company in South India, have received capital markets regulator Sebi’s go-ahead to float initial share-sales.

Sebi’s observation is very necessary for any company to launch public issues like initial public offer (IPO), follow-on public offer (FPO), and rights issue.

Arohan Financial Services plans to raise between Rs 1,750 crore and Rs 1,800 crore, as per market sources.

The public offer of the Aavishkaar Group promoted company comprises a fundraise through a fresh issuance of shares amounting to Rs 850 crore, according to Draft Red Herring Prospectus (DRHP).

In addition, the company will have an offer for sale of 2,70,55,893 equity shares by Maj Invest Financial Inclusion Fund II K/S, Michael & Susan Dell Foundation, Tano India Private Equity Fund II, TR Capital III Mauritius, and Aavishkaar Goodwell India Microfinance Development Company II Ltd.

The net proceeds from the fresh issue will be utilised for augmenting the company’s capital base to meet its future capital requirements.

Edelweiss Financial Services Ltd, ICICI Securities Ltd, Nomura Financial Advisory and Securities (India) Private Limited, and SBI Capital Markets Limited are the managers of the issue.

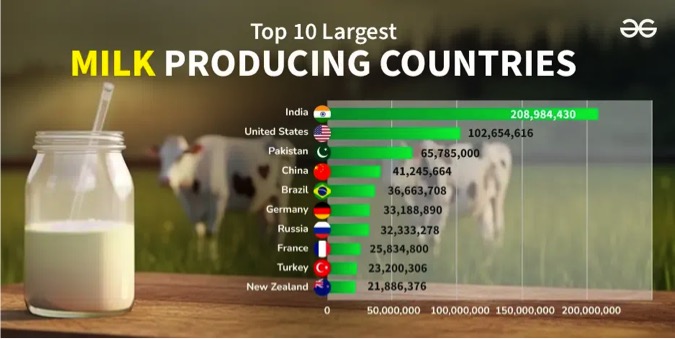

Dodla Dairy’s IPO comprises fresh issuance of shares worth up to Rs 50 crore, besides, an offer for sale of up to 10,085,444 equity shares by TPG Dodla Dairy Holdings Pte Ltd, Dodla Sunil Reddy, Dodla Deepa Reddy, and Dodla Family Trust, according to the draft papers.

Proceeds from the issue will be used for payment of certain borrowings, funding capital expenditure requirements of the company and for general corporate purposes.

Axis Capital and ICICI Securities will manage the company’s initial share sale.

The company’s operations in India are primarily across the four south Indian states of Andhra Pradesh, Telangana, Karnataka, and Tamil Nadu. Its international operations are based in Uganda and Kenya.

The equity shares of both companies will be listed on NSE and BSE.